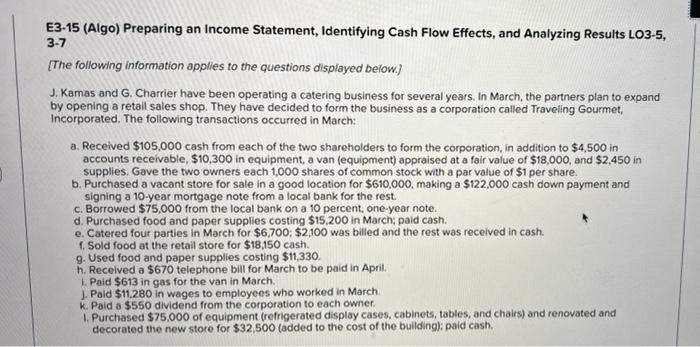

Question: E3-15 (Algo) Preparing an Income Statement, Identifying Cash Flow Effects, and Analyzing Results LO3-5, 3-7 [The following information applies to the questions displayed below.)

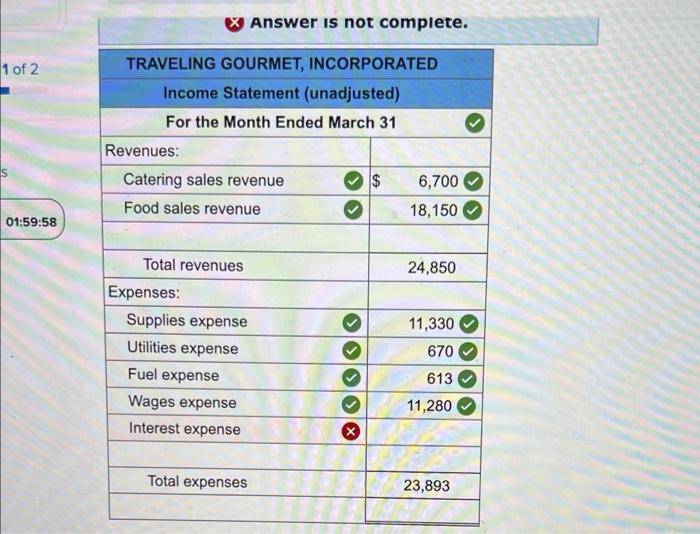

E3-15 (Algo) Preparing an Income Statement, Identifying Cash Flow Effects, and Analyzing Results LO3-5, 3-7 [The following information applies to the questions displayed below.) J. Kamas and G. Charrier have been operating a catering business for several years. In March, the partners plan to expand by opening a retail sales shop. They have decided to form the business as a corporation called Traveling Gourmet, Incorporated. The following transactions occurred in March: a. Received $105,000 cash from each of the two shareholders to form the corporation, in addition to $4,500 in accounts receivable, $10,300 in equipment, a van (equipment) appraised at a fair value of $18,000, and $2,450 in supplies. Gave the two owners each 1,000 shares of common stock with a par value of $1 per share. b. Purchased a vacant store for sale in a good location for $610,000, making a $122,000 cash down payment and signing a 10-year mortgage note from a local bank for the rest. c. Borrowed $75,000 from the local bank on a 10 percent, one-year note. d. Purchased food and paper supplies costing $15,200 in March; paid cash. e. Catered four parties in March for $6,700; $2,100 was billed and the rest was received in cash. f. Sold food at the retail store for $18,150 cash. g. Used food and paper supplies costing $11,330. h. Received a $670 telephone bill for March to be paid in April. i. Paid $613 in gas for the van in March. J. Paid $11,280 in wages to employees who worked in March. k. Paid a $550 dividend from the corporation to each owner. 1. Purchased $75,000 of equipment (refrigerated display cases, cabinets, tables, and chairs) and renovated and decorated the new store for $32,500 (added to the cost of the building); paid cash. 1 of 2 01:59:58 TRAVELING GOURMET, INCORPORATED Income Statement (unadjusted) For the Month Ended March 31 Revenues: Catering sales revenue Food sales revenue Total revenues Answer is not complete. Expenses: Supplies expense Utilities expense Fuel expense Wages expense Interest expense Total expenses $ 6,700 18,150 24,850 11,330 670 613 11,280 23,893

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step 12 An Income Statement lists all revenues and ex... View full answer

Get step-by-step solutions from verified subject matter experts