Question: Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered or plagiarized. You are

Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered or plagiarized.

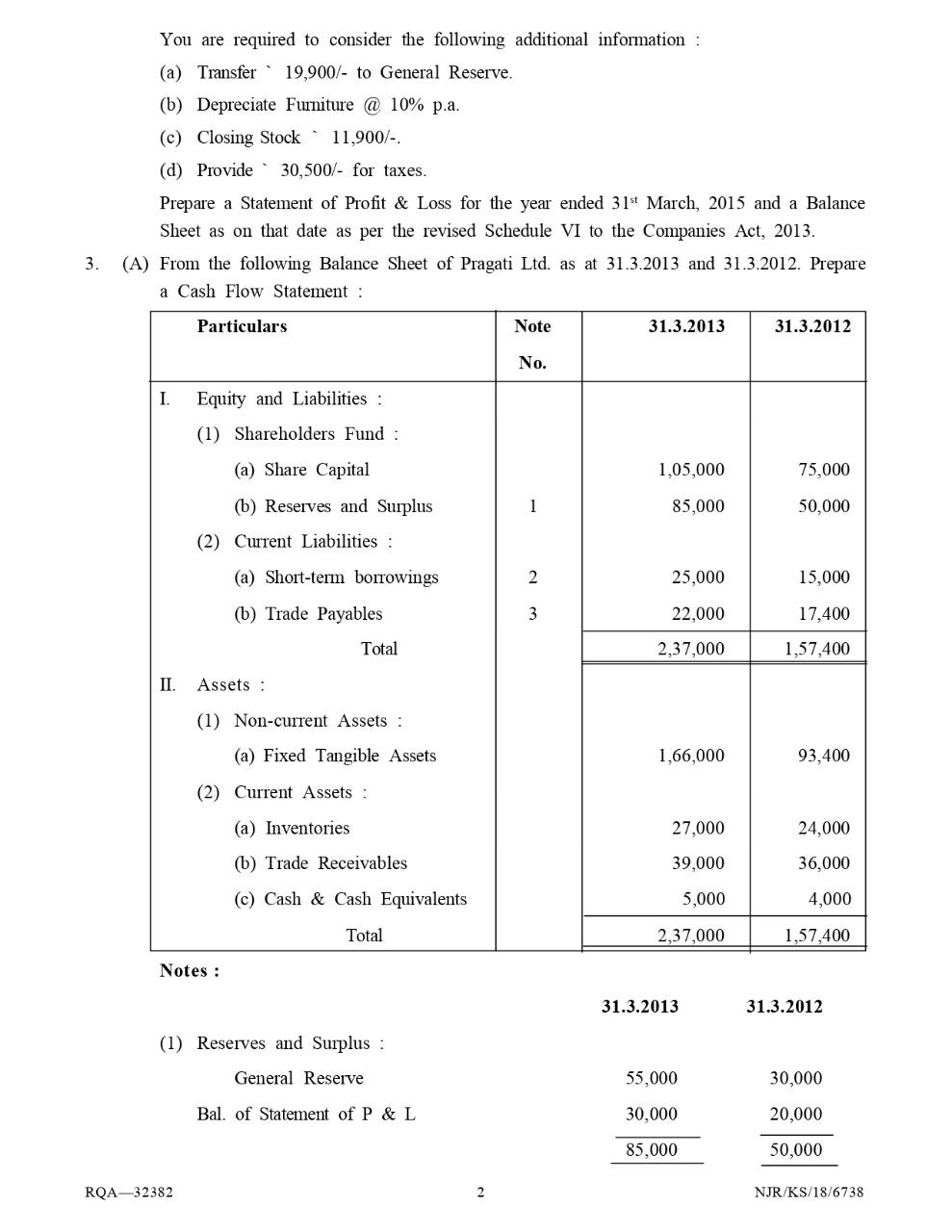

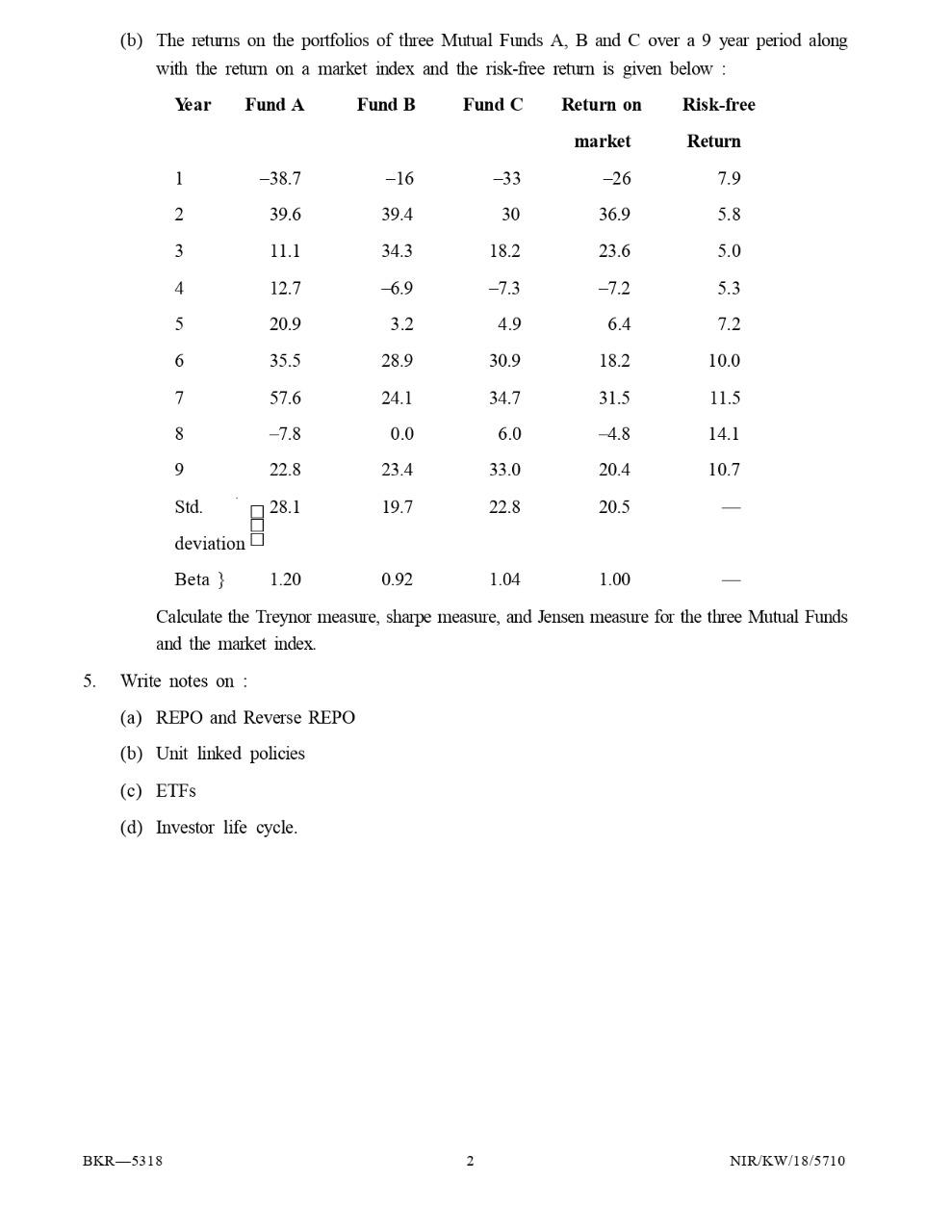

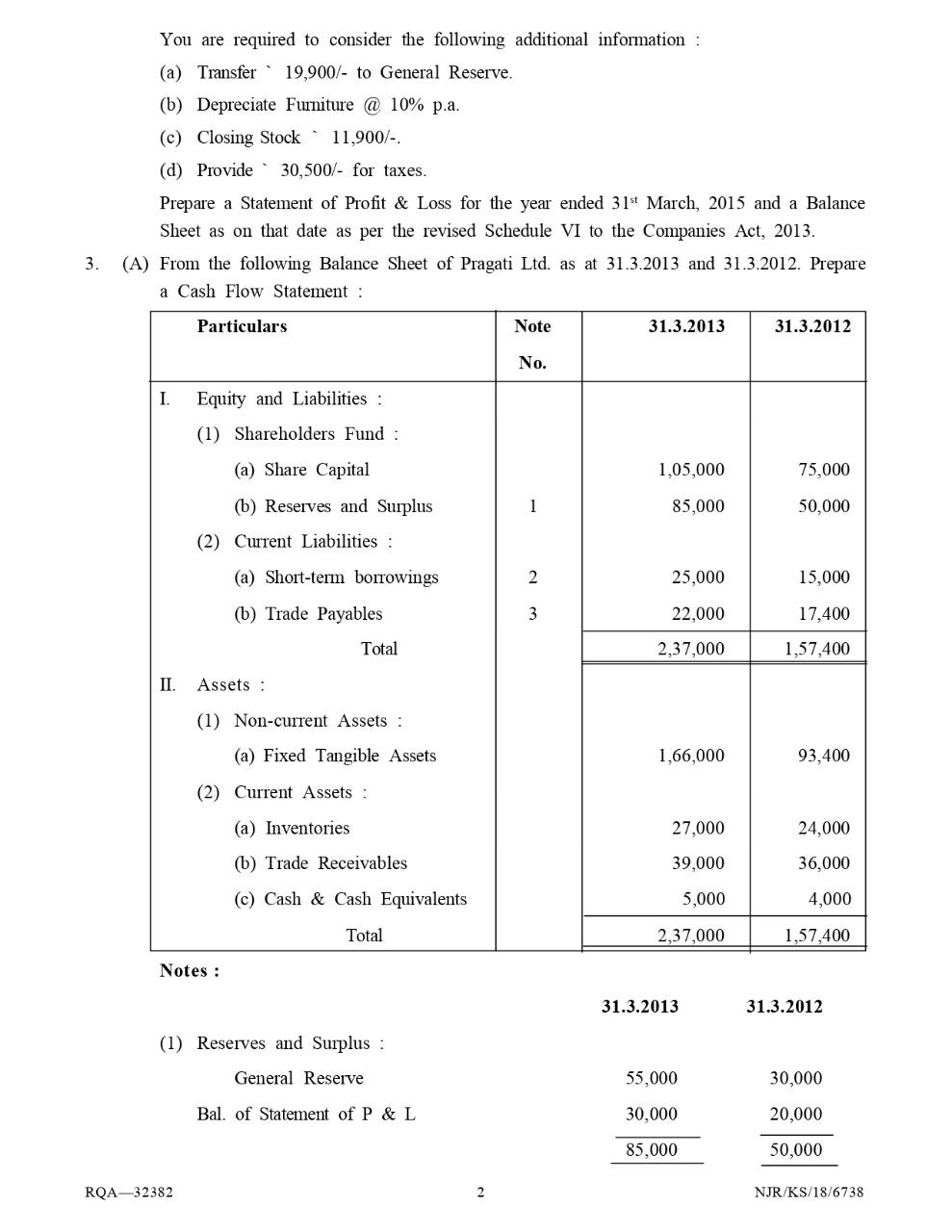

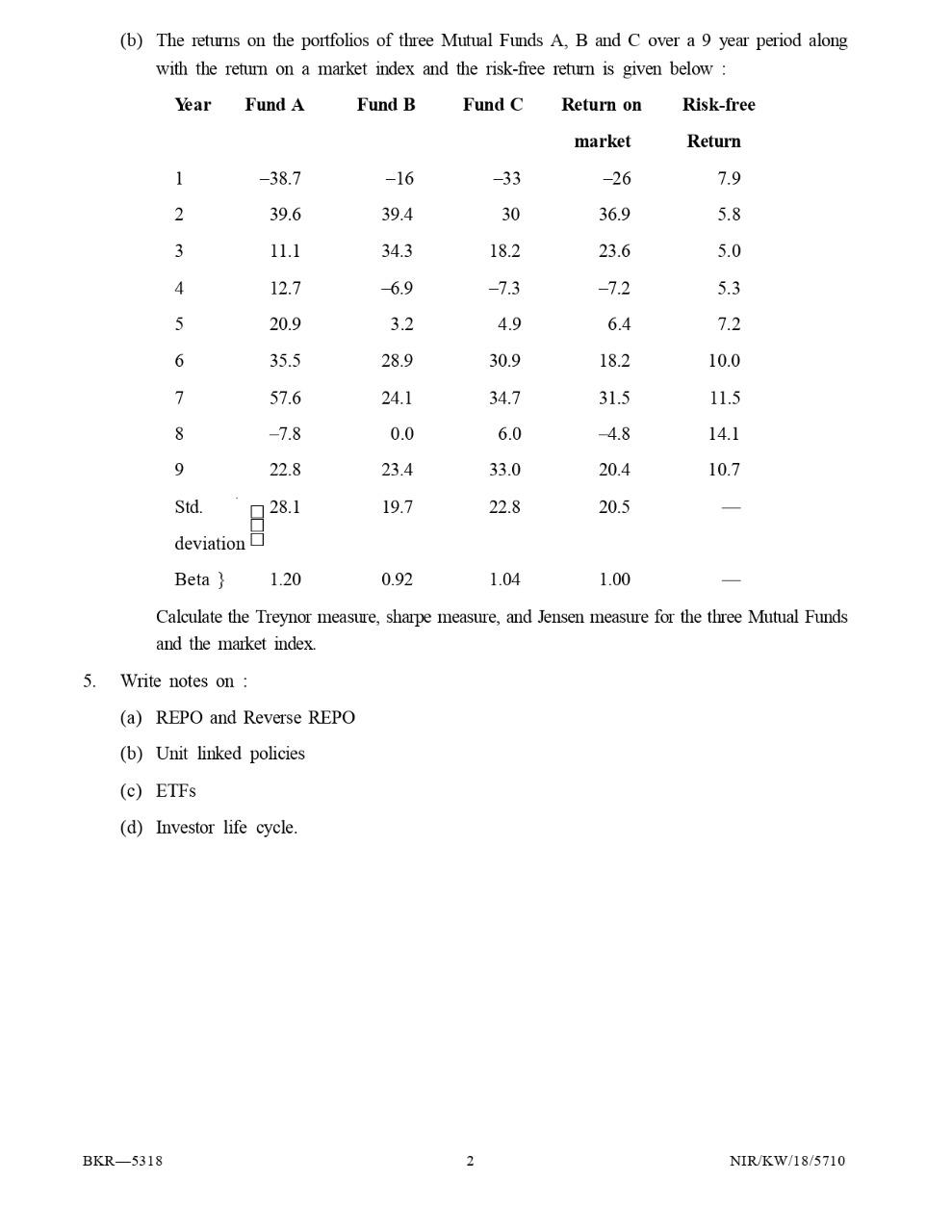

You are required to consider the following additional information (a) Transfer. 19,900/- to General Reserve. (b) Depreciate Furniture @ 10% p.a. (c) Closing Stock 11,900/-. (d) Provide 30,500/- for taxes. Prepare a Statement of Profit & Loss for the year ended 31st March, 2015 and a Balance Sheet as on that date as per the revised Schedule VI to the Companies Act, 2013. (A) From the following Balance Sheet of Pragati Ltd. as at 31.3.2013 and 31.3.2012. Prepare a Cash Flow Statement : 3. Particulars Note 31.3.2013 31.3.2012 No. I. Equity and Liabilities : (1) Shareholders Fund : (a) Share Capital 1,05,000 75,000 (b) Reserves and Surplus 1 85,000 50,000 (2) Current Liabilities: (a) Short-term borrowings 2 25,000 15,000 (b) Trade Payables 3 22,000 17,400 Total 2,37,000 1,57,400 II. Assets : (1) Non-current Assets : (a) Fixed Tangible Assets 1,66,000 93,400 (2) Current Assets : (a) Inventories 27,000 24,000 39,000 36,000 (b) Trade Receivables (c) Cash & Cash Equivalents 5,000 4,000 Total 2,37,000 1,57,400 Notes : 31.3.2013 31.3.2012 (1) Reserves and Surplus : General Reserve 55,000 30,000 Bal. of Statement of P & L 30,000 20,000 85,000 50,000 RQA-32382 2 NJR/KS/18/6738 (b) The returns on the portfolios of three Mutual Funds A, B and C over a 9 year period along with the return on a market index and the risk-free return is given below : Year Fund A Fund B Fund C Return on Risk-free market Return 1 -38.7 -16 -33 -26 7.9 2 39.6 39.4 30 36.9 5.8 3 11.1 34.3 18.2 23.6 5.0 4 12.7 -6.9 -7.3 -7.2 5.3 5 20.9 3.2 4.9 6.4 7.2 6 35.5 28.9 30.9 18.2 10.0 7 57.6 24.1 34.7 31.5 11.5 8 -7.8 0.0 6.0 -4.8 14.1 9 22.8 23.4 33.0 20.4 10.7 Std. 28.1 19.7 22.8 20.5 deviation Beta } 1.20 0.92 1.04 1.00 Calculate the Treynor measure, sharpe measure, and Jensen measure for the three Mutual Funds and the market index. 5. Write notes on: (a) REPO and Reverse REPO (b) Unit linked policies (c) ETFs (d) Investor life cycle. BKR-5318 2 NIR/KW/18/5710