Question: DO NOT COPY AND PASTE AN ANSWER ALREADY ON THE SITE! DO NOT RESPOND WITH MY ANSWER AS THE ANSWER IS INCORRECT!! I wish I

DO NOT COPY AND PASTE AN ANSWER ALREADY ON THE SITE! DO NOT RESPOND WITH MY ANSWER AS THE ANSWER IS INCORRECT!!

I wish I didn't have to preface like this, but my posts keep getting wasted by lazy "experts"

I would like help regarding these questions as of 2022. My professor said my given answer was incorrect, but gave me the hint that goodwill is not amortized. Please explain your answer thoroughly.

I would like help regarding these questions as of 2022. My professor said my given answer was incorrect, but gave me the hint that goodwill is not amortized. Please explain your answer thoroughly.

I would like help regarding these questions as of 2022. My professor said my given answer was incorrect, but gave me the hint that goodwill is not amortized. Please explain your answer thoroughly.

DO NOT COPY AND PASTE AN ANSWER ALREADY ON THE SITE! DO NOT RESPOND WITH MY ANSWER AS THE ANSWER IS INCORRECT!!

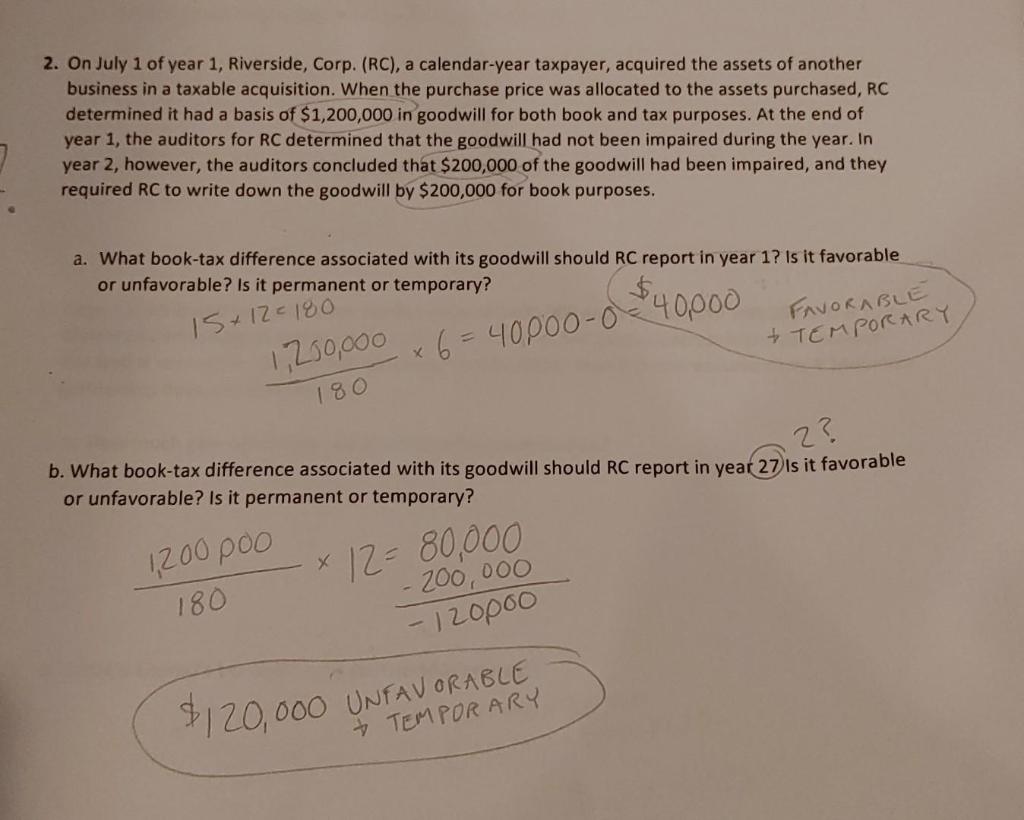

2. On July 1 of year 1, Riverside, Corp. (RC), a calendar-year taxpayer, acquired the assets of another 7 business in a taxable acquisition. When the purchase price was allocated to the assets purchased, RC determined it had a basis of $1,200,000 in goodwill for both book and tax purposes. At the end of year 1, the auditors for RC determined that the goodwill had not been impaired during the year. In year 2, however, the auditors concluded that $200,000 of the goodwill had been impaired, and they required RC to write down the goodwill by $200,000 for book purposes. a. What book-tax difference associated with its goodwill should RC report in year 1? Is it favorable or unfavorable? Is it permanent or temporary? 15+12=180 $40.000 X 6= 40000-0 1,250,000 180 FAVORABLE + TEMPORARY b. What book-tax difference associated with its goodwill should RC report in year 27 Is it favorable or unfavorable? Is it permanent or temporary? 2? 1,200.000 * 12 = 80,000 180 - 200,000 - 120000 $120,000 UNFAVORABLE +TEMPORARY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts