Question: Eads Industrial Systems Company (EISC) is considering a 5-year project to improve its production efficiency. Buying a new conveyor belt for $576,000 is estimated to

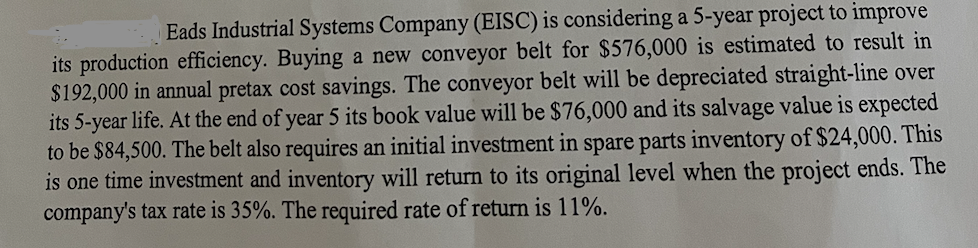

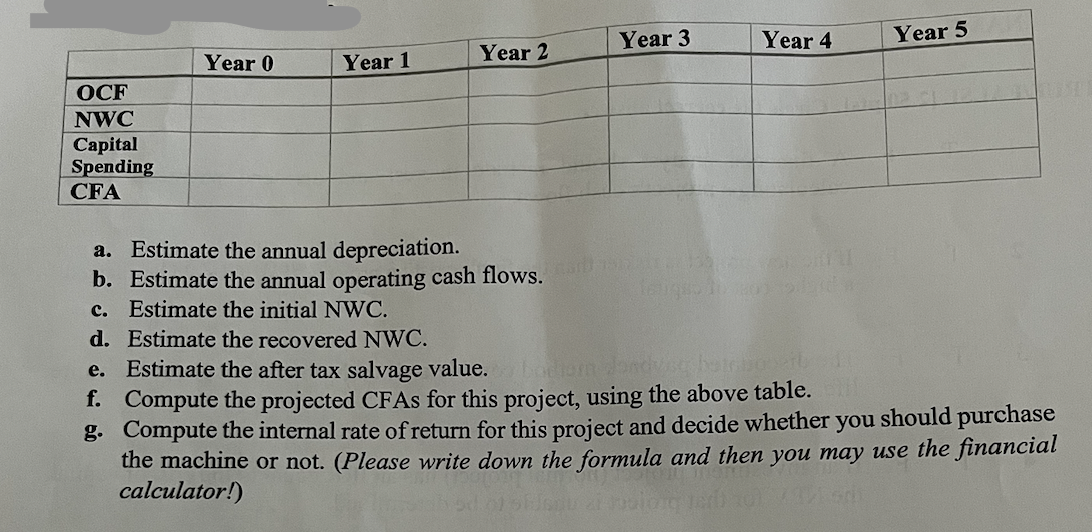

Eads Industrial Systems Company (EISC) is considering a 5-year project to improve its production efficiency. Buying a new conveyor belt for $576,000 is estimated to result in $192,000 in annual pretax cost savings. The conveyor belt will be depreciated straight-line over its 5 -year life. At the end of year 5 its book value will be $76,000 and its salvage value is expected to be $84,500. The belt also requires an initial investment in spare parts inventory of $24,000. This is one time investment and inventory will return to its original level when the project ends. The company's tax rate is 35%. The required rate of return is 11%. a. Estimate the annual depreciation. b. Estimate the annual operating cash flows. c. Estimate the initial NWC. d. Estimate the recovered NWC. e. Estimate the after tax salvage value. f. Compute the projected CFAs for this project, using the above table. g. Compute the internal rate of return for this project and decide whether you should purchase the machine or not. (Please write down the formula and then you may use the financial calculator!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts