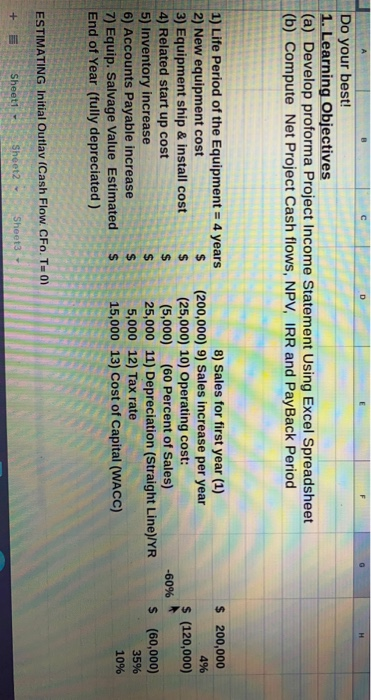

Question: Do your best! 1. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack

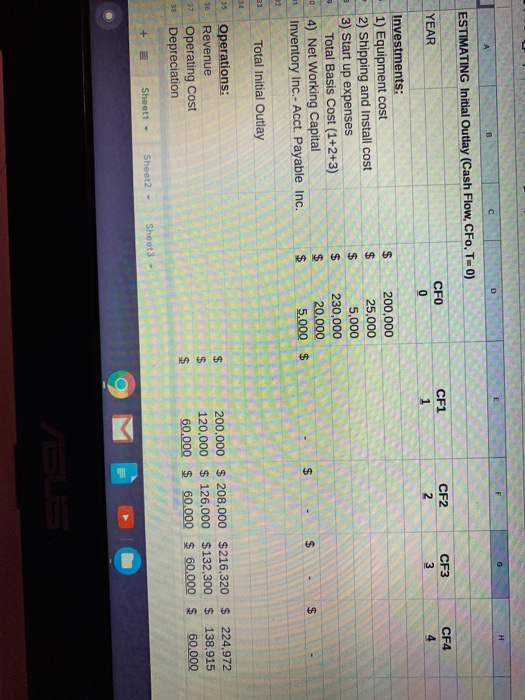

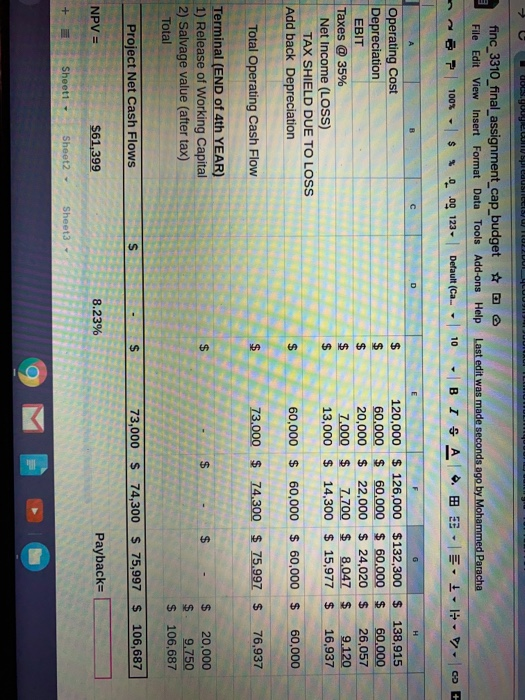

Do your best! 1. Learning Objectives (a) Develop proforma Project Income Statement Using Excel Spreadsheet (b) Compute Net Project Cash flows, NPV, IRR and PayBack Period $ 200,000 4% $ 120,000) 1) Life Period of the Equipment = 4 years 2) New equipment cost $ 3) Equipment ship & install cost $ 4) Related start up cost $ 5) Inventory increase $ 6) Accounts Payable increase $ 7) Equip. Salvage Value Estimated $ End of Year (fully depreciated) 8) Sales for first year (1) (200,000) 9) Sales increase per year (25,000) 10) Operating cost: (5,000) (60 Percent of Sales) 25,000 11) Depreciation (Straight Line)/YR 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) -60% $ (60,000) 35% 10% ESTIMATING Initial Outlav (Cash Flow. CFo. T=0) + Sheet1 Sheet2 Sheet3 p ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) CF2 CFO 0 YEAR CF1 1 CF3 3 CF4 4 2 $ $ $ $ 200,000 25,000 5,000 230,000 20.000 5,000 $ 0 $ $ - $ $ 31 Investments: - 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Inventory Inc.- Acct. Payable Inc. 32 Total Initial Outlay 34 35 Operations: Revenue 37 Operating cost 38 Depreciation $ $ $ 200,000 $ 208,000 $216,320 $ 224,972 120,000 $ 126,000 $132,300 $ 138,915 60.000 $ 60.000 $ 60,000 $ 60.000 Sheet1 - Sheet2 Sheet3 docs.gouye spildus ice TULUI finc_3310_final_assignment_cap_budget File Edit View Insert Format Data Tools Add-ons Help Last edit was made seconds ago by Mohammed Paracha 100% $ * . .00 123- Default (Ca... - 10 BI SA . E ... + R D E H Operating cost Depreciation EBIT Taxes @ 35% Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation $ $ $ $ $ 120,000 $ 126,000 $132,300 $ 138,915 60,000 $ 60,000 $60,000 $ 60.000 20,000 $ 22,000 $ 24.020 $ 26,057 7.000 $ 7.700 $ 8.047 $ 9.120 13,000 $ 14,300 $ 15,977 $ 16,937 $ 60,000 $ 60,000 $ 60,000 $ 60,000 Total Operating Cash Flow $ 73.000 $ 74.300 $ 75,997 $ 76,937 $ $ $ Terminal (END of 4th YEAR) 1) Release of Working Capital 2) Salvage value (after tax) Total $ 20,000 $ 9.750 $ 106,687 Project Net Cash Flows $ $ 73,000 $ 74,300 $ 75,997 $ 106,687 NPV = $61,399 8.23% Payback + Sheet1 - Sheet2 Sheet3 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts