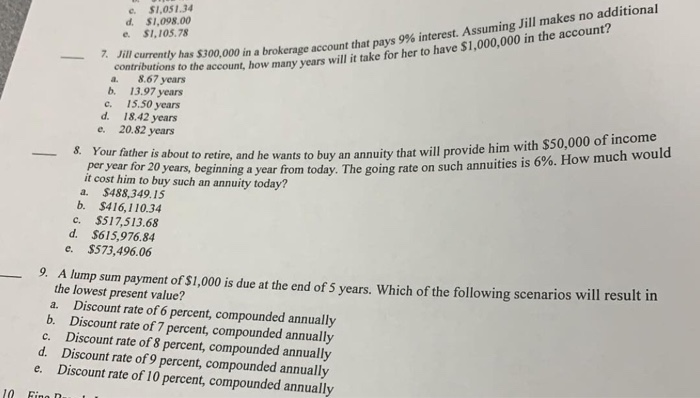

Question: e. S1,051.34 dditional d. $1,098.00 e. $1,105.78 makes no a ently has $300,000 in a brokerage account that pays 9% interest. Assuming ill 7. Jill

e. S1,051.34 dditional d. $1,098.00 e. $1,105.78 makes no a ently has $300,000 in a brokerage account that pays 9% interest. Assuming ill 7. Jill contributions to the it o the acc, how many years will it take for her to have $1,000,000 in the account a 8.67 years b. 13.97 years c. 15.50 years d. 18.42 years e. 20.82 years 8. Your father is abou r to retire, and he wants to buy an annuity that will provide him with $50,000 of income year for 20 years, beginning a year from today. The going rate on such annuities is 6%. How much would it cost him to buy such an annuity today? a. $488,349.15 b. $416,110.34 c. $517,513.68 d. $615,976.84 e. $573,496.06 A lump sum payment of s1,000 is due at the end of 5 years. Which of the following scenarios will result in 9. the lowest present value? Discount rate of 6 percent, compounded annually a. b. Discount rate of 7 percent, compounded annually c. Discount rate of 8 percent, compounded annually d. Discount rate of 9 percent, compounded annually e. Discount rate of 10 percent, compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts