Question: don't copy from the website Question 3. Suppose the current ZCB prices for maturity in two years and in five years are 0.8 and 0.7,

don't copy from the website

don't copy from the website

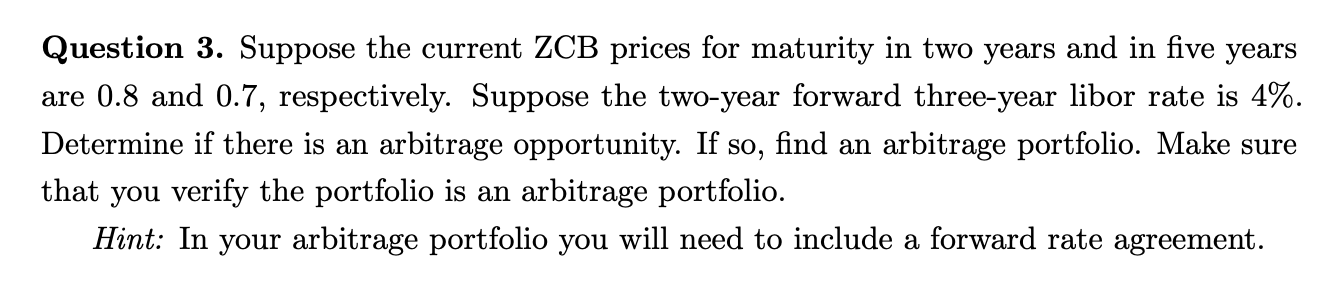

Question 3. Suppose the current ZCB prices for maturity in two years and in five years are 0.8 and 0.7, respectively. Suppose the two-year forward three-year libor rate is 4%. Determine if there is an arbitrage opportunity. If so, find an arbitrage portfolio. Make sure that you verify the portfolio is an arbitrage portfolio. Hint: In your arbitrage portfolio you will need to include a forward rate agreement. Question 3. Suppose the current ZCB prices for maturity in two years and in five years are 0.8 and 0.7, respectively. Suppose the two-year forward three-year libor rate is 4%. Determine if there is an arbitrage opportunity. If so, find an arbitrage portfolio. Make sure that you verify the portfolio is an arbitrage portfolio. Hint: In your arbitrage portfolio you will need to include a forward rate agreement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts