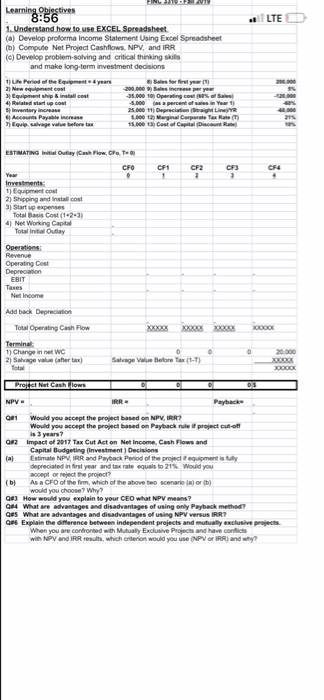

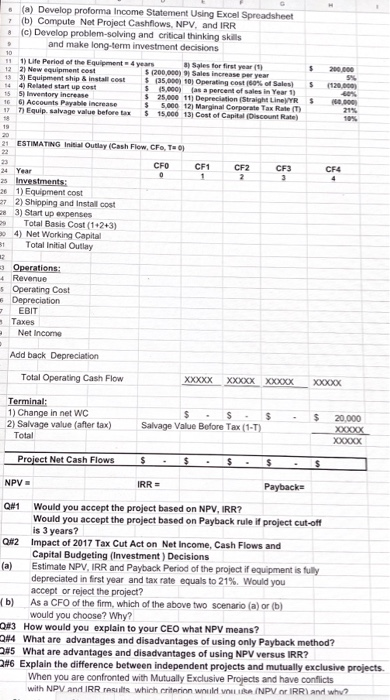

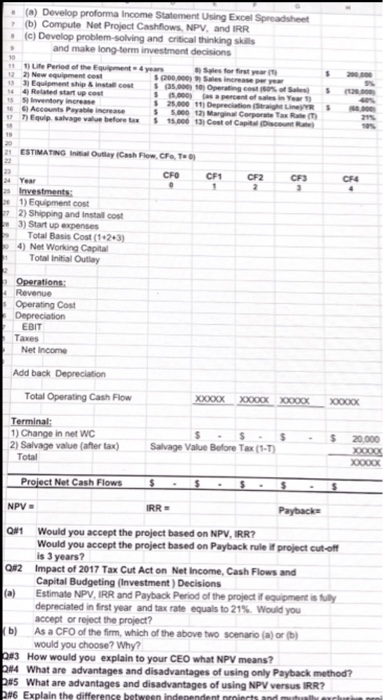

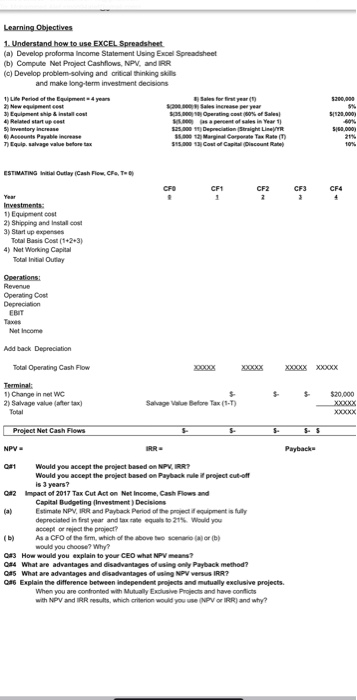

Question: LTE Learning Objectives 8:56 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV,

LTE Learning Objectives 8:56 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions of the years Sales for at 3) Mento 200.000 quant ship install cost 35.000 4. Related art 4.000 percent of 3.000 Marginal Corporate Tax Rate The foretas 15.00 Costa Catalin O Decreciom ESTIMATING Outley Cash Flow Crete 2 d ost Cost (23) 4) Net Wong Cat To Oy Oper Operating cost Add back Depreciation Total Operating Cash Flow Terminal 1) Change in net WC 2) Swinge value the tax) Salvage Vue Before (1) Projet et cash lows NPV ON 2 Payback Would you accept the project based on NPV, ROR? Would you accept the project based on Payback med project of is 3 years? Impact of 2017 Tax Cut Act on Net Income Cashflow and Capital inv estment Decisions Em NPV R yback Pro the proc enti deprecated in and out 21% d you color the project? As a CFO of them which of the ov e ral o w to your CEO What NPV ? ( 03 H ONS What we d Om Explain the rec When you NPV and o ing NPV RR? e nt produce My E ndhoven which c on would you use NPVR (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 111) Life Period of the Equipment 4 years 8) Sales for first year (1) 122) New equipment cost $ 200,000) Sales increase per year 133) Equipment ship & Install cost $ (35,000 10 Operating cost 60% of Sales) 144) Related start up cost $ 5,000) as a percent of sales in Year 1) 155 Inventory increase 25.000 11) Depreciation (Straight LineR 166) Accounts Payable increase 5.000 12) Marginal Corporate Tax Rate (T) 177) Equip salvage value before tax $ 15.000 13) Cost of Capital (Discount Rate) 200.000 (120.000) $ 60.000 21 ESTIMATING Initial Outlay (Cash Flow. CF, TO) CFCF2CF3CF4 24 Year 25 Investments 1) Equipment cost 227 2) Shipping and Instal cost 283) Start up expenses Total Basis Cost (12+3) 304) Net Working Capital 31 Total initial Outlay Operations: 4 Revenue 5 Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XXXXX XXXX XOOX XO000x Terminal: 1) Change in net WC 2) Salvage value (after tax) Total $ . S . Salvage Value Before Tax (1-T) $ . $ 20,000 XO000X Proiect Net Cash Flows $ - $ S S NPV = IRR = Payback Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if equipment is fully depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q3 How would you explain to your CEO what NPV means? Q4 What are advantages and disadvantages of using only Payback method? 25 What are advantages and disadvantages of using NPV versus IRR? 26 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have conflicts with NPV and IRR results which criterion would A INPV O IRR) and why? (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 1 Lite Period of the Equipment & years Sales for first 122) New equipment cost 200.000) Sales increase 133 Equipment ship & Incest SOS. 10 Opc o es 144 Rued start up cost S (5.00) as a percent of You S eory increase $ 25.000 11 Depreciation ( S L R 16 Accounts Payable increase S 5.00 ) Margal Corporate Tax 17 ) Equip savage value before 15.000 13 Cost of Capital ) 24 CF1 CF2 CF ESTIMATING Ini Outlay Cash Flow CFT CFO Year Investments 1) Equipment cost 2) Shipping and Instal cost 3) Start up expenses Total Basis Cost (123) 4) Net Working Capital Total initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XOOOXXOO0x x0000K XOOOX Terminal 1) Change in net WC 2) Salvage value (after tax) Total $ $ - $ Salvage Value Before Tax (1-T) Project Net Cash Flows $ $ NPV IRRE Payback (a) Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rulet project cut-off is 3 years? 12 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment) Decisions Estimate NPV, IRR and Payback period of the projectif equipment is depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? 23 How would you explain to your CEO what NPV means? 4 What are advantages and disadvantages of using only Payback method? 25 What are advantages and disadvantages of using NPV versus IRR? #6 Explain the difference between independent proiects and mutu r i Learning Objectives 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions years 5200.000 120.000 1 Lite Period of the time Newm ent cost 3) Equipment whip & Install Related start upset 5) Inventory Increase Au Payable 7) Equip, salvage value before tax 20. SOS. . 25.000 15.00 315.000 Sales increase per year Operating cost 80% of Sales sa percent of sales in Year 1) Depreciation Straight Line/YR Mary Corporate Tax Rate Cast of Capital Discount Rate 560.000) ESTIMATING W Outlay Cash Flow Chat Investments: 1) Equipment cost 2) Shipping and instalo 3) Startup expenses Total Basis Cost (1+2+3) 4) Net Working Capital Total Intl Oulay Operations: Revenue Operating cost Depreciation Net Income Add back Depreciation Total Operating Cash Flow xxx xxxx xxxx xxxx Terminal 1) Change in net WC 2) Salvage value (arter tax) $20.000 Stage Bube Project Net Cash Flows NPV- Payback Would you accept the project based on NPV, IRR? Would you accept the project based on Payback we project cut-off Is Jyears? #2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions Estimate NPV, IRR and Payback period of the project guipment is fully deprecated in first year and a u to21%. Would you accept or reject the project? As a CFO of the firm, which of the above t o would you choose? Why? #3 How would you explain to your CEO what NPV means? 4 What are advantages and disadvantages of using only Payback method? # What are advantages and disadvantages of using NPV versus IRR? 6 Explain the difference between Independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have contics with NPV and IRR results, which criterion would you use NPV O IRR) and why? LTE Learning Objectives 8:56 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions of the years Sales for at 3) Mento 200.000 quant ship install cost 35.000 4. Related art 4.000 percent of 3.000 Marginal Corporate Tax Rate The foretas 15.00 Costa Catalin O Decreciom ESTIMATING Outley Cash Flow Crete 2 d ost Cost (23) 4) Net Wong Cat To Oy Oper Operating cost Add back Depreciation Total Operating Cash Flow Terminal 1) Change in net WC 2) Swinge value the tax) Salvage Vue Before (1) Projet et cash lows NPV ON 2 Payback Would you accept the project based on NPV, ROR? Would you accept the project based on Payback med project of is 3 years? Impact of 2017 Tax Cut Act on Net Income Cashflow and Capital inv estment Decisions Em NPV R yback Pro the proc enti deprecated in and out 21% d you color the project? As a CFO of them which of the ov e ral o w to your CEO What NPV ? ( 03 H ONS What we d Om Explain the rec When you NPV and o ing NPV RR? e nt produce My E ndhoven which c on would you use NPVR (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 111) Life Period of the Equipment 4 years 8) Sales for first year (1) 122) New equipment cost $ 200,000) Sales increase per year 133) Equipment ship & Install cost $ (35,000 10 Operating cost 60% of Sales) 144) Related start up cost $ 5,000) as a percent of sales in Year 1) 155 Inventory increase 25.000 11) Depreciation (Straight LineR 166) Accounts Payable increase 5.000 12) Marginal Corporate Tax Rate (T) 177) Equip salvage value before tax $ 15.000 13) Cost of Capital (Discount Rate) 200.000 (120.000) $ 60.000 21 ESTIMATING Initial Outlay (Cash Flow. CF, TO) CFCF2CF3CF4 24 Year 25 Investments 1) Equipment cost 227 2) Shipping and Instal cost 283) Start up expenses Total Basis Cost (12+3) 304) Net Working Capital 31 Total initial Outlay Operations: 4 Revenue 5 Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XXXXX XXXX XOOX XO000x Terminal: 1) Change in net WC 2) Salvage value (after tax) Total $ . S . Salvage Value Before Tax (1-T) $ . $ 20,000 XO000X Proiect Net Cash Flows $ - $ S S NPV = IRR = Payback Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off is 3 years? Q#2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions (a) Estimate NPV, IRR and Payback period of the project if equipment is fully depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? (b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? Q3 How would you explain to your CEO what NPV means? Q4 What are advantages and disadvantages of using only Payback method? 25 What are advantages and disadvantages of using NPV versus IRR? 26 Explain the difference between independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have conflicts with NPV and IRR results which criterion would A INPV O IRR) and why? (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions 1 Lite Period of the Equipment & years Sales for first 122) New equipment cost 200.000) Sales increase 133 Equipment ship & Incest SOS. 10 Opc o es 144 Rued start up cost S (5.00) as a percent of You S eory increase $ 25.000 11 Depreciation ( S L R 16 Accounts Payable increase S 5.00 ) Margal Corporate Tax 17 ) Equip savage value before 15.000 13 Cost of Capital ) 24 CF1 CF2 CF ESTIMATING Ini Outlay Cash Flow CFT CFO Year Investments 1) Equipment cost 2) Shipping and Instal cost 3) Start up expenses Total Basis Cost (123) 4) Net Working Capital Total initial Outlay Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income Add back Depreciation Total Operating Cash Flow XOOOXXOO0x x0000K XOOOX Terminal 1) Change in net WC 2) Salvage value (after tax) Total $ $ - $ Salvage Value Before Tax (1-T) Project Net Cash Flows $ $ NPV IRRE Payback (a) Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rulet project cut-off is 3 years? 12 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment) Decisions Estimate NPV, IRR and Payback period of the projectif equipment is depreciated in first year and tax rate equals to 21%. Would you accept or reject the project? b) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? 23 How would you explain to your CEO what NPV means? 4 What are advantages and disadvantages of using only Payback method? 25 What are advantages and disadvantages of using NPV versus IRR? #6 Explain the difference between independent proiects and mutu r i Learning Objectives 1. Understand how to use EXCEL Spreadsheet (a) Develop proforma Income Statement Using Excel Spreadsheet (b) Compute Net Project Cashflows, NPV, and IRR (c) Develop problem-solving and critical thinking skills and make long-term investment decisions years 5200.000 120.000 1 Lite Period of the time Newm ent cost 3) Equipment whip & Install Related start upset 5) Inventory Increase Au Payable 7) Equip, salvage value before tax 20. SOS. . 25.000 15.00 315.000 Sales increase per year Operating cost 80% of Sales sa percent of sales in Year 1) Depreciation Straight Line/YR Mary Corporate Tax Rate Cast of Capital Discount Rate 560.000) ESTIMATING W Outlay Cash Flow Chat Investments: 1) Equipment cost 2) Shipping and instalo 3) Startup expenses Total Basis Cost (1+2+3) 4) Net Working Capital Total Intl Oulay Operations: Revenue Operating cost Depreciation Net Income Add back Depreciation Total Operating Cash Flow xxx xxxx xxxx xxxx Terminal 1) Change in net WC 2) Salvage value (arter tax) $20.000 Stage Bube Project Net Cash Flows NPV- Payback Would you accept the project based on NPV, IRR? Would you accept the project based on Payback we project cut-off Is Jyears? #2 Impact of 2017 Tax Cut Act on Net Income, Cash Flows and Capital Budgeting (Investment ) Decisions Estimate NPV, IRR and Payback period of the project guipment is fully deprecated in first year and a u to21%. Would you accept or reject the project? As a CFO of the firm, which of the above t o would you choose? Why? #3 How would you explain to your CEO what NPV means? 4 What are advantages and disadvantages of using only Payback method? # What are advantages and disadvantages of using NPV versus IRR? 6 Explain the difference between Independent projects and mutually exclusive projects. When you are confronted with Mutually Exclusive Projects and have contics with NPV and IRR results, which criterion would you use NPV O IRR) and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts