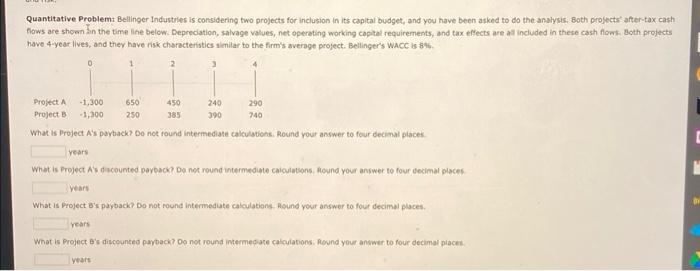

Question: Quantitative Problemt Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the anslysis. Both projects'

Quantitative Problemt Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the anslysis. Both projects' after-tax cash faws are shoon an the time line below. Depredation, salvage values, net operating working copital requirements, and tax efects are all included in thete cash flows. Both projects have 4-year lives, and they have risk characterstics slmilar to the firm's average project. Bellinger's WACC is 845 . What is Project A's paytack? Do not found intermediate calculavichs. Round your answer to four decimal piaces. years What is Project A ' dacounted payback? Do not round intermediate caloulatsons, flound your answer to four decimal places. years What is Project Brs payback? Do not round intermedute calculations. Hosund your answer to four decimal places. rears What is Project a's disceunted paytack? Do not round intermeqate caloulations. fovnd your answer to four decimal places. years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts