Question: E5 - You can choose between two mutually exclusive projects, Project A and Project B. The initial investment (today) is 90 MSEK for project

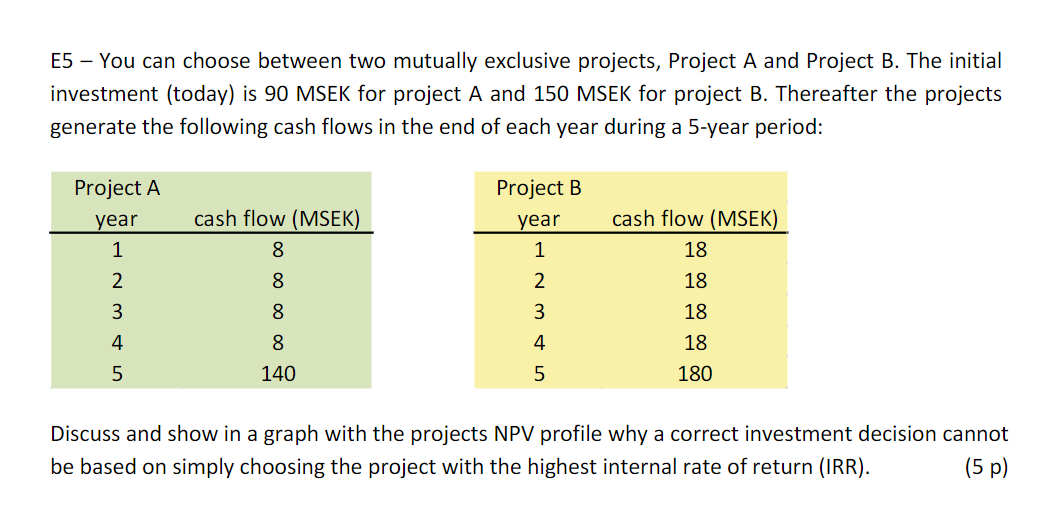

E5 - You can choose between two mutually exclusive projects, Project A and Project B. The initial investment (today) is 90 MSEK for project A and 150 MSEK for project B. Thereafter the projects generate the following cash flows in the end of each year during a 5-year period: Project A year 1 2 3 4 5 cash flow (MSEK) 8 8 8 8 140 Project B year 1 2 3 4 5 cash flow (MSEK) 18 18 18 18 180 Discuss and show in a graph with the projects NPV profile why a correct investment decision cannot be based on simply choosing the project with the highest internal rate of return (IRR). (5 p)

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Hance solved it Answer NPV IRR is the rate at which NPV 0 Discount rates 6 ... View full answer

Get step-by-step solutions from verified subject matter experts