Question: do not use any financial calculator or excel... do by hand and show all the steps 14:13) You have observed the following returns over time:

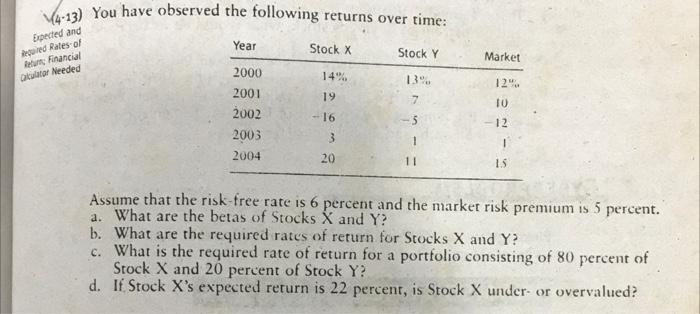

14:13) You have observed the following returns over time: Year Stock X Stock Y Expected and Recured Rales of Run Financial Dular Needed Market 14% 13 12 19 7 10 2000 2001 2002 2003 2004 -16 12 3 1 ! 20 15 Assume that the risk-free rate is 6 percent and the market risk premium is 5 percent. a. What are the betas of Stocks X and Y? b. What are the required rates of return for Stocks X and Y? c. What is the required rate of return for a portfolio consisting of 80 percent of Stock X and 20 percent of Stock Y? d. If Stock X's expected return is 22 percent, is Stock X under- or overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts