Question: DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST Question 5. Answer all parts I. Explain why an actively managed fund might be 'searching

DO NOT ANSWER IN EXCEL PLEASE, THIS IS PAPER TEST

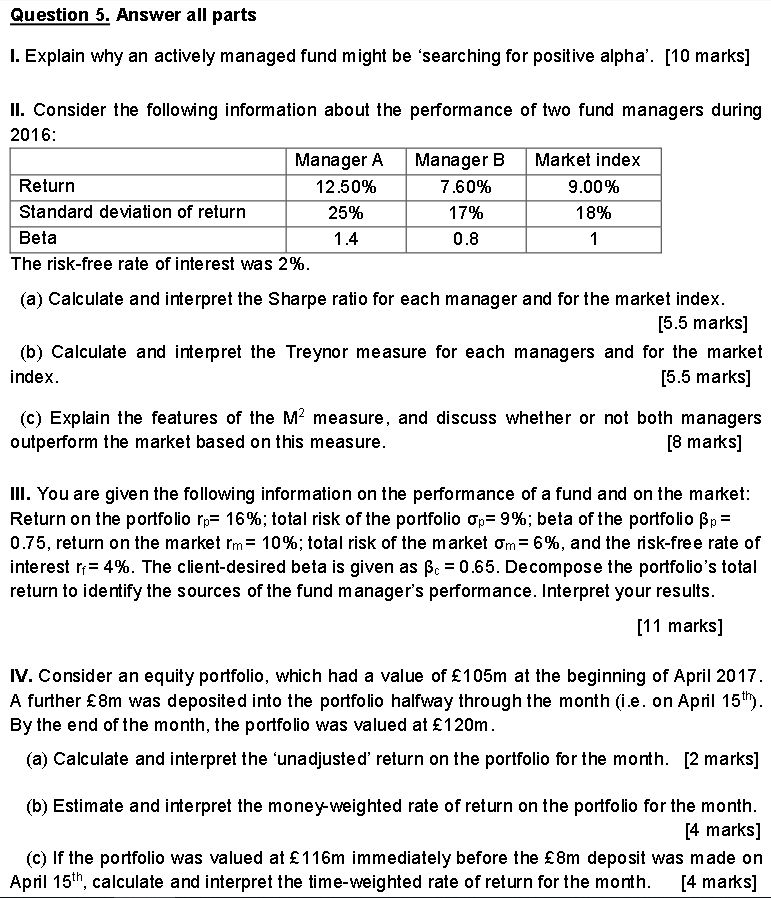

Question 5. Answer all parts I. Explain why an actively managed fund might be 'searching for positive alpha'. [10 marks] II. Consider the following information about the performance of two fund managers during 2016 Manager A Manager B Market index Return Standard deviation of return Beta 12.50% 25% 7,60% 17% 0.8 9.00% 18% The risk-free rate of interest was 2% (a) Calculate and interpret the Sharpe ratio for each manager and for the market index. [5.5 marks] (b) Calculate and interpret the Treynor measure for each managers and for the market index [5.5 marks] (c) Explain the features of the M2 measure, and discuss whether or not both managers outperform the market based on this measure [8 marks] III. You are given the following information on the performance of a fund and on the market Return on the portfolio rp-16%; total risk of the portfolio ,-9%, beta of the portfolio p_ 0.75, return on the market rm-10%, total risk of the market m_ 6%, and the nsk-free rate of interest r,-4%. The client-desired beta is given as c =0.65. Decompose the portfolio's total return to ide ntify the sources of the fund manager's performance. Interpret your results [11 marks IV. Consider an equity portfolio, which had a value of 105m at the beginning of April 2017. A further 8m was deposited into the portfolio halfway through the month (i.e. on April 15th) By the end of the month, the portfolio was valued at 120m (a) Calculate and interpret the 'unadjusted return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month 4 marks] (c) If the portfolio was valued at 116m immediately before the 8m deposit was made on April 15th, calculate and interpret the time-weighted rate of return for the month. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts