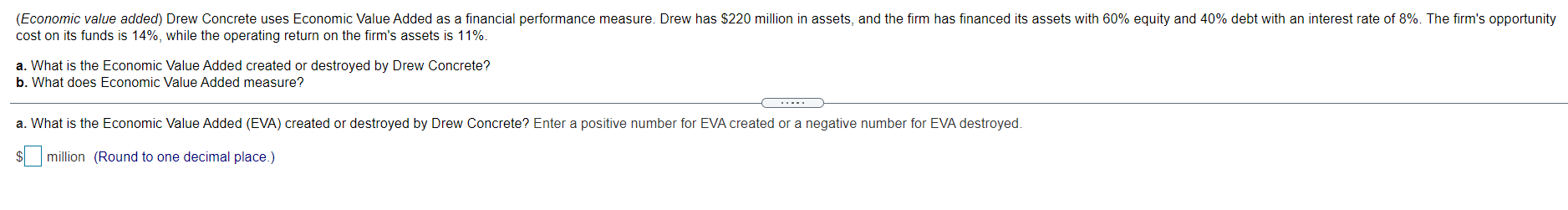

Question: Drew Concrete uses Economic Value Added as a financial performance measure. Drew has $220 million in assets, and the firm has financed its assets with

Drew Concrete uses Economic Value Added as a financial performance measure. Drew has $220 million in assets, and the firm has financed its assets with 60% equity and 40% debt with an interest rate of %. The firm's opportunity cost on its funds is 40%, while the operating return on the firm's assets is 11% .

a. What is the Economic Value Added created or destroyed by Drew Concrete?

b. What does Economic Value Added measure?

What is the Economic Value Added (EVA) created or destroyed by Drew Concrete? Enter a positive number for EVA created or a negative number for EVA destroyed.

(Economic value added) Drew Concrete uses Economic Value Added as a financial performance measure. Drew has $220 million in assets, and the firm has financed its assets with 60% equity and 40% debt with an interest rate of 8%. The firm's opportunity cost on its funds is 14%, while the operating return on the firm's assets is 11%. a. What is the Economic Value Added created or destroyed by Drew Concrete? b. What does Economic Value Added measure? a. What is the Economic Value Added (EVA) created or destroyed by Drew Concrete? Enter a positive number for EVA created or a negative number for EVA destroyed million (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts