Question: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should

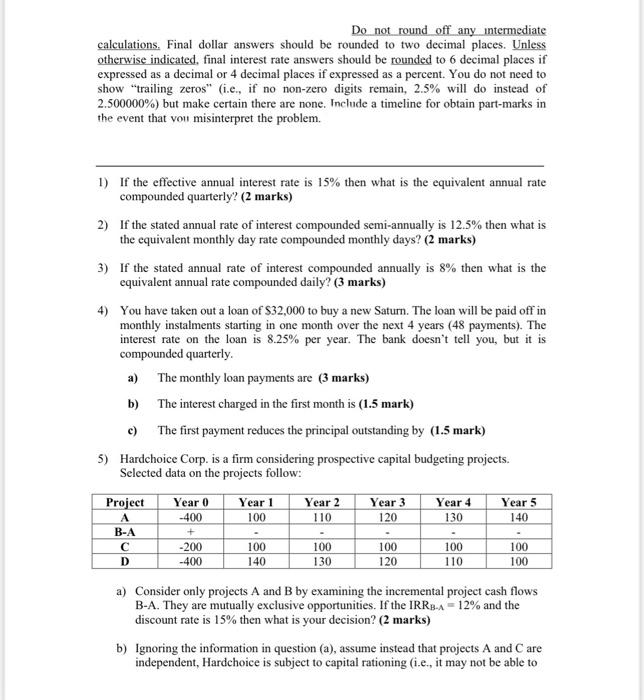

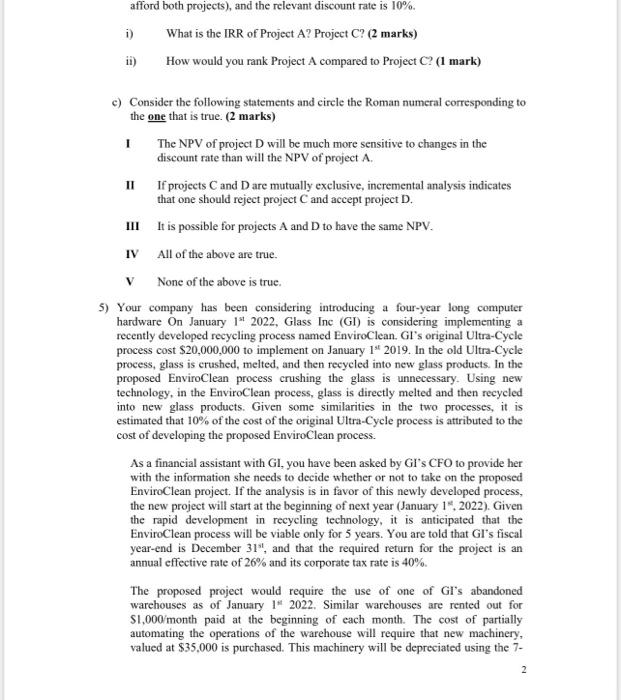

Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show "trailing zeros" (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. 1) If the effective annual interest rate is 15% then what is the equivalent annual rate compounded quarterly? (2 marks) 2) If the stated annual rate of interest compounded semi-annually is 12.5% then what is the equivalent monthly day rate compounded monthly days? (2 marks) 3) If the stated annual rate of interest compounded annually is 8% then what is the equivalent annual rate compounded daily? (3 marks) 4) You have taken out a loan of S32,000 to buy a new Saturn. The loan will be paid off in monthly instalments starting in one month over the next 4 years (48 payments). The interest rate on the loan is 8.25% per year. The bank doesn't tell you, but it is compounded quarterly a) The monthly loan payments are (3 marks) b) The interest charged in the first month is (1.5 mark) The first payment reduces the principal outstanding by (1.5 mark) 5) Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow: c) Year 1 100 Year 2 110 Year 3 120 Year 4 130 Year 5 140 Project A B-A D Year 0 -400 + -200 -400 100 140 100 130 100 120 100 110 100 100 a) Consider only projects A and B by examining the incremental project cash flows B-A. They are mutually exclusive opportunities. If the IRRB-A = 12% and the discount rate is 15% then what is your decision? (2 marks) b) Ignoring the information in question (a), assume instead that projects A and Care independent, Hardchoice is subject to capital rationing (i.e., it may not be able to afford both projects), and the relevant discount rate is 10%. i) What is the IRR of Project A? Project C? (2 marks) ii) How would you rank Project A compared to Project C? (1 mark) V c) Consider the following statements and circle the Roman numeral corresponding to the one that is true. (2 marks) 1 The NPV of project D will be much more sensitive to changes in the discount rate than will the NPV of project A. 11 If projects C and Dare mutually exclusive, incremental analysis indicates that one should reject project and accept project D. III It is possible for projects A and D to have the same NPV. IV All of the above are true. None of the above is true 5) Your company has been considering introducing a four-year long computer hardware On January 1" 2022, Glass Inc (GI) is considering implementing a recently developed recycling process named EnviroClean. GI's original Ultra-Cycle process cost $20,000,000 to implement on January 14 2019. In the old Ultra-Cycle process, glass is crushed, melted, and then recycled into new glass products. In the proposed EnviroClean process crushing the glass is unnecessary. Using new technology, in the EnviroClean process, glass is directly melted and then recycled into new glass products. Given some similarities in the two processes, it is estimated that 10% of the cost of the original Ultra-Cycle process is attributed to the cost of developing the proposed EnviroClean process. As a financial assistant with Gl, you have been asked by GI's CFO to provide her with the information she needs to decide whether or not to take on the proposed EnviroClean project. If the analysis is in favor of this newly developed process, the new project will start at the beginning of next year (January 19, 2022). Given the rapid development in recycling technology, it is anticipated that the EnviroClean process will be viable only for 5 years. You are told that GI's fiscal year-end is December 31", and that the required return for the project is an annual effective rate of 26% and its corporate tax rate is 40%. The proposed project would require the use of one of Gr's abandoned warehouses as of January 1" 2022. Similar warehouses are rented out for S1,000 month paid at the beginning of each month. The cost of partially automating the operations of the warehouse will require that new machinery, valued at $35.000 is purchased. This machinery will be depreciated using the 7- 2 year depreciation schedule. Upon completion of the proposed project, the new machinery will be sold for a value equivalent to its Undepreciated Capital Cost (UCC) at the time of the sale. 10 employees for the proposed project will be hired to begin work on January 1* 2022. Each will work one hundred and seventy hours per month. They will be paid at the end of every month at a wage of $15,00 per hour for the duration of the project. Given the current labor shortage, this wage will certainly impact wages of workers currently employed in other operations of the firm. It is anticipated that the impact on current wages will increase expenses of GI's other operations by $20,000 per year indefinitely Aware that the new service offered by the EnviroClean project will partially replace the old Ultra-Cycle process, you estimate that reduced Ultra-Cycle output will reduce GI's revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by $550,000 each year. The CFOs team predicts that the proposed EnviroClean project will partially replace the old Ultra-Cycle process, you estimate that reduced Ultra-Cycle output will reduce GI's revenues by $200,000 each year. However, you are certain that the new EnviroClean products will increase revenues by 5550,000 each year. The CFOs team predicts that the proposed EnviroClean project will require the following levels of current assets and current liabilities items during the life of the project: Jan 1 2027 SO SO SO Jan 1 Jan 1 Jan 1 Jan 1 Jan! 2022 2023 2024 2025 2026 Inventory SO $30,000 $30,000 $30,000 $30,000 Cash $15,000 $4,000 $4,000 $4.000 $5,000 Accounts SO $4,000 $3,000 $8.000 $3,500 Receivable Accounts S12,000 $5,000 $4,000 $1,000 $3,500 Payable Taxes SO $1.500 $1,000 $1,000 $2,000 Payable SO 50 What is the NPV of the proposed project and what is your recommendation? (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts