Question: Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered pr plagiarized. IN.D. -

Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered pr plagiarized.

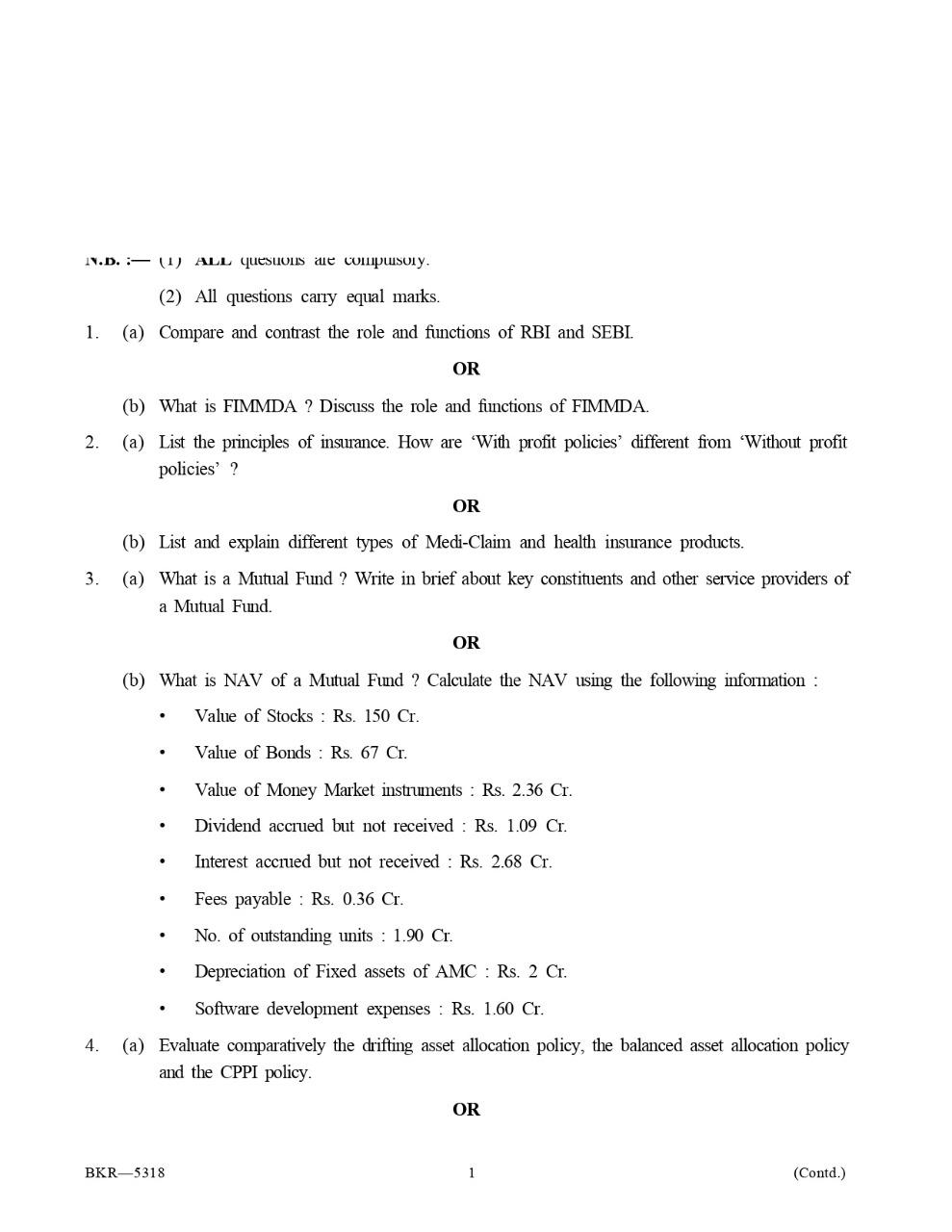

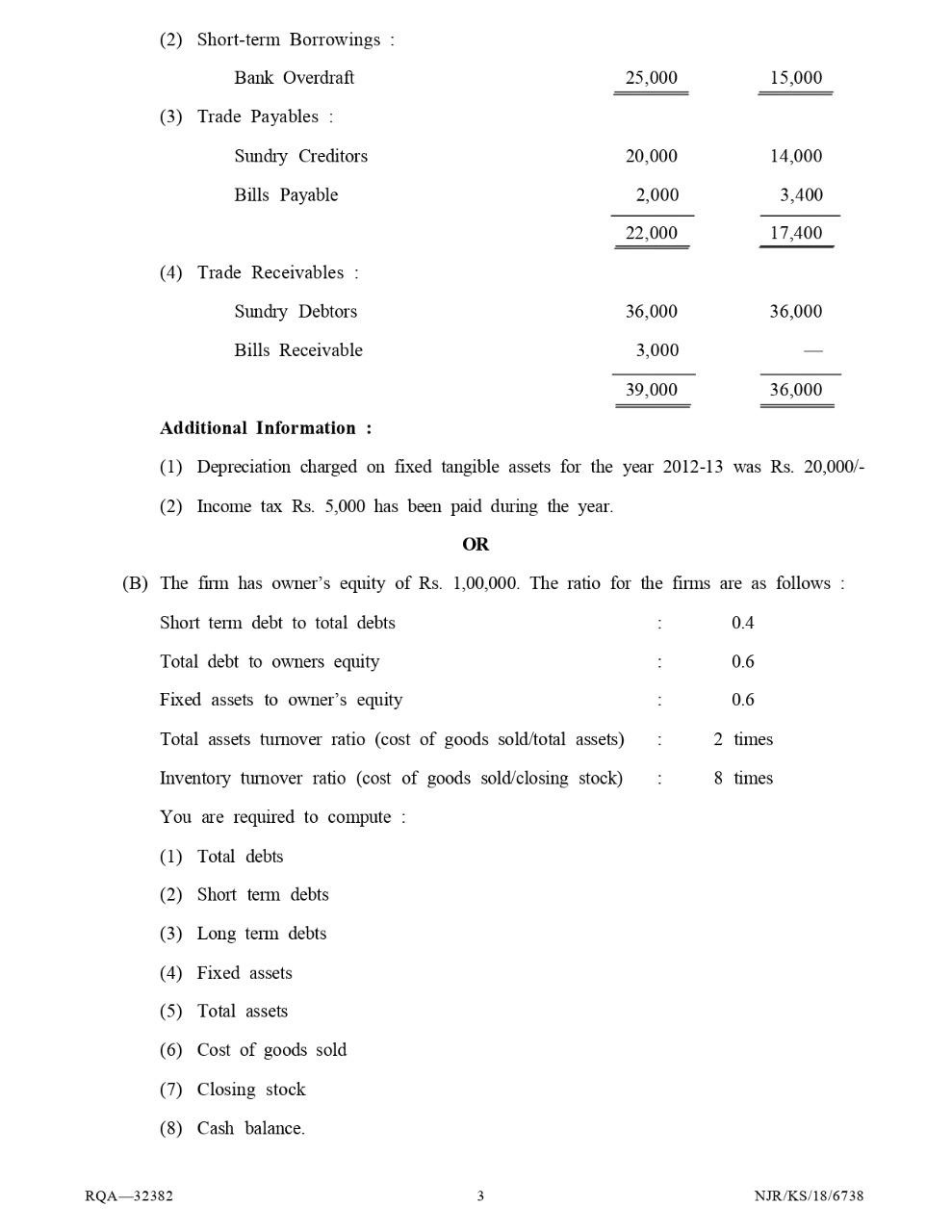

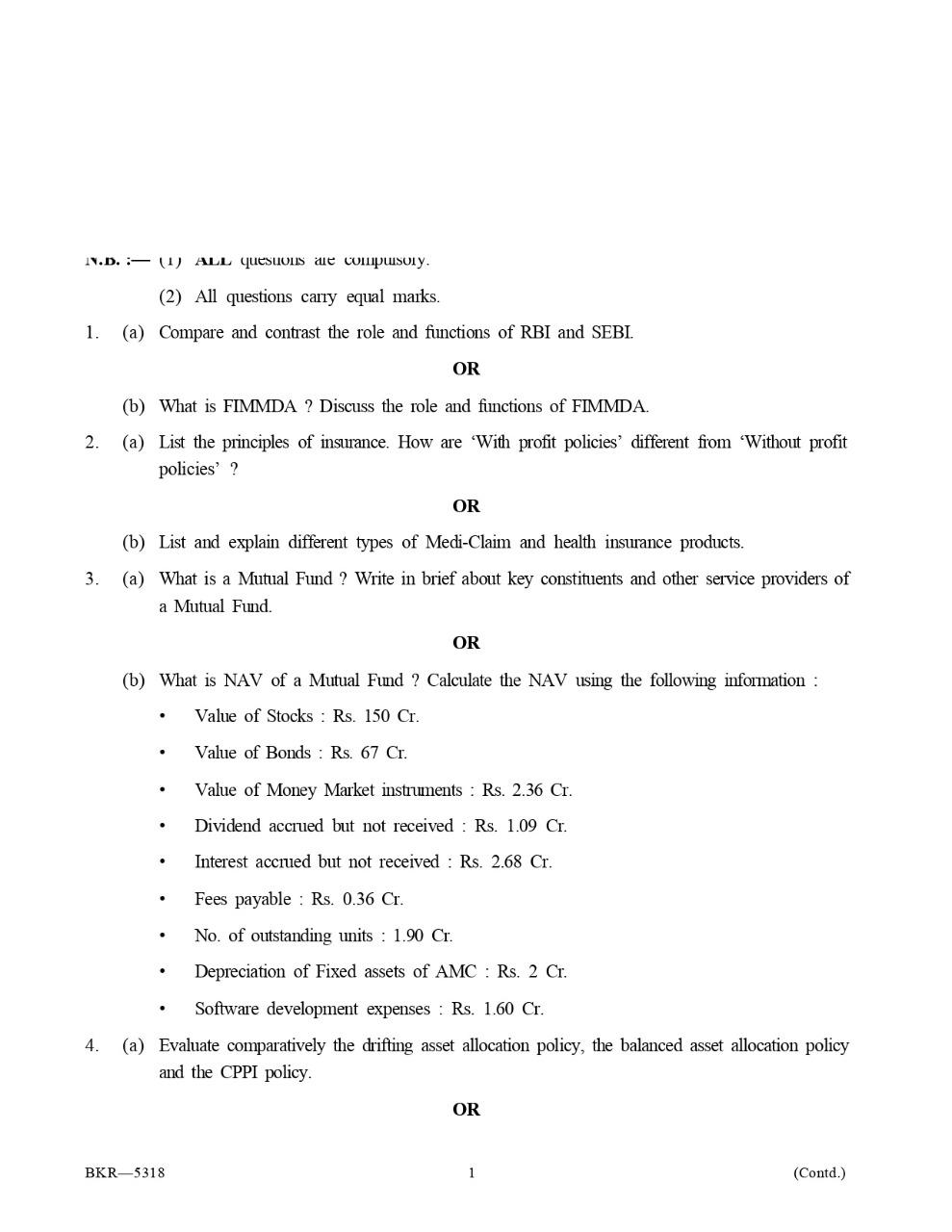

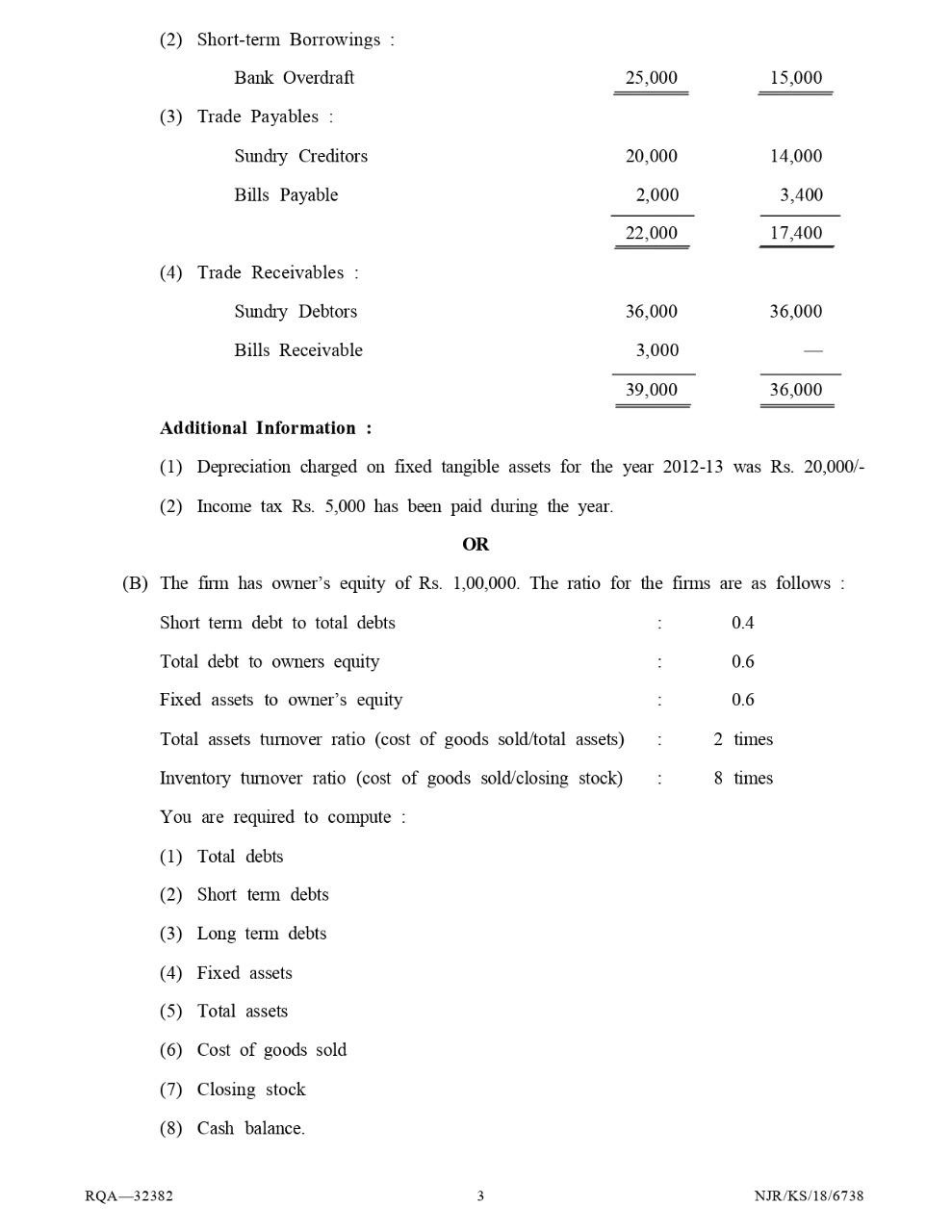

IN.D. - (1) ALL quesuous are compusony. (2) All questions cary equal marks. 1. (a) Compare and contrast the role and functions of RBI and SEBI. OR 2. (b) What is FIMMDA ? Discuss the role and functions of FIMMDA. (a) List the principles of insurance. How are 'With profit policies' different from 'Without profit policies ? OR 3. (b) List and explain different types of Medi-Claim and health insurance products. (a) What is a Mutual Fund ? Write in brief about key constituents and other service providers of a Mutual Fund. OR (b) What is NAV of a Mutual Fund ? Calculate the NAV using the following information : Value of Stocks : Rs. 150 Cr. Value of Bonds : Rs. 67 Cr. Value of Money Market instruments : Rs. 2.36 Cr. Dividend accrued but not received : Rs. 1.09 Cr. Interest accrued but not received : Rs. 2.68 Cr. Fees payable : Rs. 0.36 Cr. No. of outstanding units : 1.90 Cr. Depreciation of Fixed assets of AMC : Rs. 2 Cr. Software development expenses : Rs. 1.60 Cr. 4. (a) Evaluate comparatively the drifting asset allocation policy, the balanced asset allocation policy and the CPPI policy. OR BKR-5318 1 (Contd.) (2) Short-term Borrowings: Bank Overdraft 25,000 15,000 (3) Trade Payables : Sundry Creditors 20,000 14,000 Bills Payable 2,000 3,400 22,000 17,400 (4) Trade Receivables : Sundry Debtors 36,000 36,000 Bills Receivable 3,000 39,000 36,000 Additional Information : (1) Depreciation charged on fixed tangible assets for the year 2012-13 was Rs. 20,000/- (2) Income tax Rs. 5,000 has been paid during the year. OR (B) The firm has owner's equity of Rs. 1,00,000. The ratio for the firms are as follows: Short term debt to total debts 0.4 Total debt to owners equity : 0.6 Fixed assets to owner's equity 0.6 Total assets turnover ratio (cost of goods sold/total assets) : 2 times Inventory turnover ratio (cost of goods sold closing stock) : 8 times You are required to compute : (1) Total debts (2) Short term debts (3) Long term debts (4) Fixed assets (5) Total assets (6) Cost of goods sold (7) Closing stock (8) Cash balance. RQA-32382 3 NJR/KS/18/6738