Question: Don't know how to start on this. Please help, many thanks! 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel

Don't know how to start on this. Please help, many thanks!

Don't know how to start on this. Please help, many thanks!

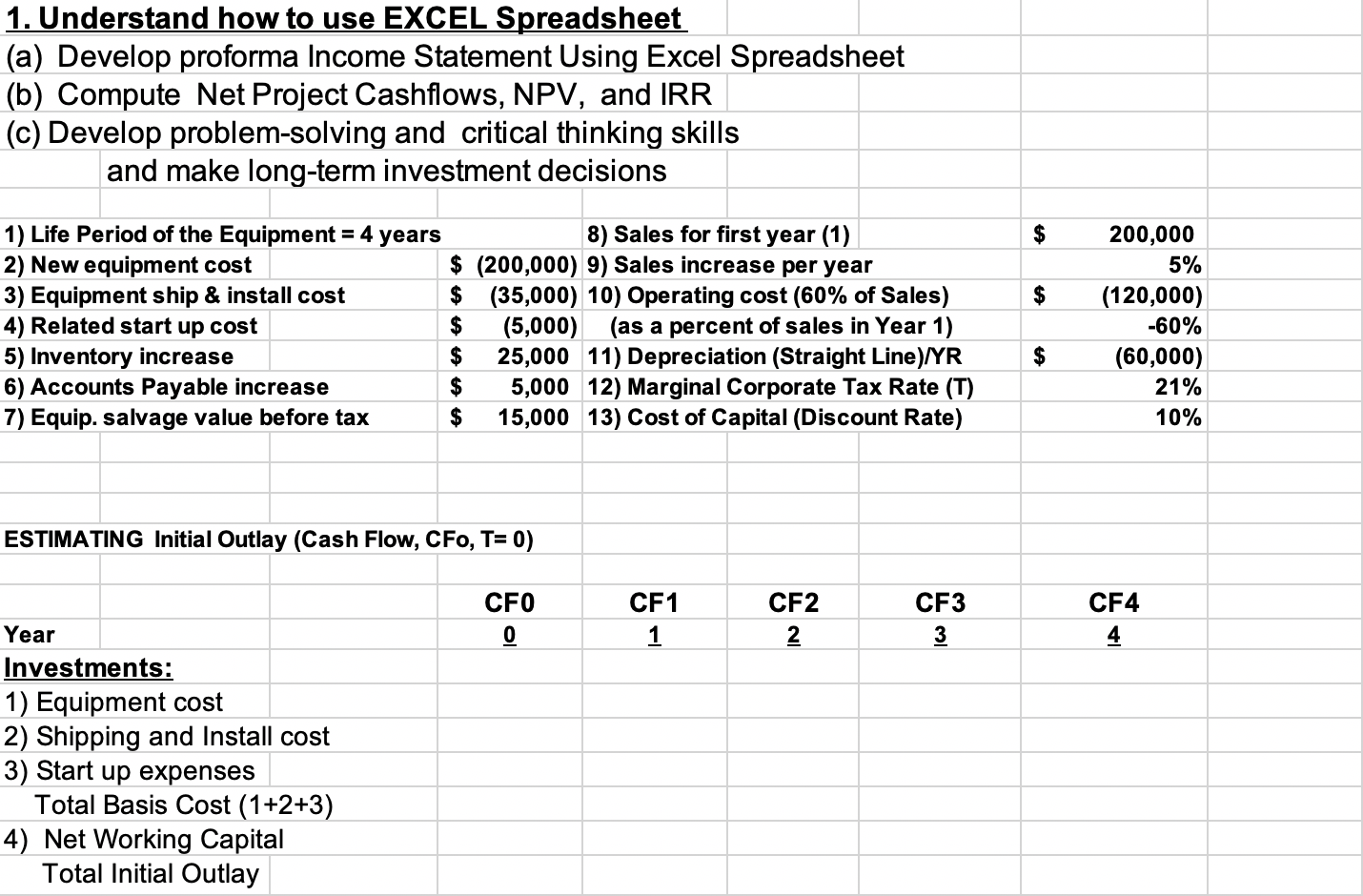

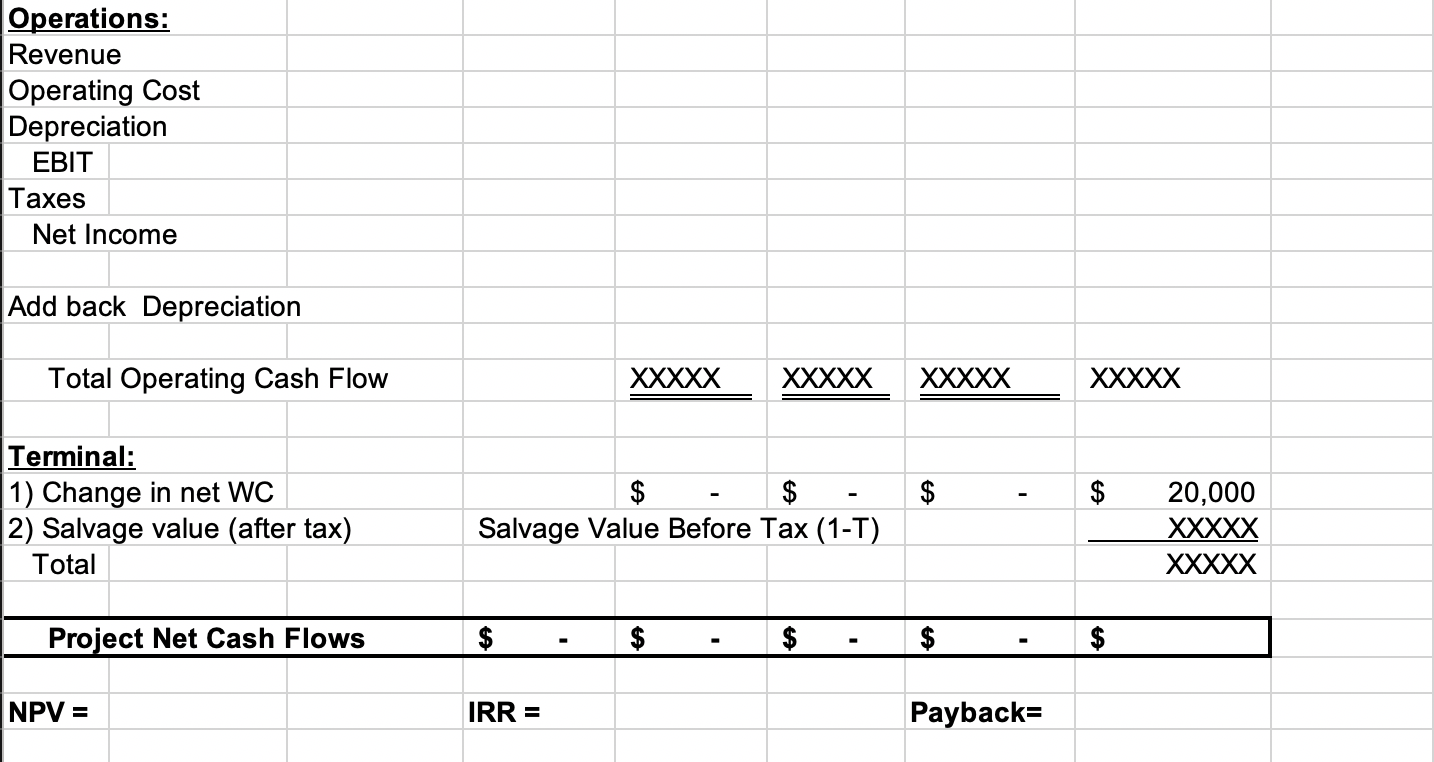

1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions $ 1) Life Period of the Equipment = 4 years 8) Sales for first year (1) 2) New equipment cost $ (200,000) 9) Sales increase per year 3) Equipment ship & install cost $ (35,000) 10) Operating cost (60% of Sales) 4) Related start up cost $ (5,000) (as a percent of sales in Year 1) 5) Inventory increase $ 25,000 11) Depreciation (Straight Line)/YR 6) Accounts Payable increase $ 5,000 12) Marginal Corporate Tax Rate (T) 7) Equip. salvage value before tax $ 15.000 13) Cost of Capital (Discount Rate) 200,000 5% (120,000) -60% (60,000) 21% 10% ESTIMATING Initial Outlay (Cash Flow, CFO, T= 0) CFO CF1 CF2 CF3 CF4 O 1 3 4 Year Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Total Initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XXXXX XXXXX XXXXXXXXXX - $ - Terminal: 1) Change in net WC 2) Salvage value (after tax) Total - $ Salvage Value Before Tax (1-T) 20,000 XXXXX XXXXX Project Net Cash Flows $ - $ NPV = IRR = Payback= 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions $ 1) Life Period of the Equipment = 4 years 8) Sales for first year (1) 2) New equipment cost $ (200,000) 9) Sales increase per year 3) Equipment ship & install cost $ (35,000) 10) Operating cost (60% of Sales) 4) Related start up cost $ (5,000) (as a percent of sales in Year 1) 5) Inventory increase $ 25,000 11) Depreciation (Straight Line)/YR 6) Accounts Payable increase $ 5,000 12) Marginal Corporate Tax Rate (T) 7) Equip. salvage value before tax $ 15.000 13) Cost of Capital (Discount Rate) 200,000 5% (120,000) -60% (60,000) 21% 10% ESTIMATING Initial Outlay (Cash Flow, CFO, T= 0) CFO CF1 CF2 CF3 CF4 O 1 3 4 Year Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Total Initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XXXXX XXXXX XXXXXXXXXX - $ - Terminal: 1) Change in net WC 2) Salvage value (after tax) Total - $ Salvage Value Before Tax (1-T) 20,000 XXXXX XXXXX Project Net Cash Flows $ - $ NPV = IRR = Payback=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts