Question: e) Consider two risky assets A and B. Asset A has an expected return of 16% and a standard deviation of 13%. Asset B has

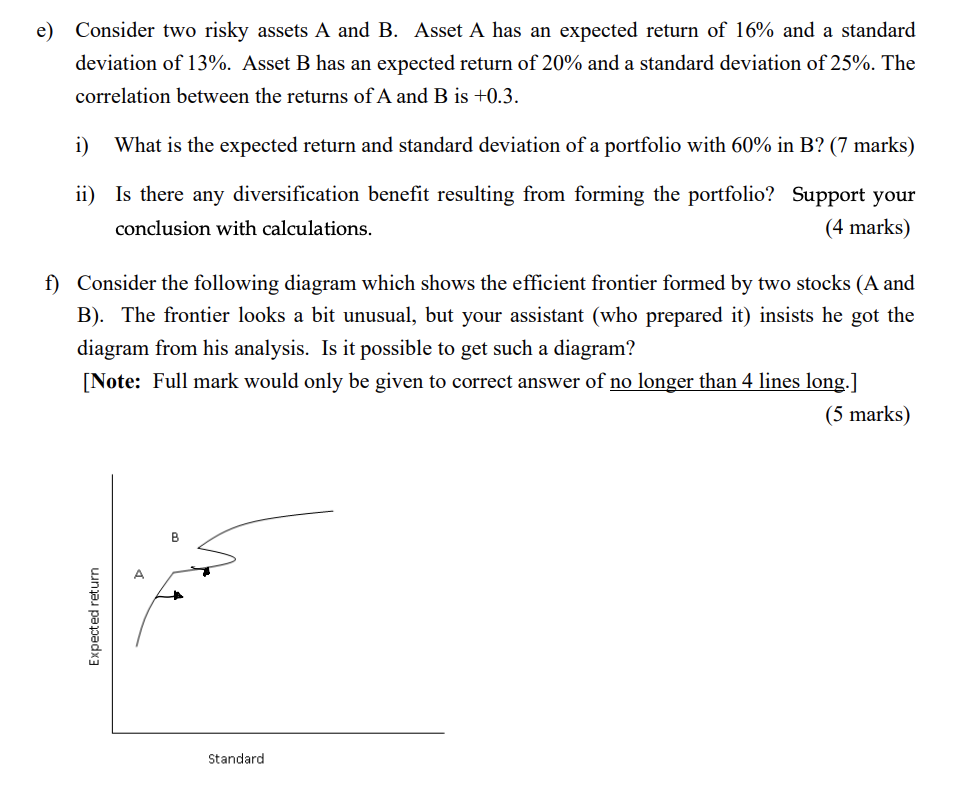

e) Consider two risky assets A and B. Asset A has an expected return of 16% and a standard deviation of 13%. Asset B has an expected return of 20% and a standard deviation of 25%. The correlation between the returns of A and B is +0.3. i) What is the expected return and standard deviation of a portfolio with 60% in B? (7 marks) ii) Is there any diversification benefit resulting from forming the portfolio? Support your conclusion with calculations. (4 marks) f) Consider the following diagram which shows the efficient frontier formed by two stocks (A and B). The frontier looks a bit unusual, but your assistant (who prepared it) insists he got the diagram from his analysis. Is it possible to get such a diagram? [Note: Full mark would only be given to correct answer of no longer than 4 lines long.] (5 marks)

e) Consider two risky assets A and B. Asset A has an expected return of 16% and a standard deviation of 13%. Asset B has an expected return of 20% and a standard deviation of 25%. The correlation between the returns of A and B is +0.3. i) What is the expected return and standard deviation of a portfolio with 60% in B? (7 marks) ii) Is there any diversification benefit resulting from forming the portfolio? Support your conclusion with calculations. (4 marks) f) Consider the following diagram which shows the efficient frontier formed by two stocks (A and B). The frontier looks a bit unusual, but your assistant (who prepared it) insists he got the diagram from his analysis. Is it possible to get such a diagram? [Note: Full mark would only be given to correct answer of no longer than 4 lines long.] (5 marks)

e) Consider two risky assets A and B. Asset A has an expected return of 16% and a standard deviation of 13%. Asset B has an expected return of 20% and a standard deviation of 25%. The correlation between the returns of A and B is +0.3. i) What is the expected return and standard deviation of a portfolio with 60% in B? (7 marks) ii) Is there any diversification benefit resulting from forming the portfolio? Support your conclusion with calculations. (4 marks) f) Consider the following diagram which shows the efficient frontier formed by two stocks (A and B). The frontier looks a bit unusual, but your assistant (who prepared it) insists he got the diagram from his analysis. Is it possible to get such a diagram? [Note: Full mark would only be given to correct answer of no longer than 4 lines long.) (5 marks) Expected return Standard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts