Question: do the whole thing plese 2. Answer the questions. 1) The current stock price for Firm D is $80 while the current dividend is $8.

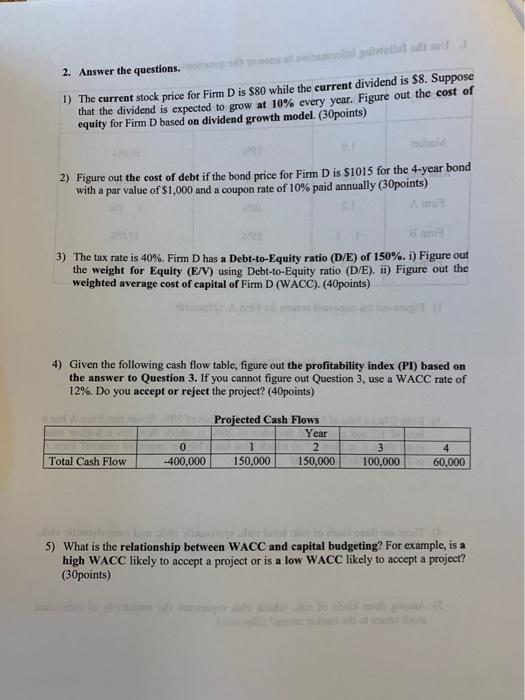

2. Answer the questions. 1) The current stock price for Firm D is $80 while the current dividend is $8. Suppose that the dividend is expected to grow at 10% every year. Figure out the cost of equity for Firm D based on dividend growth model. (30points) Figure out the cost of debt if the bond price for Firm D is S1015 for the 4-year bond with a par value of $1,000 and a coupon rate of 10% paid annually (30points) 2) 3) The tax rate is 40%. Firm D has a Debt-to-Equity ratio (D/E) of 150%.) Figure out the weight for Equity (EN) using Debt-to-Equity ratio (DE), ii) Figure out the weighted average cost of capital of Firm D (WACC). (40points) 4) Given the following cash flow table, figure out the profitability index (PI) based on the answer to Question 3. If you cannot figure out Question 3, use a WACC rate of 12%. Do you accept or reject the project? (40points) Projected Cash Flows Year Total Cash Flow 400,000150,000 150,000 100,000 60.000 5) What is the relationship between WACC and capital budgeting? For example, is a high WACC likely to accept a project or is a low WACC likely to accept a project? (30points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts