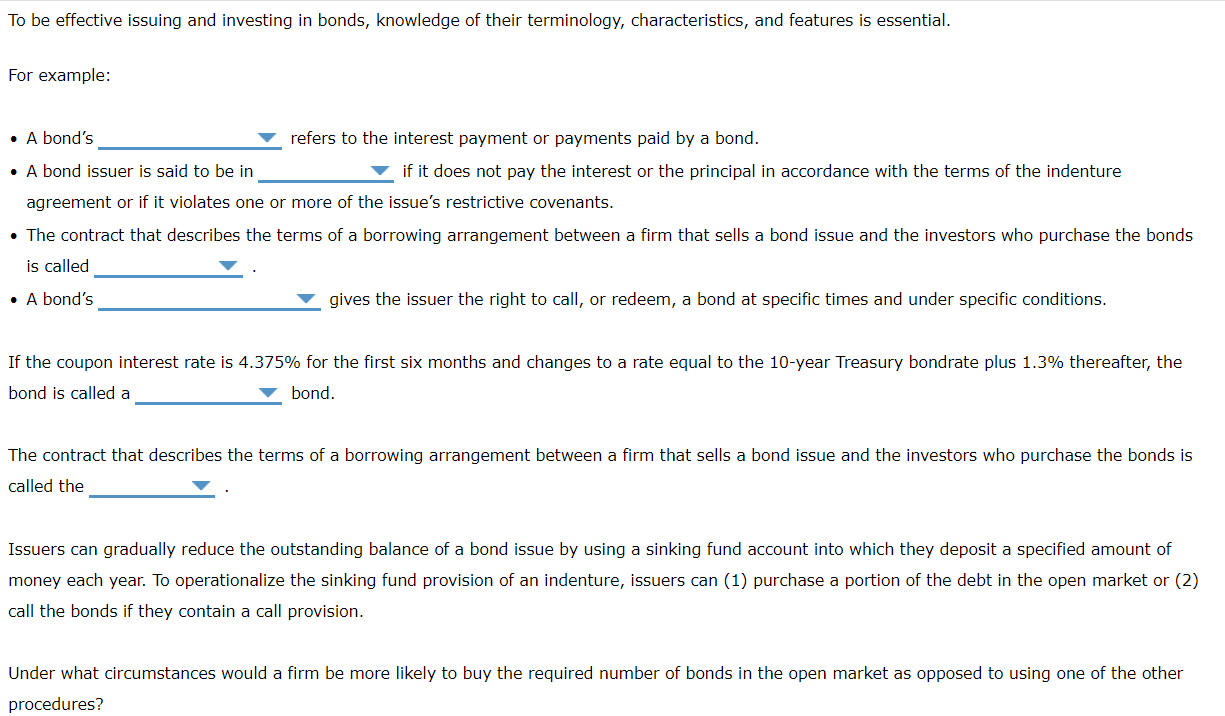

Question: drop down 1 options: Coupon payment, par value, or yeild to maturity drop town 2 options: liquidation, default, bankruptcy drop down 3 options: a trustee,

drop down 1 options: Coupon payment, par value, or yeild to maturity

drop town 2 options: liquidation, default, bankruptcy

drop down 3 options: a trustee, a debenture, an indenture

drop down 4 options: a convertible provision, call provision, call premium

drop down 5 option: floating-rate or fixed-rate

drop down 6 option:trustee, indenture, debenture

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: A bond's refers to the interest payment or payments paid by a bond. A bond issuer is said to be in if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called A bond's gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bondrate plus 1.3% thereafter, the bond is called a bond. The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bonds is called the Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are lower than they were when the bonds were issued When interest rates are higher than they were when the bonds were issued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts