Question: Economics question 14.8.3 Consider a hidden action model in which the owner is risk neutral while the manager has preferences defined over the mean and

Economics question

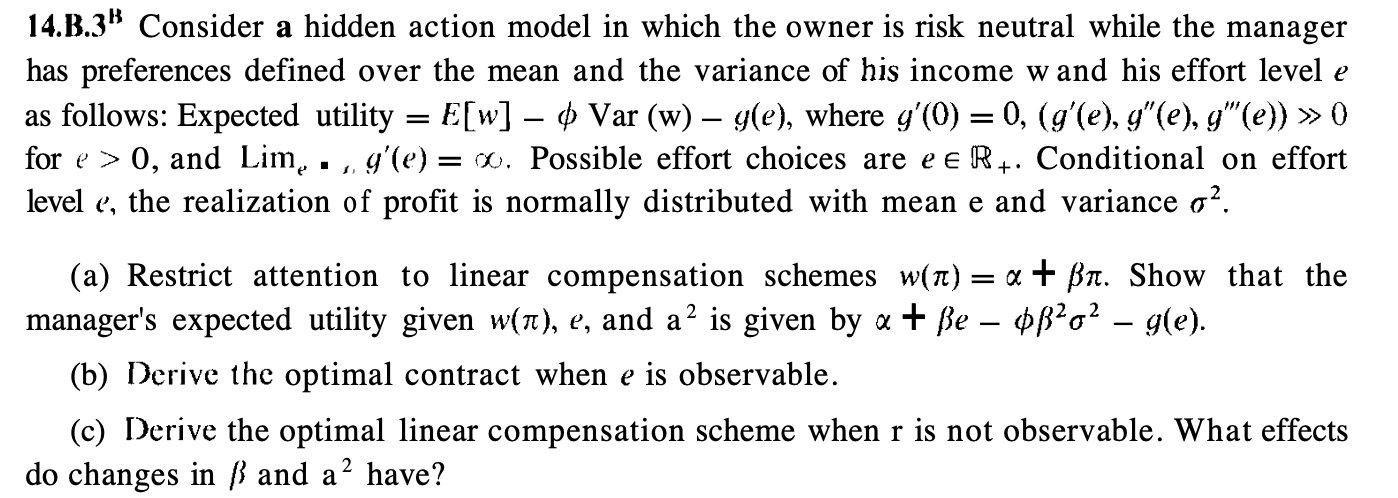

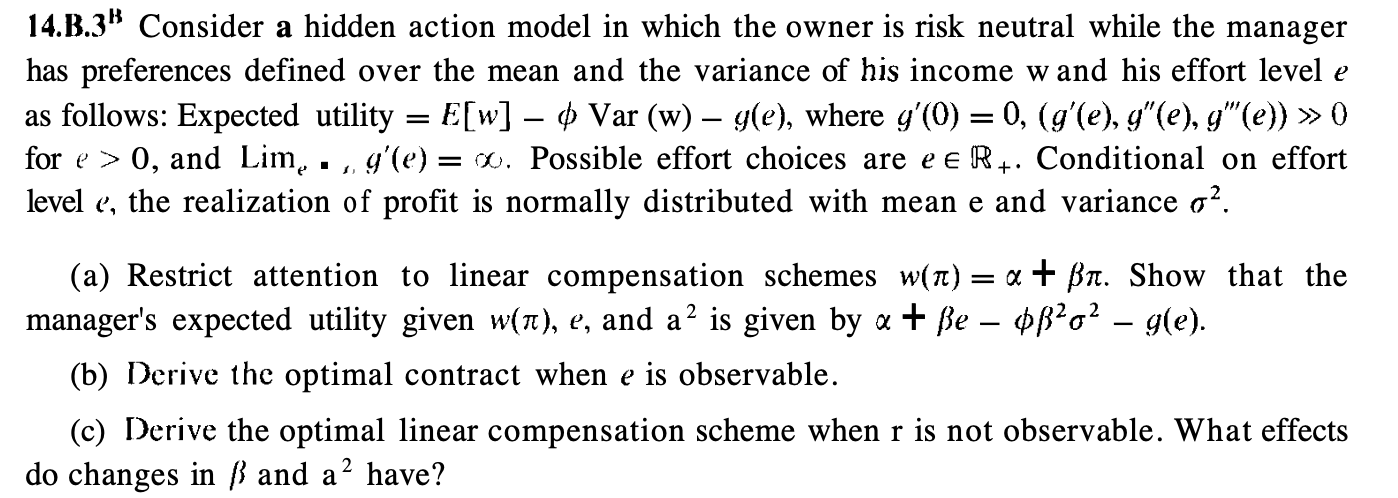

14.8.3" Consider a hidden action model in which the owner is risk neutral while the manager has preferences defined over the mean and the variance of his income w and his effort level 3 as follows: Expected utility = F [w] gb Var (w) 9(a), where g'(0) = 0, (g'(e), g\"(e), g\"'(e)) >> O for e > O, and Lim', . ,_ g'(e) = 00. Possible effort choices are e 5 UL. Conditional on effort level a. the realization of profit is normally distributed with mean e and variance 02. (a) Restrict attention to linear compensation schemes w(n) = oc+ n. Show that the manager's expected utility given Mn), 9, and a2 is given by ac + e (132ch g(e). (b) Derive the optimal contract when 9 is observable. (c) Derive the optimal linear compensation scheme when r is not observable. What effects do changes in {3 and a2 have

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts