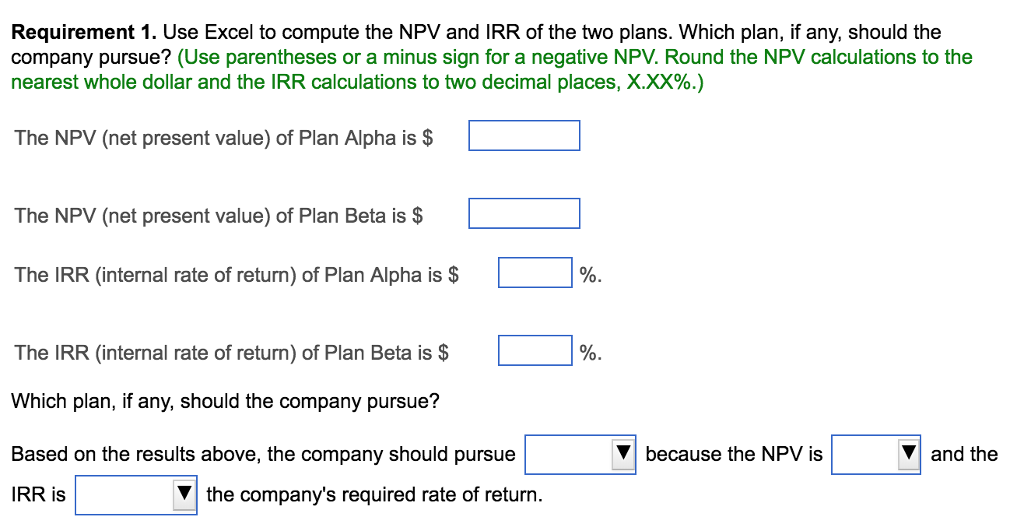

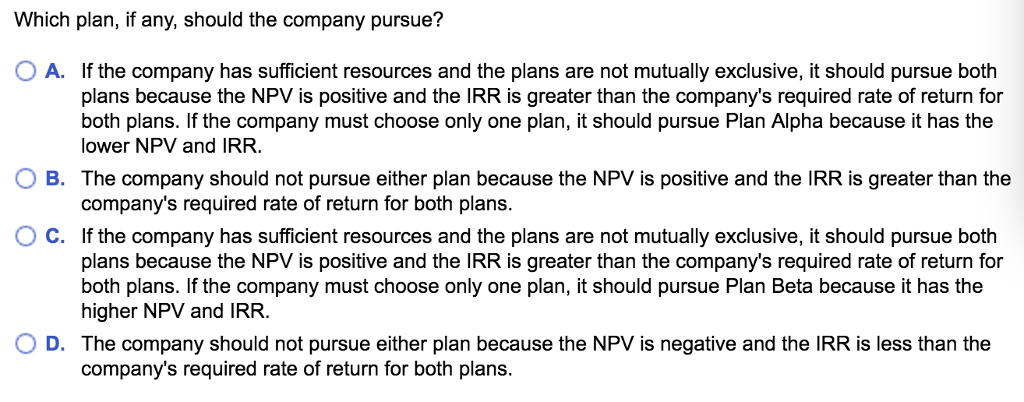

Question: Dropdown choices #1: Plan Alpha, Plan Beta Dropdown choices #2: negative, positive Dropdown choices #3: greater than, less than Dropdown choices #1: equal to zero,

Dropdown choices #1: Plan Alpha, Plan Beta

Dropdown choices #1: Plan Alpha, Plan Beta

Dropdown choices #2: negative, positive

Dropdown choices #3: greater than, less than

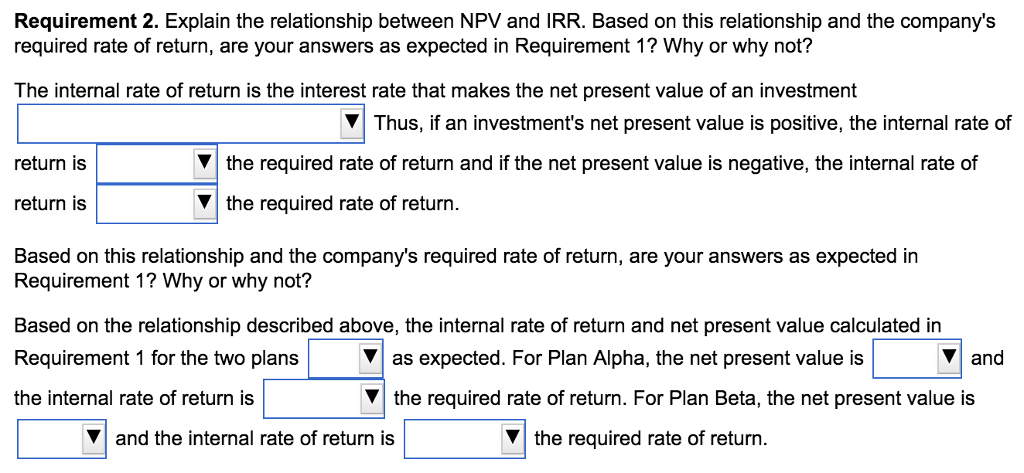

Dropdown choices #1: equal to zero, greater than original cost, less than the sum of cash inflows

Dropdown choices #2: greater than, less than

Dropdown choices #3: greater than, less than

Dropdown choices #4: are, are not

Dropdown choices #5: negative, positive

Dropdown choices #6: greater than, less than

Dropdown choices #7: negative, positive

Dropdown choices #8: greater than, less than

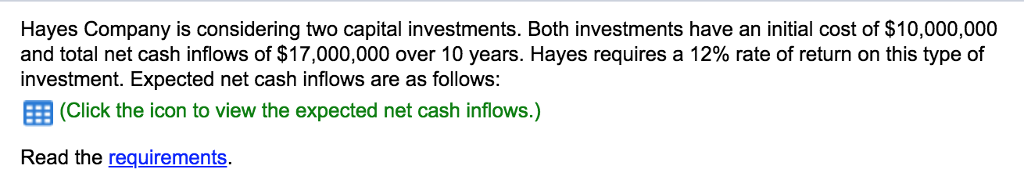

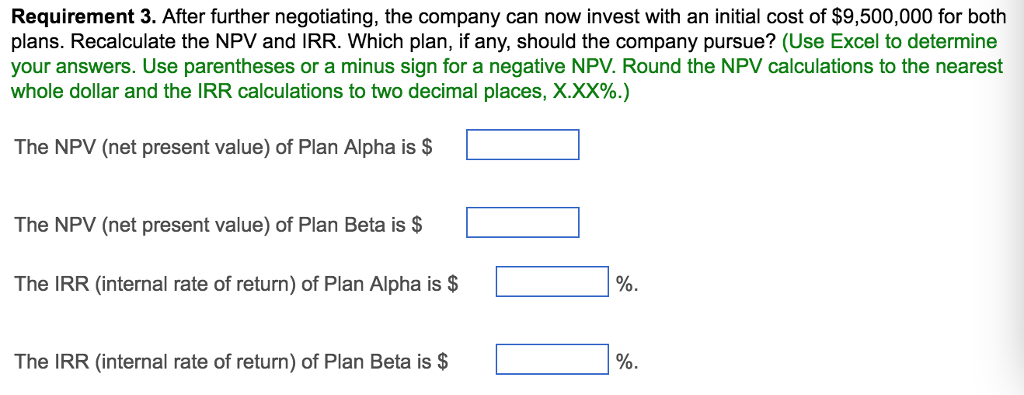

Hayes Company is considering two capital investments. Both investments have an initial cost of $10,000,000 and total net cash inflows of $17,000,000 over 10 years. Hayes requires a 12% rate of return on this type of investment. Expected net cash inflows are as follows: ?(Click the icon to view the expected net cash inflows.) Read the requirements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts