Question: + Edit Page Protect Tools Q Click to search: Question 3 (25 Marks) Zakiah, a Malaysian citizen purchased a small factory in Batu Pahat, Johor

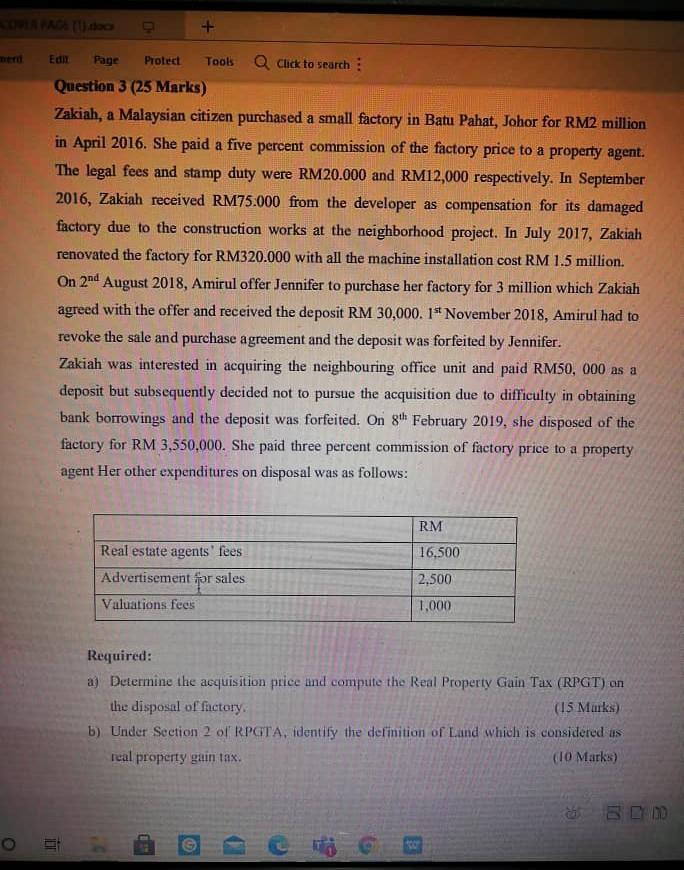

+ Edit Page Protect Tools Q Click to search: Question 3 (25 Marks) Zakiah, a Malaysian citizen purchased a small factory in Batu Pahat, Johor for RM2 million in April 2016. She paid a five percent commission of the factory price to a property agent. The legal fees and stamp duty were RM20.000 and RM12,000 respectively. In September 2016, Zakiah received RM75.000 from the developer as compensation for its damaged factory due to the construction works at the neighborhood project. In July 2017, Zakiah renovated the factory for RM320.000 with all the machine installation cost RM 1.5 million. On 2nd August 2018, Amirul offer Jennifer to purchase her factory for 3 million which Zakiah agreed with the offer and received the deposit RM 30,000.1" November 2018, Amirul had to revoke the sale and purchase agreement and the deposit was forfeited by Jennifer. Zakiah was interested in acquiring the neighbouring office unit and paid RM50,000 as a deposit but subsequently decided not to pursue the acquisition due to difficulty in obtaining bank borrowings and the deposit was forfeited. On 8th February 2019, she disposed of the factory for RM 3,550,000. She paid three percent commission of factory price to a property agent Her other expenditures on disposal was as follows: RM Real estate agents' fees Advertisement for sales Valuations fees 16,500 2,500 1,000 Required: a) Determine the acquisition price and compute the Real Property Gain Tax (RPGT) on the disposal of factory. (15 Muks) b) Under Section 2 of RPGTA, identify the definition of Land which is considered us real property gain tax. (TO Marks) + Edit Page Protect Tools Q Click to search: Question 3 (25 Marks) Zakiah, a Malaysian citizen purchased a small factory in Batu Pahat, Johor for RM2 million in April 2016. She paid a five percent commission of the factory price to a property agent. The legal fees and stamp duty were RM20.000 and RM12,000 respectively. In September 2016, Zakiah received RM75.000 from the developer as compensation for its damaged factory due to the construction works at the neighborhood project. In July 2017, Zakiah renovated the factory for RM320.000 with all the machine installation cost RM 1.5 million. On 2nd August 2018, Amirul offer Jennifer to purchase her factory for 3 million which Zakiah agreed with the offer and received the deposit RM 30,000.1" November 2018, Amirul had to revoke the sale and purchase agreement and the deposit was forfeited by Jennifer. Zakiah was interested in acquiring the neighbouring office unit and paid RM50,000 as a deposit but subsequently decided not to pursue the acquisition due to difficulty in obtaining bank borrowings and the deposit was forfeited. On 8th February 2019, she disposed of the factory for RM 3,550,000. She paid three percent commission of factory price to a property agent Her other expenditures on disposal was as follows: RM Real estate agents' fees Advertisement for sales Valuations fees 16,500 2,500 1,000 Required: a) Determine the acquisition price and compute the Real Property Gain Tax (RPGT) on the disposal of factory. (15 Muks) b) Under Section 2 of RPGTA, identify the definition of Land which is considered us real property gain tax. (TO Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts