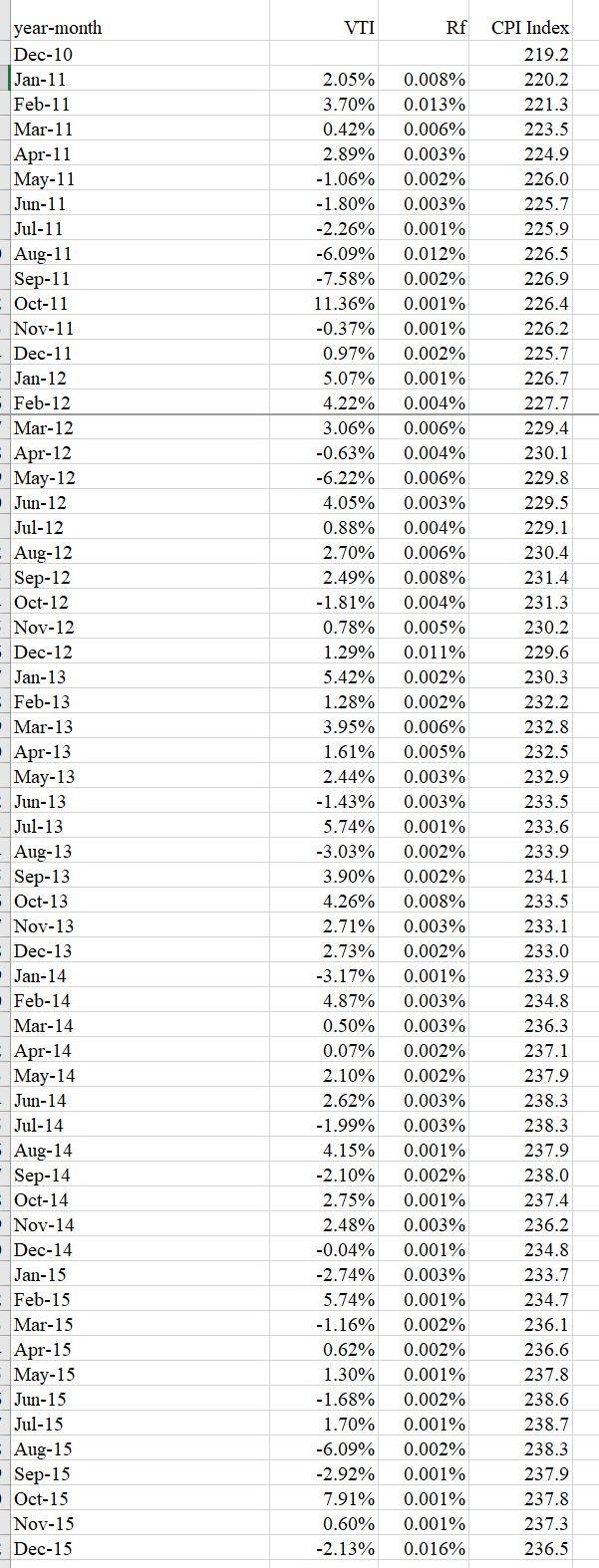

Question: Do the following for VTI. Continuously compounded return for each month 60-month holding period return Geometric average monthly return given the 60-month holding period return

Do the following for VTI.

- Continuously compounded return for each month

- 60-month holding period return

- Geometric average monthly return given the 60-month holding period return computed above

- Geometric average annual return (same as EAR) given the 60-month holding period return computed above

- Simple average of the monthly return over the 60-month period

- How does the simple average monthly return compare with the geometric average monthly return? Is the difference between two numbers consistent with what you expect?

- If you expect history to repeat itself, what is your best estimate of the forecast of expected monthly return?

- Standard deviation of monthly return over the 60-month period

- If you expect history to repeat itself, what is the best estimate of the forecast of the standard deviation of monthly returns?

- Excess return for each month

- Risk premium over the 60-month period

- Standard deviation of monthly excess return over the 60-month period

- Sharpe ratio

- Sharpe ratio using the standard deviation of return (instead of using standard deviation of excess return) in the denominator. Why is it different from the Sharpe ratio computed above?

- Inflation rate for each month. Use the CPI index in adjacent month to compute the inflation rate.

- Real return for VTI each month

VTI Rf CPI Index 219.2 220.2 221.3 223.5 224.9 226.0 225.7 225.9 226.5 226.9 226.4 226.2 year-month Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 2.05% 3.70% 0.42% 2.89% -1.06% -1.80% -2.26% -6.09% -7.58% 11.36% -0.37% 0.97% 5.07% 4.22% 3.06% -0.63% -6.22% 4.05% 0.88% 2.70% 2.49% -1.81% 0.78% 1.29% 5.42% 1.28% 3.95% 1.61% 2.44% -1.43% 5.74% -3.03% 3.90% 4.26% 2.71% 2.73% -3.17% 4.87% 0.50% 0.07% 2.10% 2.62% -1.99% 4.15% -2.10% 2.75% 2.48% -0.04% -2.74% 5.74% -1.16% 0.62% 1.30% -1.68% 1.70% -6.09% -2.92% 7.91% 0.60% -2.13% 0.008% 0.013% 0.006% 0.003% 0.002% 0.003% 0.001% 0.012% 0.002% 0.001% 0.001% 0.002% 0.001% 0.004% 0.006% 0.004% 0.006% 0.003% 0.004% 0.006% 0.008% 0.004% 0.005% 0.011% 0.002% 0.002% 0.006% 0.005% 0.003% 0.003% 0.001% 0.002% 0.002% 0.008% 0.003% 0.002% 0.001% 0.003% 0.003% 0.002% 0.002% 0.003% 0.003% 0.001% 0.002% 0.001% 0.003% 0.001% 0.003% 0.001% 0.002% 0.002% 0.001% 0.002% 0.001% 0.002% 0.001% 0.001% 0.001% 0.016% 225.7 226.7 227.7 229.4 230.1 229.8 229.5 229.1 230.4 231.4 231.3 230.2 229.6 230.3 232.2 232.8 232.5 232.9 233.5 233.6 233.9 234.1 233.5 233.1 233.0 233.9 234.8 236.3 237.1 237.9 238.3 238.3 237.9 238.0 237.4 236.2 234.8 233.7 234.7 236.1 236.6 237.8 238.6 238.7 238.3 237.9 237.8 237.3 236.5 VTI Rf CPI Index 219.2 220.2 221.3 223.5 224.9 226.0 225.7 225.9 226.5 226.9 226.4 226.2 year-month Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 2.05% 3.70% 0.42% 2.89% -1.06% -1.80% -2.26% -6.09% -7.58% 11.36% -0.37% 0.97% 5.07% 4.22% 3.06% -0.63% -6.22% 4.05% 0.88% 2.70% 2.49% -1.81% 0.78% 1.29% 5.42% 1.28% 3.95% 1.61% 2.44% -1.43% 5.74% -3.03% 3.90% 4.26% 2.71% 2.73% -3.17% 4.87% 0.50% 0.07% 2.10% 2.62% -1.99% 4.15% -2.10% 2.75% 2.48% -0.04% -2.74% 5.74% -1.16% 0.62% 1.30% -1.68% 1.70% -6.09% -2.92% 7.91% 0.60% -2.13% 0.008% 0.013% 0.006% 0.003% 0.002% 0.003% 0.001% 0.012% 0.002% 0.001% 0.001% 0.002% 0.001% 0.004% 0.006% 0.004% 0.006% 0.003% 0.004% 0.006% 0.008% 0.004% 0.005% 0.011% 0.002% 0.002% 0.006% 0.005% 0.003% 0.003% 0.001% 0.002% 0.002% 0.008% 0.003% 0.002% 0.001% 0.003% 0.003% 0.002% 0.002% 0.003% 0.003% 0.001% 0.002% 0.001% 0.003% 0.001% 0.003% 0.001% 0.002% 0.002% 0.001% 0.002% 0.001% 0.002% 0.001% 0.001% 0.001% 0.016% 225.7 226.7 227.7 229.4 230.1 229.8 229.5 229.1 230.4 231.4 231.3 230.2 229.6 230.3 232.2 232.8 232.5 232.9 233.5 233.6 233.9 234.1 233.5 233.1 233.0 233.9 234.8 236.3 237.1 237.9 238.3 238.3 237.9 238.0 237.4 236.2 234.8 233.7 234.7 236.1 236.6 237.8 238.6 238.7 238.3 237.9 237.8 237.3 236.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts