Question: do both for an automatic thumbs up please Gonzales Corporation generated free cash flow of $86 million this year. For the next two years, the

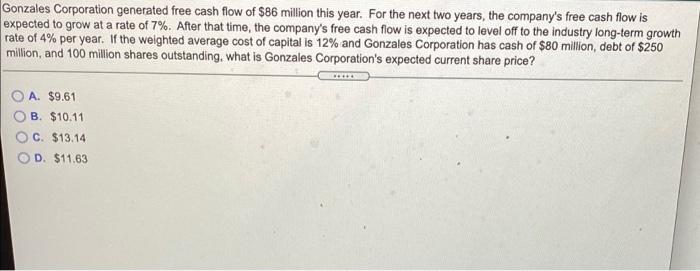

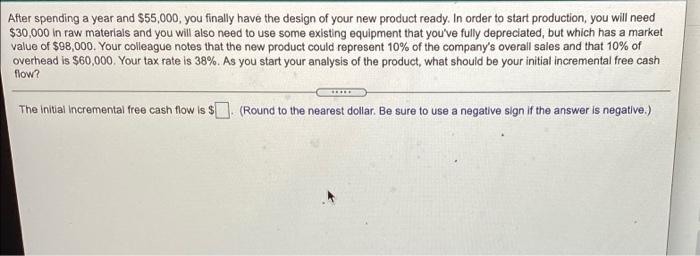

Gonzales Corporation generated free cash flow of $86 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 7%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 4% per year. If the weighted average cost of capital is 12% and Gonzales Corporation has cash of $80 million, debt of $250 million, and 100 million shares outstanding, what is Gonzales Corporation's expected current share price? A. $9.61 B. $10.11 C. $13.14 D $11.63 After spending a year and $55,000, you finally have the design of your new product ready. In order to start production, you will need $30,000 in raw materials and you will also need to use some existing equipment that you've fully depreciated, but which has a market value of $98,000. Your colleague notes that the new product could represent 10% of the company's overall sales and that 10% of overhead is $60,000. Your tax rate is 38%. As you start your analysis of the product, what should be your initial incremental free cash flow? The initial Incremental free cash flow is $. (Round to the nearest dollar. Be sure to use a negative sign if the answer is negative.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts