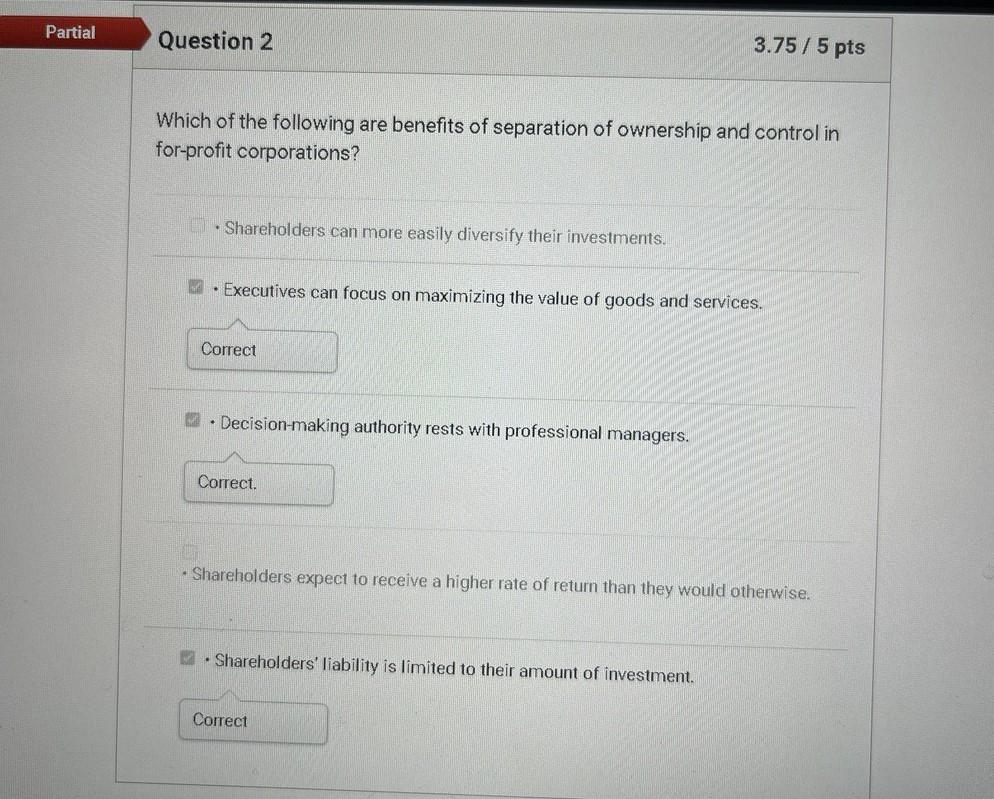

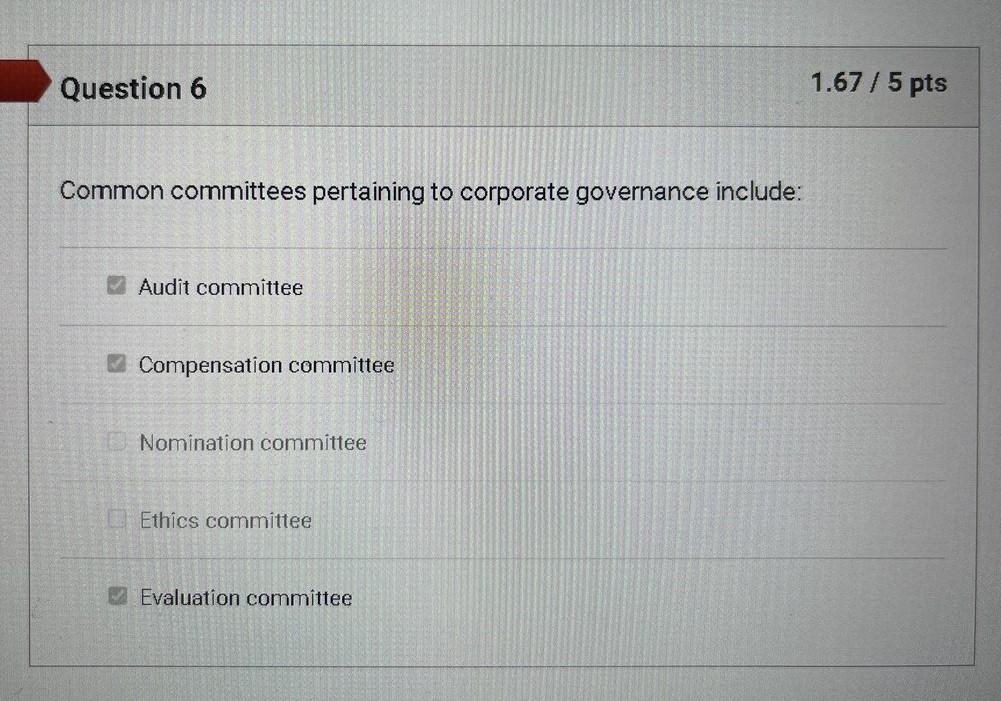

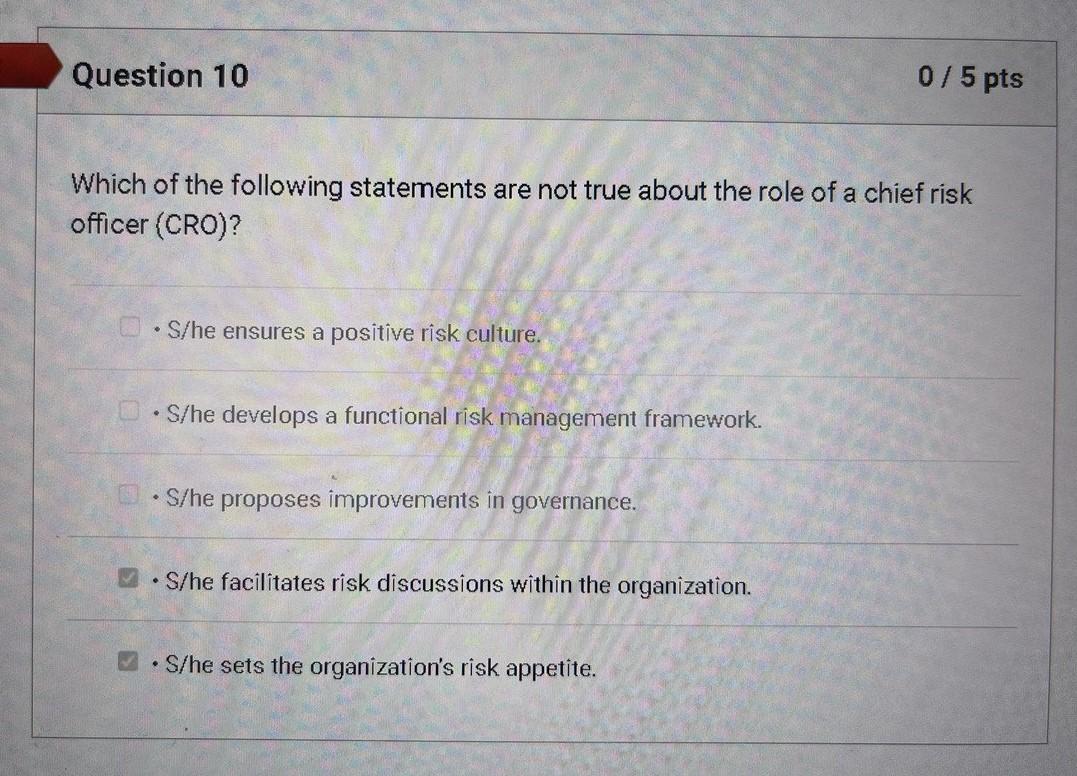

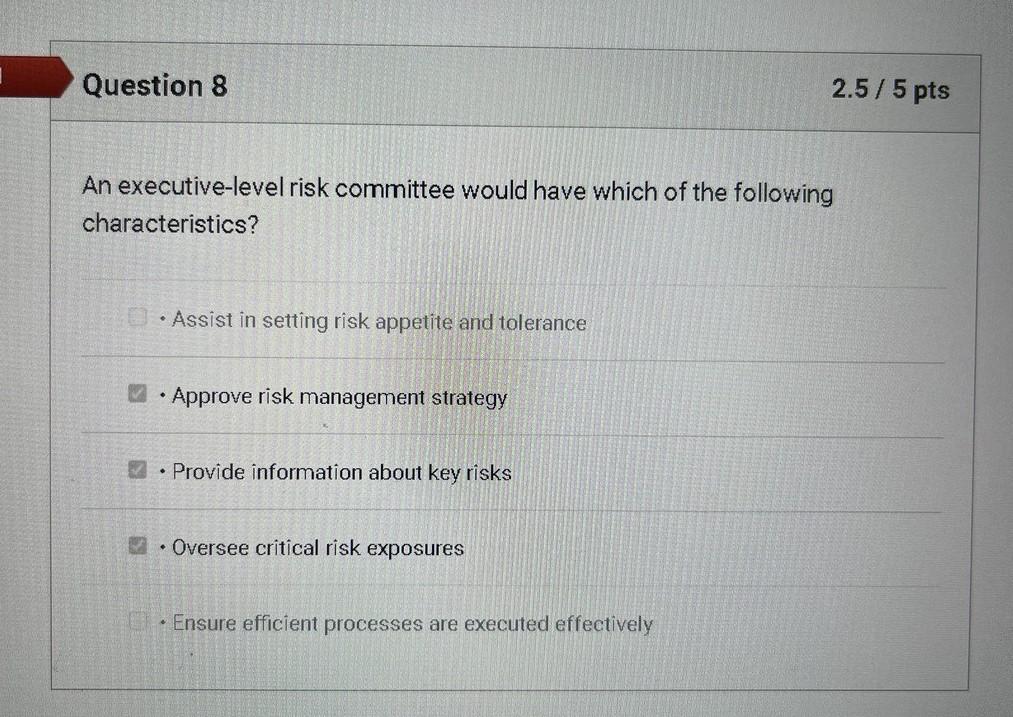

Question: Each question has a different assigned mark for each correct answer. PLEASE HELP ME THANKS! Which of the following are benefits of separation of ownership

Each question has a different assigned mark for each correct answer. PLEASE HELP ME THANKS!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts