Question

Dwayne Wales contributed equipment, inventory, and $106.000 cash to a partnership. The equipment had a book value of $50,000 and a market value of

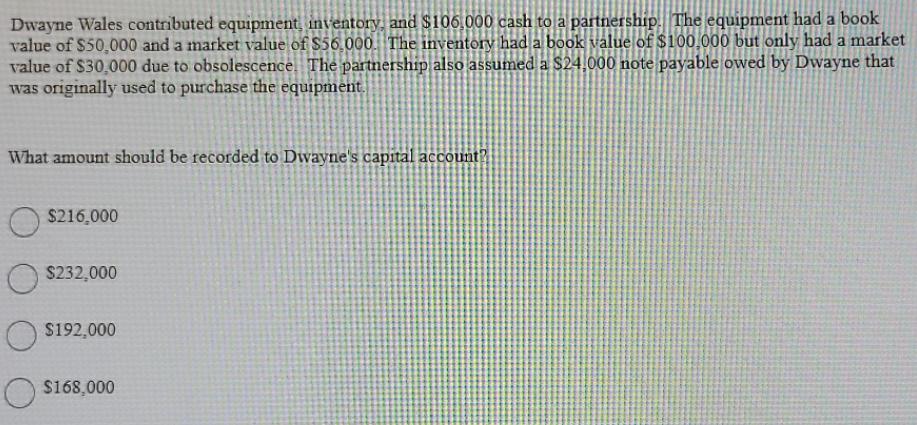

Dwayne Wales contributed equipment, inventory, and $106.000 cash to a partnership. The equipment had a book value of $50,000 and a market value of $56,000. The inventory had a book value of $100,000 but only had a market value of $30,000 due to obsolescence The partnership also assumed a $24,000 note payable owed by Dwayne that was originally used to purchase the equipment. What amount should be recorded to Dwayne's capital account? $216,000 $232,000 $192,000 S168,000

Step by Step Solution

3.51 Rating (124 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option D 168000 Workings Dw...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information For Decisions

Authors: Robert w Ingram, Thomas L Albright

6th Edition

9780324313413, 324672705, 324313411, 978-0324672701

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App