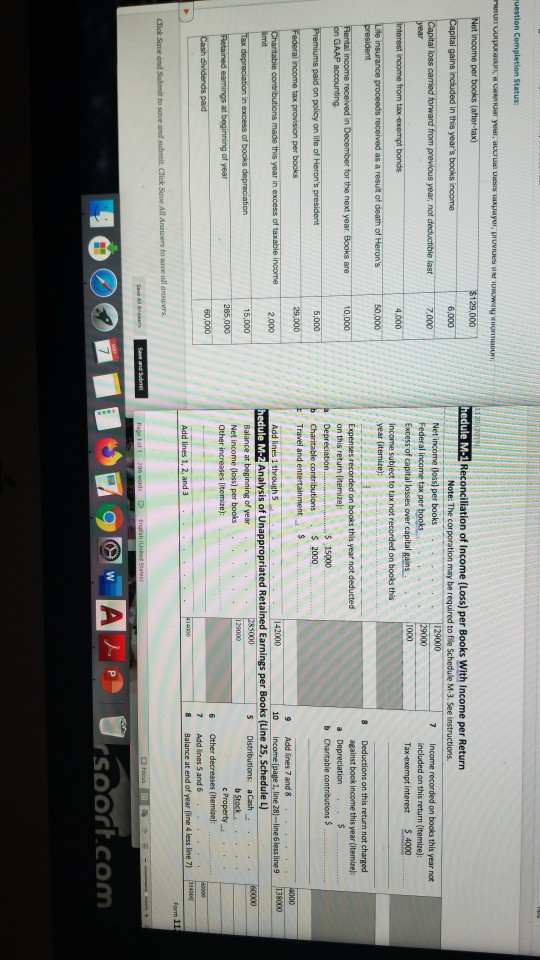

Question: does this look correct? uestion Completion Status: UIT OTPOURRI, U yudi, da DS Taxpayur, UVIOUS WIR TUROW T Net income per books (after-tax) $129,000 Capital

does this look correct?

uestion Completion Status: UIT OTPOURRI, U yudi, da DS Taxpayur, UVIOUS WIR TUROW T Net income per books (after-tax) $129,000 Capital gains included in this year's books income 6,000 Capital loss carried forward from previous year, not deductible last ar 7.000 Interest income from tax exempt bonds 4.000 50,000 Life insurance proceeds received as a result of death of Heron's president Rental income received in December for the next year. Books are lon GAAP accounting 10,000 hedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructions Net income (loss) per books . 129000 7 Income recorded on books this year not Federal income tax per books 29000 included on this return (itemize): Excess of capital losses over capital gains. 1000 Tax-exempt interest S 4000 Income subject to tax not recorded on books this year (itemize): ................................... 8 Deductions on this return not charged Expenses recorded on books this year not deducted against book income this year (itemize): on this return itemize): a Depreciation s Depreciation...................$ 15000 b Charitable contributions $ Charitable contributions . $ 2000..... Travel and entertainment S... 9 Add lines 7 and 8 : .. .. . 4000 Add lines 1 through 5 . 142000 10 Income (page 1, line 28) --line Gless line 9 138000 hedule M-2 Analysis of Unappropriated Retained Earnings per Books (Line 25, Schedule L) 285000 Balance at beginning of year 5 Distributions: a Cash . 00000 . Net income (loss) per books b Stock- Other increases (itemize): c Property . . 6 Other decreases (itemizel: 7 Add lines 5 and 6 ... ... Add lines 1, 2, and 3 . . . . . . 8 Balance at end of year line 4 less line 7) Premiums paid on policy on life of Heron's president 5,000 Federal income tax provision per books 29.000 Charitable contributions made this year in excess of taxable income limit 2.000 Tax depreciation in excess of books depreciation 15,000 Retained eamings at beginning of year 285,000 Cash dividends paid 60,000 Click Save and Submit to save and submit. Click Save All Ansters to save all answers Are S ave and submit Page 1 296 words English States L OLI 9W ALPUrsport.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts