Question: Each investment return must also be compared to a comparable benchmark to assess if the investment has over - or underperformed during the last 1

Each investment return must also be compared to a comparable benchmark to assess if the investment has over or underperformed during the last months. You can compare the last month return of your investment to the last month return of a bond index when the investment is a bond, a large stock market index when the investment is a stock, or individual stocks when the investment is a stock, and so on Find a comparable benchmark and enter the difference between the portfolio investments return and the benchmark in column L

Specifically, you must address the following rubric criteria:

Analyze past portfolio performance. Include the following in your calculations:

Quantitative assessments from:

Annual return

Riskadjusted return

Fiveyear return

Annual return versus appropriate benchmark

Compare portfolio investments to relevant benchmarks. Include the following in your calculations and summary:

Identify benchmarks for existing investments to be compared to and identify the reason for benchmark selection.

Discuss return data on investments within the portfolio.

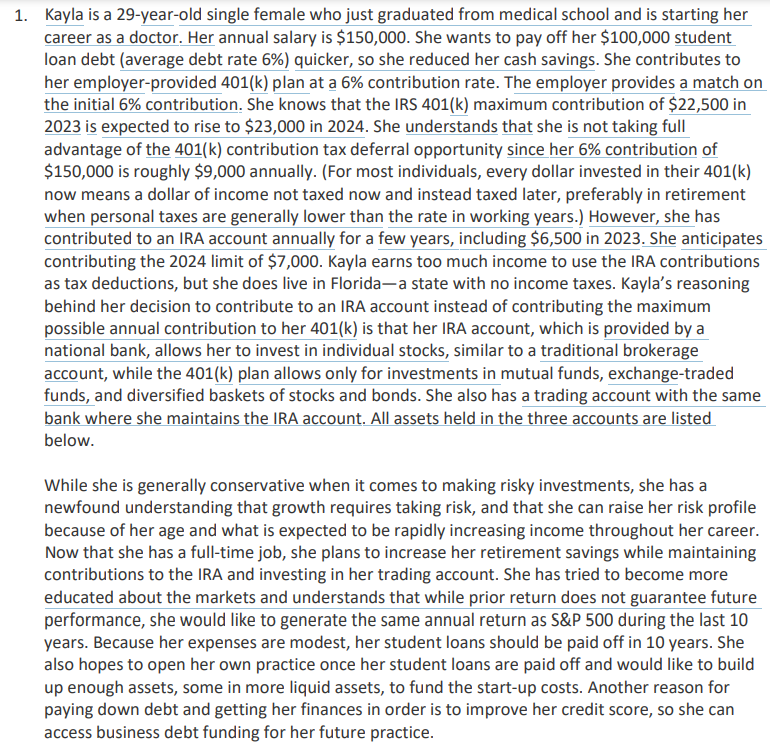

Identify over and underperforming investments in relation to each benchmark. Kayla is a yearold single female who just graduated from medical school and is starting her

career as a doctor. Her annual salary is $ She wants to pay off her $ student

loan debt average debt rate quicker, so she reduced her cash savings. She contributes to

her employerprovided plan at a contribution rate. The employer provides a match on

the initial contribution. She knows that the IRS k maximum contribution of $ in

is expected to rise to $ in She understands that she is not taking full

advantage of the contribution tax deferral opportunity since her contribution of

$ is roughly $ annually. For most individuals, every dollar invested in their k

now means a dollar of income not taxed now and instead taxed later, preferably in retirement

when personal taxes are generally lower than the rate in working years. However, she has

contributed to an IRA account annually for a few years, including $ in She anticipates

contributing the limit of $ Kayla earns too much income to use the IRA contributions

as tax deductions, but she does live in Floridaa state with no income taxes. Kayla's reasoning

behind her decision to contribute to an IRA account instead of contributing the maximum

possible annual contribution to her is that her IRA account, which is provided by a

national bank, allows her to invest in individual stocks, similar to a traditional brokerage

account, while the k plan allows only for investments in mutual funds, exchangetraded

funds, and diversified baskets of stocks and bonds. She also has a trading account with the same

bank where she maintains the IRA account. All assets held in the three accounts are listed

below.

While she is generally conservative when it comes to making risky investments, she has a

newfound understanding that growth requires taking risk, and that she can raise her risk profile

because of her age and what is expected to be rapidly increasing income throughout her career.

Now that she has a fulltime job, she plans to increase her retirement savings while maintaining

contributions to the IRA and investing in her trading account. She has tried to become more

educated about the markets and understands that while prior return does not guarantee future

performance, she would like to generate the same annual return as S&P during the last

years. Because her expenses are modest, her student loans should be paid off in years. She

also hopes to open her own practice once her student loans are paid off and would like to build

up enough assets, some in more liquid assets, to fund the startup costs. Another reason for

paying down debt and getting her finances in order is to improve her credit score, so she can

access business debt funding for her future practice. tableAssetAccount,Ticker,Size $CashBank Savings,NA$tableVanguardIntermediateTermTreasury ETFkVGIT,$tableVanguard Total StockMarket ETFkVTI,$tableBlackRock EquityDividend FundkMADVX,$Johnson & Johnson,IRA,JNJ$PfizerIRA,PFE,$

Southern

New Hampshire

University

tableAssetAccount,Ticker,Size $Bank of America,IRA,BAC,$WalmartTradingBrokerageWMT$CVS Health,TradingBrokerageCVS$Total$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock