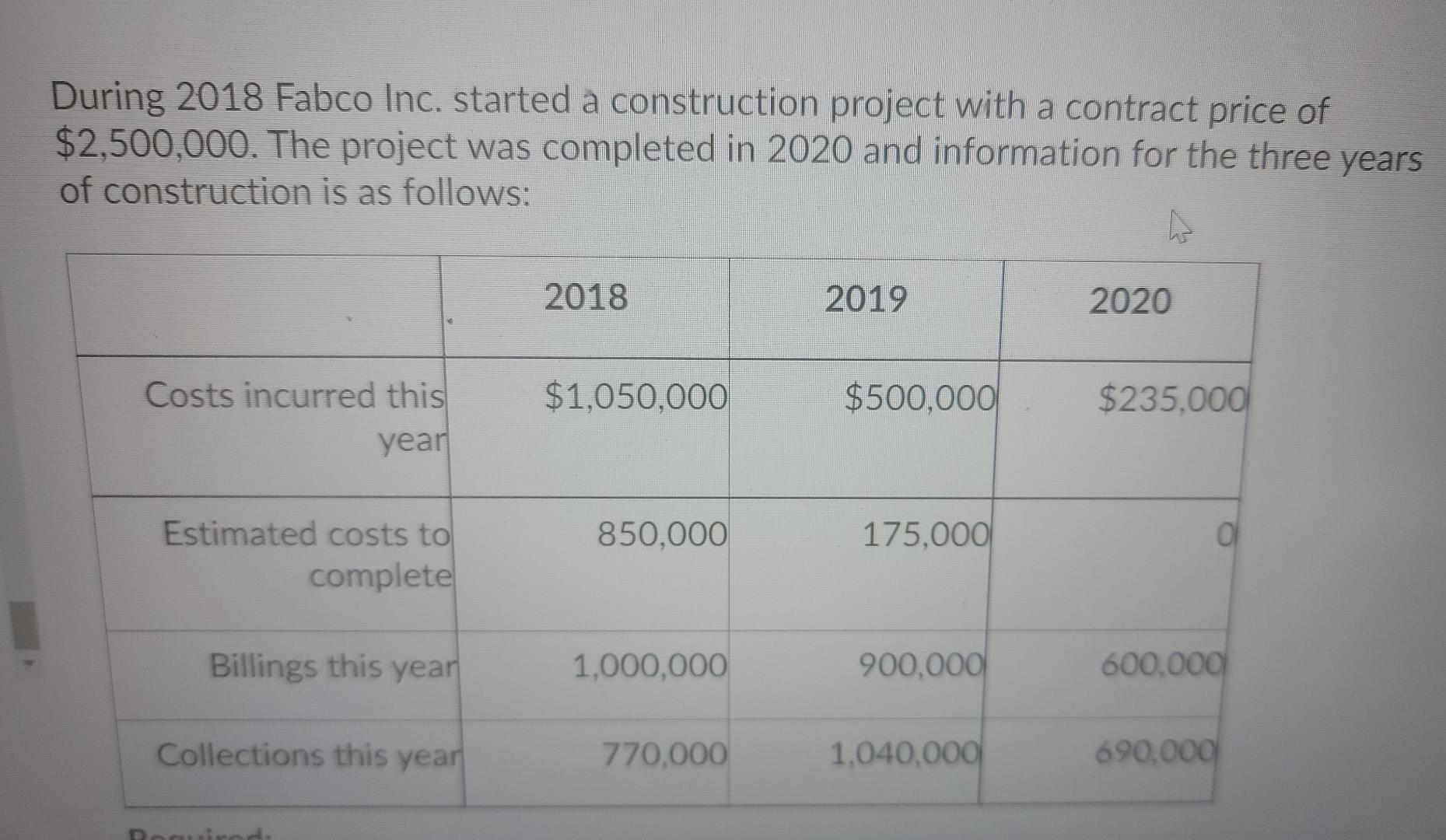

Question: During 2018 Fabco Inc. started a construction project with a contract price of $2,500,000. The project was completed in 2020 and information for the three

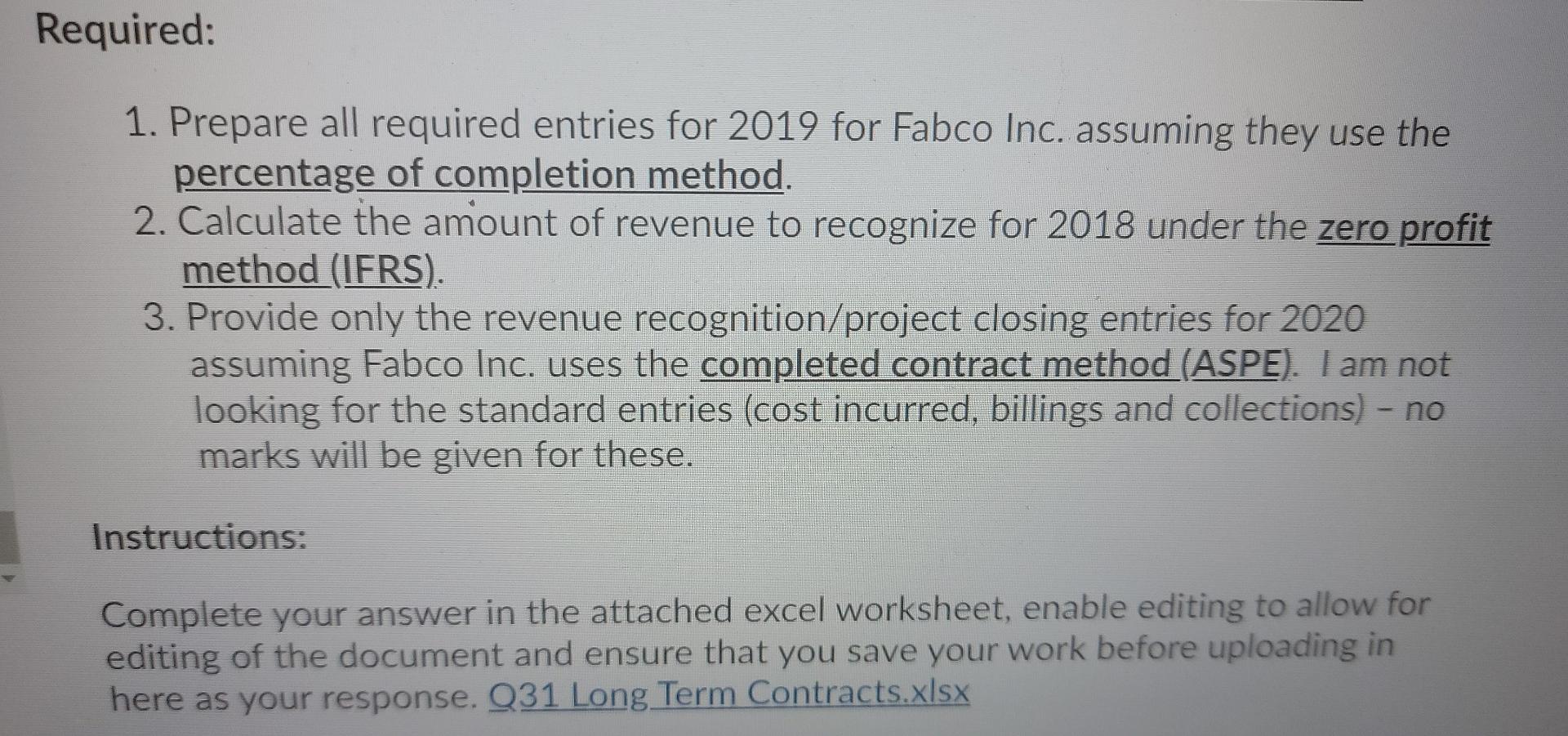

During 2018 Fabco Inc. started a construction project with a contract price of $2,500,000. The project was completed in 2020 and information for the three years of construction is as follows: 2018 2019 2020 $1,050.000 $500,000 $235,000 Costs incurred this year 850,000 175,000 a Estimated costs to complete Billings this year 1,000,000 900,000 600.000 Collections this year 770,000 1,040,000 690.000 Required: 1. Prepare all required entries for 2019 for Fabco Inc. assuming they use the percentage of completion method. 2. Calculate the amount of revenue to recognize for 2018 under the zero profit method (IFRS). 3. Provide only the revenue recognition/project closing entries for 2020 assuming Fabco Inc. uses the completed contract method (ASPE). I am not looking for the standard entries (cost incurred, billings and collections) - no marks will be given for these. Instructions: Complete your answer in the attached excel worksheet, enable editing to allow for editing of the document and ensure that you save your work before uploading in here as your response. Q31 Long Term Contracts.xlsx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts