Question: DO NOT USE EXCEL .4 Smith borrows 20,000 to purchase a car. The car dealer finances the purchase and offers Smith two alternative financing plans,

DO NOT USE EXCEL

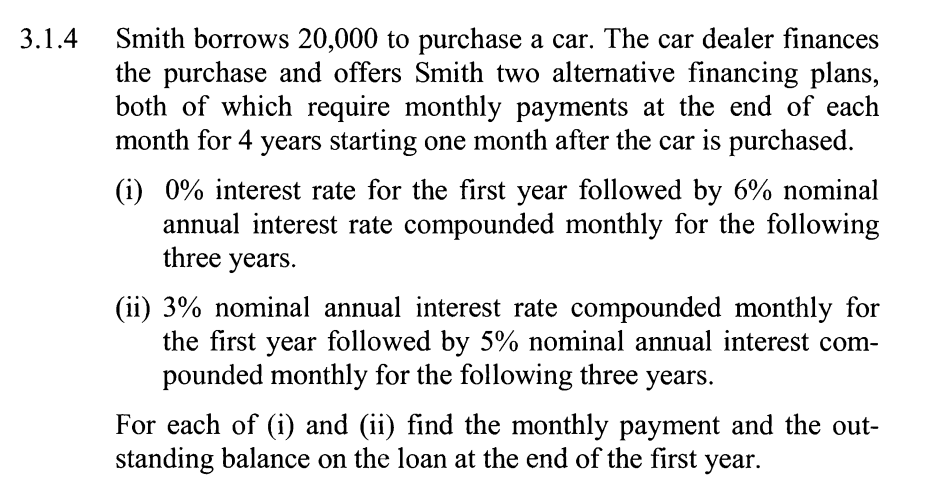

.4 Smith borrows 20,000 to purchase a car. The car dealer finances the purchase and offers Smith two alternative financing plans, both of which require monthly payments at the end of each month for 4 years starting one month after the car is purchased. (i) 0% interest rate for the first year followed by 6% nominal annual interest rate compounded monthly for the following three years. (ii) 3\% nominal annual interest rate compounded monthly for the first year followed by 5% nominal annual interest compounded monthly for the following three years. For each of (i) and (ii) find the monthly payment and the outstanding balance on the loan at the end of the first year

Step by Step Solution

There are 3 Steps involved in it

To solve the problem we need to approach it in steps applying the formulas for loan amortization under each financing plan The loan amount is 20000 and the payments are to be made at the end of each m... View full answer

Get step-by-step solutions from verified subject matter experts