Question: do not use Excel to solve. I am trying to understand the step-by-step process necessary to solve the question. 2. The information below is for

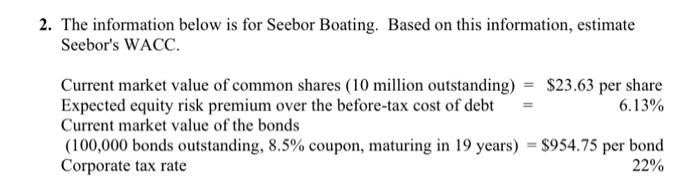

2. The information below is for Seebor Boating. Based on this information, estimate Seebor's WACC. Current market value of common shares (10 million outstanding) =$23.63 per share Expected equity risk premium over the before-tax cost of debt =6.13% Current market value of the bonds ( 100,000 bonds outstanding, 8.5% coupon, maturing in 19 years )=$954.75 per bond Corporate tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts