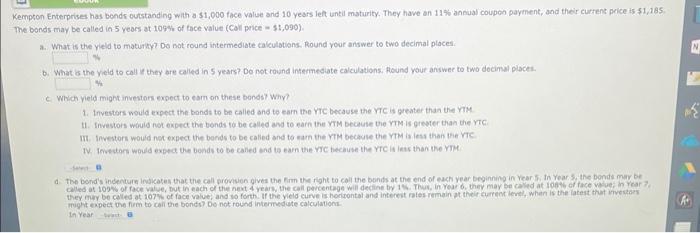

Question: empton Enterprises has bendr eutstanding with a $1,000 face value and 10 years left until maturity. They have an 11% annual coupon payment, and their

empton Enterprises has bendr eutstanding with a $1,000 face value and 10 years left until maturity. They have an 11% annual coupon payment, and their curtent peice is $1,185. he bonds may be called in 5 yeors at 109% of tace value (Coll price =$1,090). a. What is the yield to maturky? Do not round intermediate calculations. Round vour answer to two decimal places. b. What is the yeld to coll ie they are caled in 5 years? Do not cound intermeciate calculations. Hound your aniser to two decimal places. c. Which vield might investors expect to eam on these bonds? Why? 1. Investors would expect the bonds to be calied and to earn the YrC because the YrC is greater than the YiM. 11. Investors widid not expect the bonds to be called and to earn the YTM becouse the YTM is greater than the YtC 1i. Investor woud nec expect the bards to be calied and to nam the VTM beckule the YTM is less than the VTC. IV. Isvetors would expect the bends to be caned and ta earn the vic hecause the Yre is ieas than the YTM. a. Toe bond's indenture indicates thac the call provenen gives the finm the right to coll the bonds at the end of each year beginning in Year 5. In Year s. the bondt may be they may be caled at 107 of face value; and to forth. If the yield curve is berigontal and intereit rates remain at their cureect ievel, when is the lateit that investars meght expect the firm to call the bonds? De not rousd intemesdide calculations. in Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts