Question: do all the steps. I am including a problem and an example. do all the steps that the example problem have. example question What is

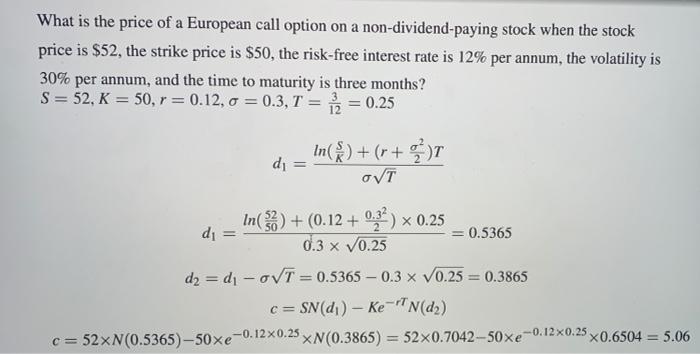

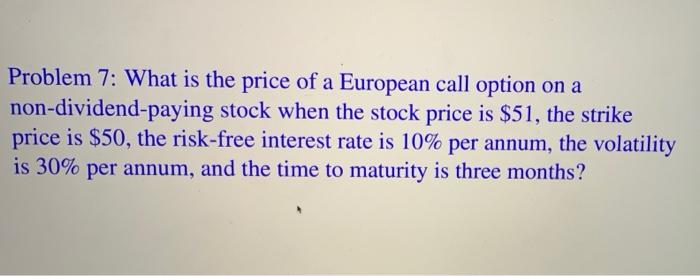

What is the price of a European call option on a non-dividend-paying stock when the stock price is $52, the strike price is $50, the risk-free interest rate is 12% per annum, the volatility is 30% per annum, and the time to maturity is three months? S = 52, K = 50, r = 0.12,0 = 0.3, T = ia = 0.25 di In(S) + (r+T OVT In(3) + (0.12 + 0,3%) * 0.25 di = 0.5365 0.3 x 0.25 d2 = di -OVT = 0.5365 0.3 X V0.25 = 0.3865 c = SN(di) - Ke-N(d) c=52xN(0.5365)-50xe-0.120.25 x N(0.3865) = 52x0.704250xe-0.12%0.25 x0.6504 = 5.06 Problem 7: What is the price of a European call option on a non-dividend-paying stock when the stock price is $51, the strike price is $50, the risk-free interest rate is 10% per annum, the volatility is 30% per annum, and the time to maturity is three months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts