Question: do only part 4 and 5 please. 2. Answer the questions. 1) The current stock price for Firm D is $100 while the next dividend

do only part 4 and 5 please.

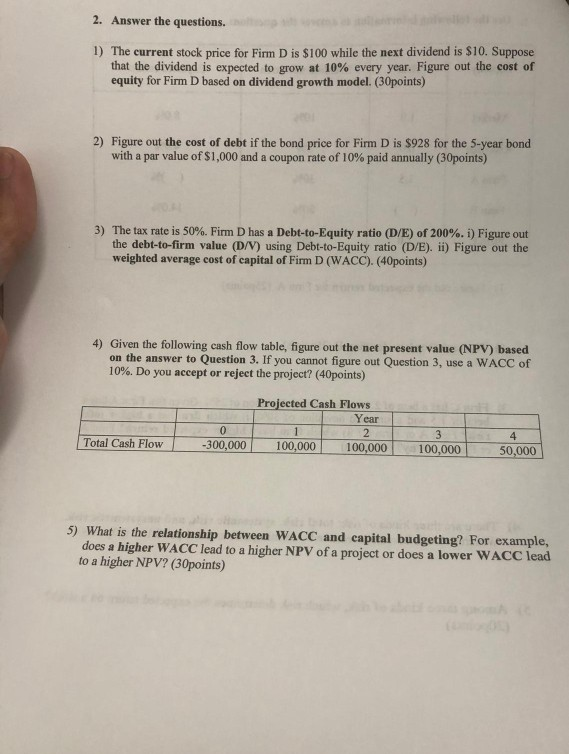

2. Answer the questions. 1) The current stock price for Firm D is $100 while the next dividend is $10. Suppose that the dividend is expected to grow at 10% every year. Figure out the cost of equity for Firm D based on dividend growth model. (30points) 2) Figure out the cost of debt if the bond price for Firm D is $928 for the 5-year bond with a par value of $1,000 and a coupon rate of 10% paid annually (30points) 3) The tax rate is 50%. Firm D has a Debt-to-Equity ratio (D/E) of 200%.) Figure out the debt-to-firm value (D/V) using Debt-to-Equity ratio (D/E). ii) Figure out the weighted average cost of capital of Firm D (WACC). (40points) 4) Given the following cash flow table, figure out the net present value (NPV) based on the answer to Question 3. If you cannot figure out Question 3, use a WACC of 10%. Do you accept or reject the project? (40points) Projected Cash Flows Year 4 Total Cash Flow 300,000 100,000 100,000 100,000 5) What is the relationship between WACC and capital budgeting? For example, does a higher WACC lead to a higher NPV of a project or does a lower WACC to a higher NPV? (30points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts