Question: Does someone know how to do these? Please highlight answers thx Will rate thumb up for good response thanks so much! 1. BTU Inc is

Does someone know how to do these?

Please highlight answers thx Will rate thumb up for good response

thanks so much!

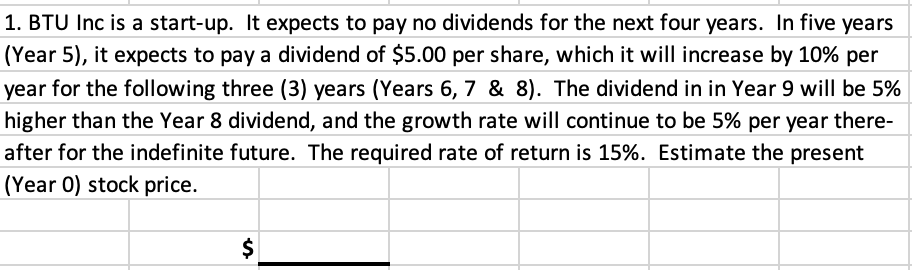

1. BTU Inc is a start-up. It expects to pay no dividends for the next four years. In five years (Year 5), it expects to pay a dividend of $5.00 per share, which it will increase by 10% per year for the following three (3) years (Years 6, 7 & 8). The dividend in in Year 9 will be 5% higher than the Year 8 dividend, and the growth rate will continue to be 5% per year there- after for the indefinite future. The required rate of return is 15%. Estimate the present (Year O) stock price. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts