Question: Does someone know how to do these? Please highlight answers thx Will rate thumb up for good response thanks so much! All information is here

Does someone know how to do these?

Please highlight answers thx Will rate thumb up for good response

thanks so much!

All information is here

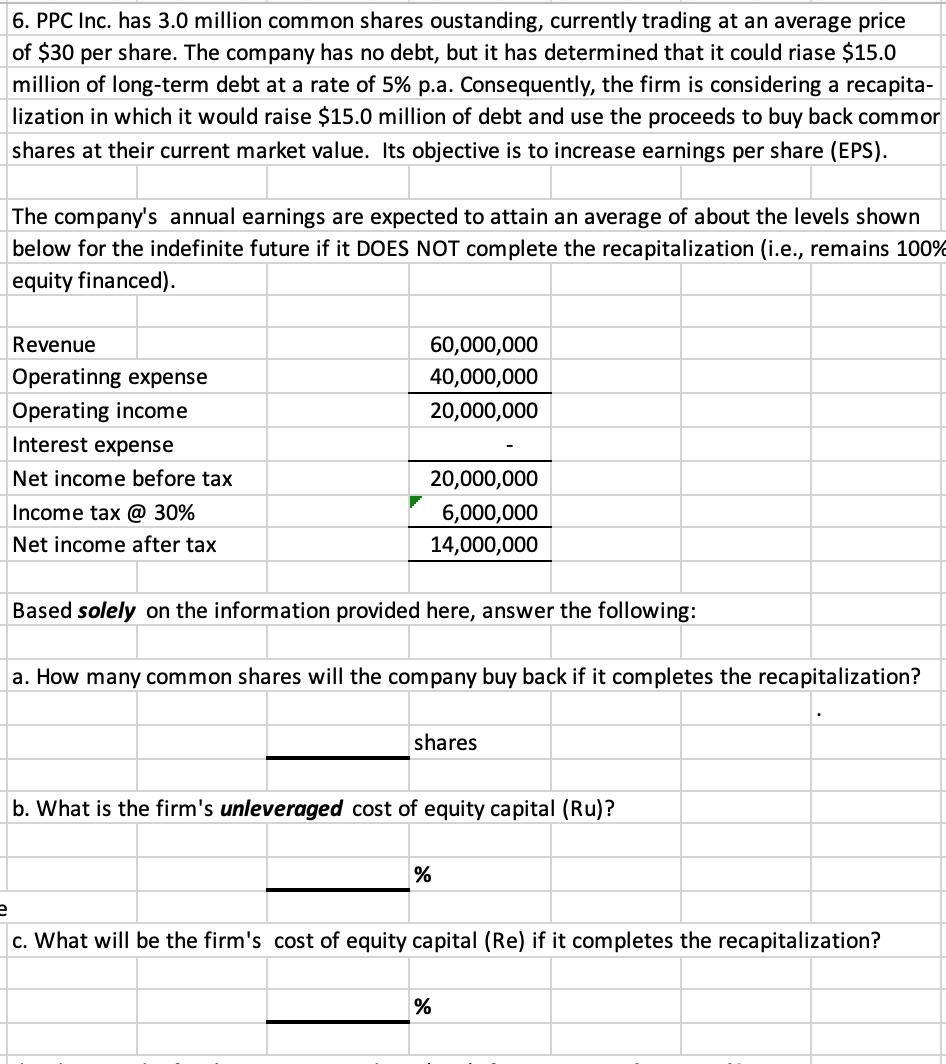

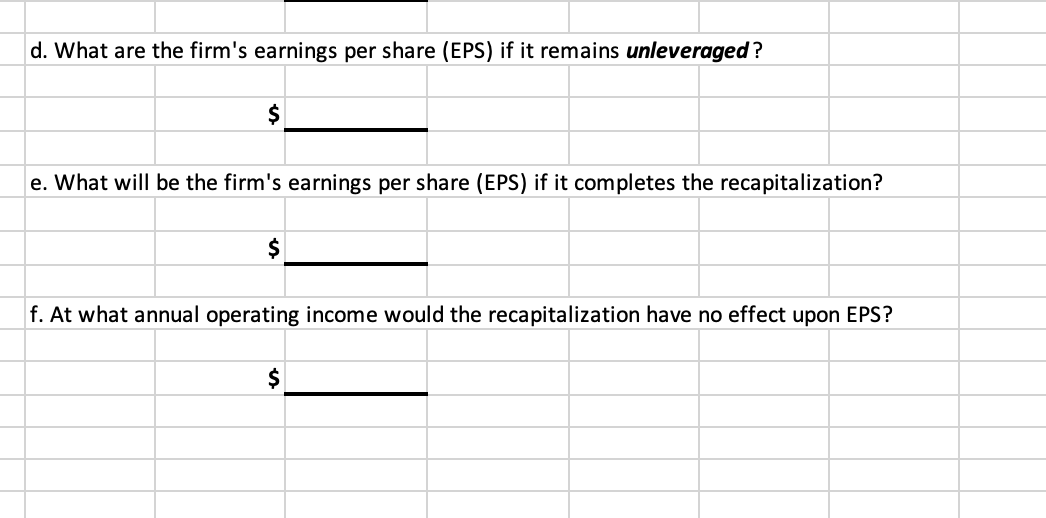

6. PPC Inc. has 3.0 million common shares oustanding, currently trading at an average price of $30 per share. The company has no debt, but it has determined that it could riase $15.0 million of long-term debt at a rate of 5% p.a. Consequently, the firm is considering a recapita- lization in which it would raise $15.0 million of debt and use the proceeds to buy back commor shares at their current market value. Its objective is to increase earnings per share (EPS). The company's annual earnings are expected to attain an average of about the levels shown below for the indefinite future if it DOES NOT complete the recapitalization (i.e., remains 100% equity financed). 60,000,000 40,000,000 20,000,000 Revenue Operatinng expense Operating income Interest expense Net income before tax Income tax @ 30% Net income after tax 20,000,000 6,000,000 14,000,000 Based solely on the information provided here, answer the following: a. How many common shares will the company buy back if it completes the recapitalization? shares b. What is the firm's unleveraged cost of equity capital (Ru)? % 22 c. What will be the firm's cost of equity capital (Re) if it completes the recapitalization? % d. What are the firm's earnings per share (EPS) if it remains unleveraged? e. What will be the firm's earnings per share (EPS) if it completes the recapitalization? f. At what annual operating income would the recapitalization have no effect upon EPS? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts