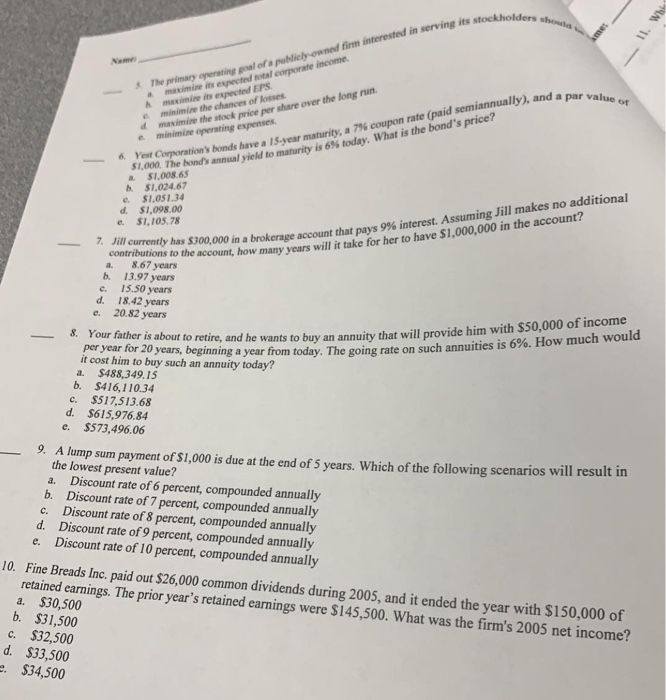

Question: Iders shout frm interested in serving its stockho The primary operating goal of a publiclyowned firm 5. e minimize the chances of losses d maximine

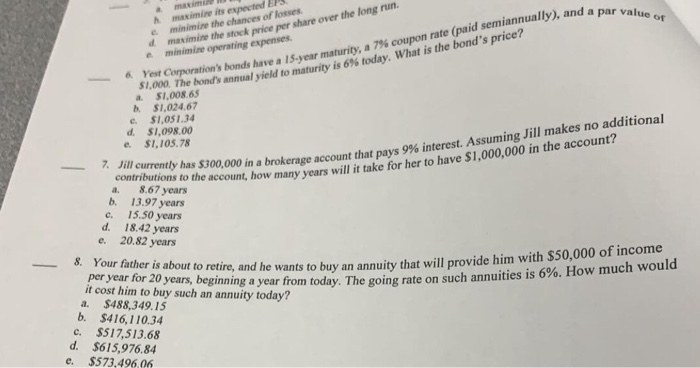

Iders shout frm interested in serving its stockho The primary operating goal of a publiclyowned firm 5. e minimize the chances of losses d maximine the stock price per share over the long un operating expenses CTh ration's bonds have a 15-year maturity, a 7% coupon rate (paidsemiannually), and a 6. Yest Corporations yield to maturity is 6% today. what is the bond's price? $1,000. The bond's annual a. $1,008 65 h$1,024.67 . $1,051.34 d. $1,098.00 Assuming Jill makes no additional e. $1,105.78 Jill currently has $300,000 in a brokerage account that pays currently has$300,000 in a brokerage account that pays 9% interest. o the account, how many years will it take for her to have $1,000,000 in the account? b. 13.97 years c. 15.50 years d. 18.42 years e. 20.82 years r 2 aout toretire, and he wants to buy an annuity that will provide him with $50,000 of income per year for 20 years, beginning year it cost him to buy such an annuity today? a. $488,349.15 ait costhen to buys changan nga year from today. The going rate on such annuities s6% How much would b. $416,110.34 c. $517,513.68 d. $615,976.84 e. $573,496.06 9. A lump sum payment of $1,000 is due at the end of 5 years. Which of the following scenarios will result in the lowest present value? a. Discount rate of 6 percent, compounded annually b. Discount rate of 7 percent, compounded annually c. Discount rate of 8 percent, compounded annually d. Discount rate of 9 percent, compounded annually e. Discount rate of 10 percent, compounded annually Fine Breads Inc. paid out $26,000 common dividends during 2005, and it ended the year with $150,000 of 10. retained earnings. The prior year's retained earnings were $145,500. What was the firm's 2005 net income? a. $30,500 b. $31,500 c. $32,500 d. $33,500 e. $34,500 h maximire its expected EPS operating expenses $1,000. The bond's annual yield to e minimire Yest Corporation's bonds have a 15.year maturity, a a, $1. Oe bond's annual yield to maturity is 6% today, what is the bond's price? maximire the stock price per share over the long run bonds have a 15-year maturity, a 7% coupon rate (paid semiannually), and a b. $1,024.67 e. $1,051.34 d. $1,098.00 e. SI,105.78 000 in a brokerage account that pays 9% interest. Assuming Jill makes no additional the account, how many years will i take for her to have $1,000,000 in the account? 7 Jill contributions to a. 8.67 years b 13.97 years c 15.50 years d. 18.42 years e. 20.82 years 8. Your father is about to retire, and he wants to buy an annuity that will provide him with $50,000 of income per year for 20 years, beginning a year from t it cost him to buy such an annuity today? a. $488,349.15 b. $416,110.34 oday. The going rate on such annuities is 6%. How much would c. $517,513.68 d. $615,976.84 e. $573.496.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts