Question: double declining balance method. Compare your results from the two methods. Create a reusable Excel spreadsheet to perform this analysis. Required: X Download spreadsheet DepreciationCaseData-435c8f.xlsx

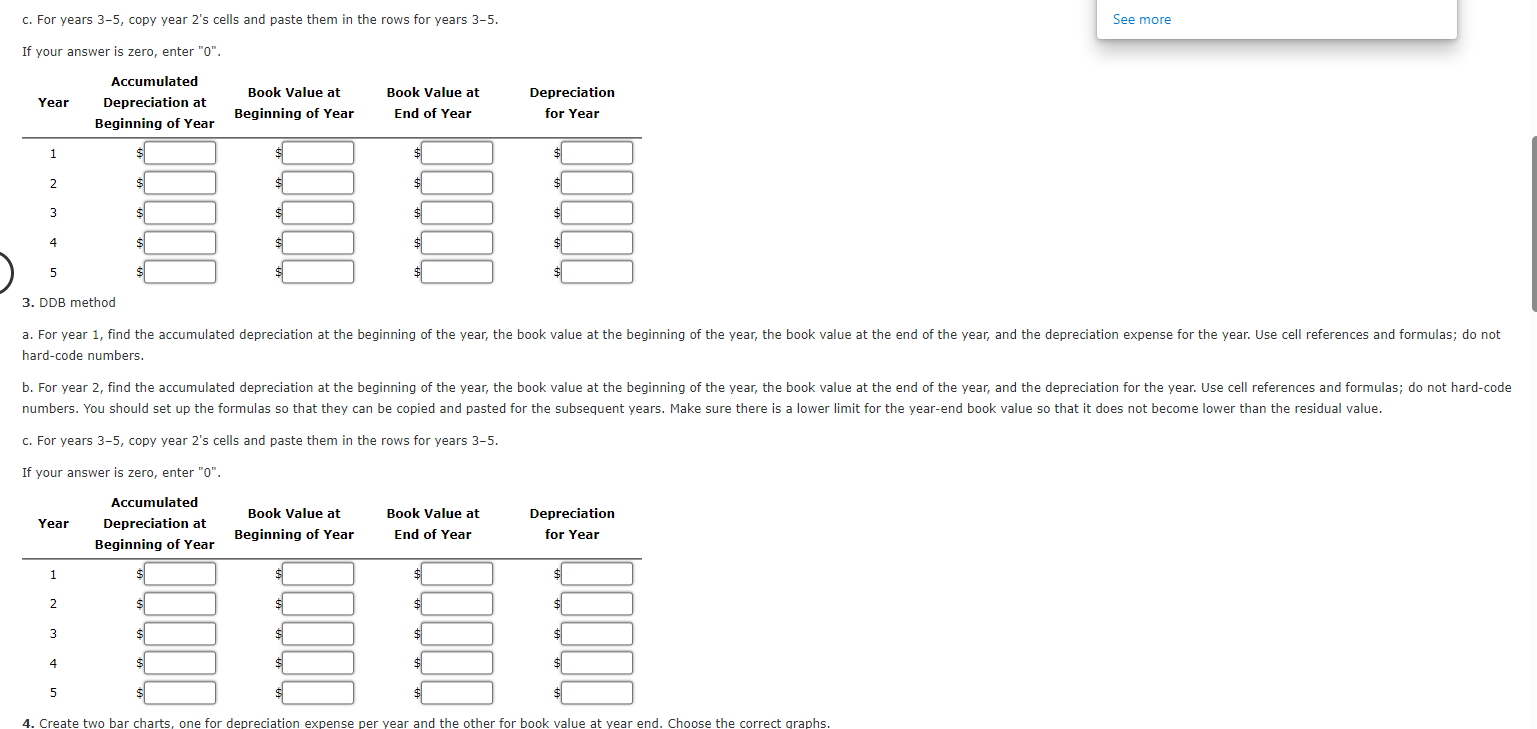

double declining balance method. Compare your results from the two methods. Create a reusable Excel spreadsheet to perform this analysis. Required: X Download spreadsheet DepreciationCaseData-435c8f.xlsx the year, the book value at the end of the year, and also the depreciation expense each year. Compare the results of the two methods. HINT: STEP-BY-STEP WALKTHROUGH 1. Straight-line rate and DDB rate: calculate the rates. You should name cells so that these values can be used in calculations more conveniently. Straight-line rate % DDB rate % 2. Straight-line method hard-code numbers. can be copied and pasted for the subsequent years. c. For years 3-5, copy year 2's cells and paste them in the rows for years 3-5. c. For years 3-5, copy year 2's cells and paste them in the rows for years 3-5. If your answer is zero, enter " 0 ". . Ineuivu hard-code numbers. c. For years 3-5, copy year 2's cells and paste them in the rows for years 3-5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts