Question: Help Save & Exit Submit (The following information applies to the questions displayed below.) On January 1, Year 1, the general ledger of Company A

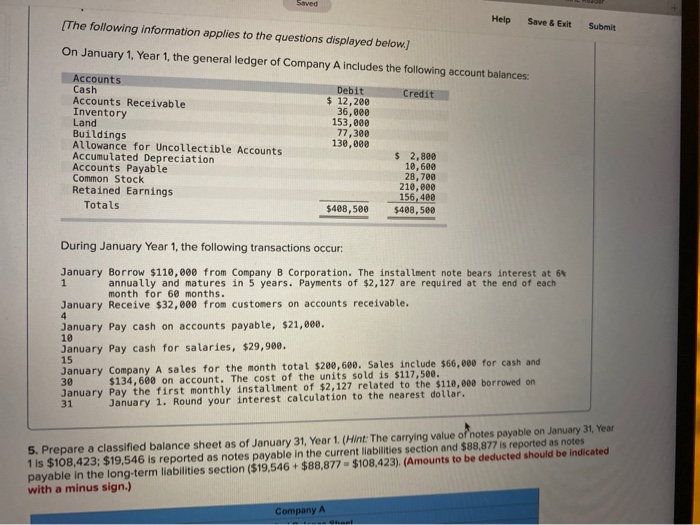

Help Save & Exit Submit (The following information applies to the questions displayed below.) On January 1, Year 1, the general ledger of Company A includes the following account balances. Credit Accounts Cash Accounts Receivable Inventory Land Buildings Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals Debit $ 12,200 36,000 153,000 77,300 130,000 $ 2,800 10,600 28,700 210,000 156,400 $408,500 $408,500 During January Year 1, the following transactions occur: January Borrow $110,000 from Company B Corporation. The installment note bears interest at 6 annually and matures in 5 years. Payments of $2,127 are required at the end of each month for 60 months. January Receive $32,000 from customers on accounts receivable. January Pay cash on accounts payable, $21,000. January Pay cash for salaries, $29,900. 15 January Company A sales for the month total $200,600. Sales include $66,000 for cash and 30 $134,600 on account. The cost of the units sold is $117,500. January Pay the first monthly installment of $2,127 related to the $110,000 borrowed on January 1. Round your interest calculation to the nearest dollar. 5. Prepare a classified balance sheet as of January 31, Year 1. (Hint: The carrying value of notes payable on January 31 Year 1 is $108,423: $19,546 is reported as notes payable in the current liabilities section and $88,877 is reported as notes payable in the long-term liabilities section ($19,546 + $88.877 $108.423). (Amounts to be deducted should be indicated with a minus sign.) Company A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts