Question: Does someone know how to do these? Please highlight answers thx Will rate thumb up for good response thanks so much 4. Consider the following

Does someone know how to do these? Please highlight answers thx

Will rate thumb up for good response thanks so much

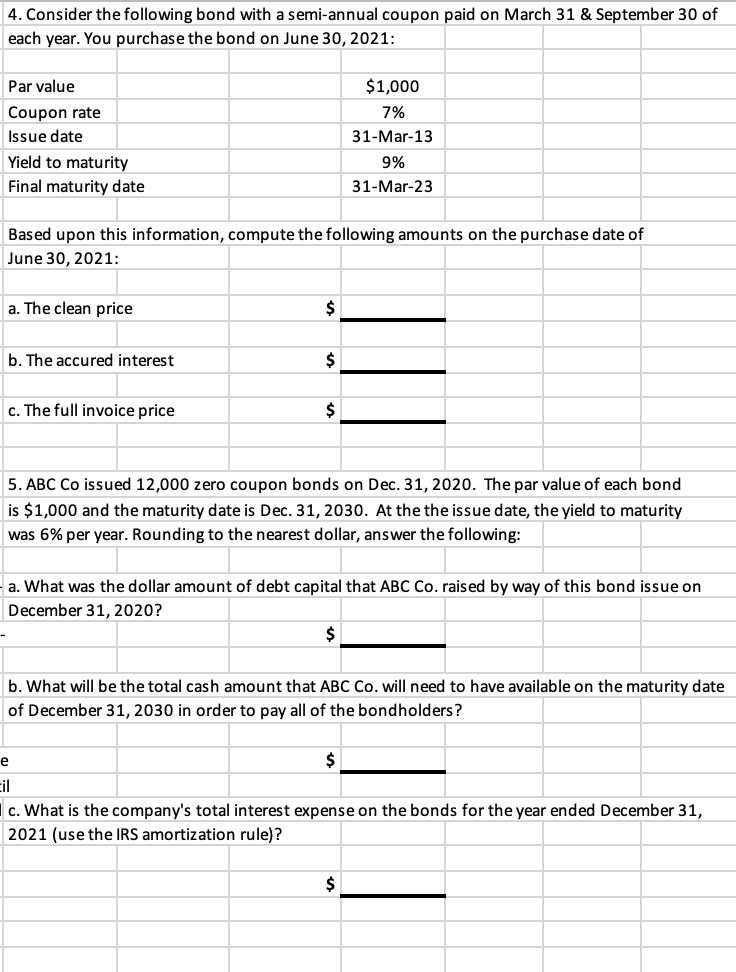

4. Consider the following bond with a semi-annual coupon paid on March 31 & September 30 of each year. You purchase the bond on June 30, 2021: Par value Coupon rate Issue date Yield to maturity Final maturity date $1,000 7% 31-Mar-13 9% 31-Mar-23 Based upon this information, compute the following amounts on the purchase date of June 30, 2021: a. The clean price $ b. The accured interest $ c. The full invoice price $ 5. ABC Co issued 12,000 zero coupon bonds on Dec. 31, 2020. The par value of each bond is $1,000 and the maturity date is Dec. 31, 2030. At the the issue date, the yield to maturity was 6% per year. Rounding to the nearest dollar, answer the following: a. What was the dollar amount of debt capital that ABC Co. raised by way of this bond issue on December 31, 2020? $ b. What will be the total cash amount that ABC Co. will need to have available on the maturity date of December 31, 2030 in order to pay all of the bondholders? e $ cil c. What is the company's total interest expense on the bonds for the year ended December 31, 2021 (use the IRS amortization rule)? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts