Question: Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered pr plagiarized. Suggest the

Ensure to answer all questions. Don't answer only one question. I will give 6 dislikes if only 1 question is answered pr plagiarized.

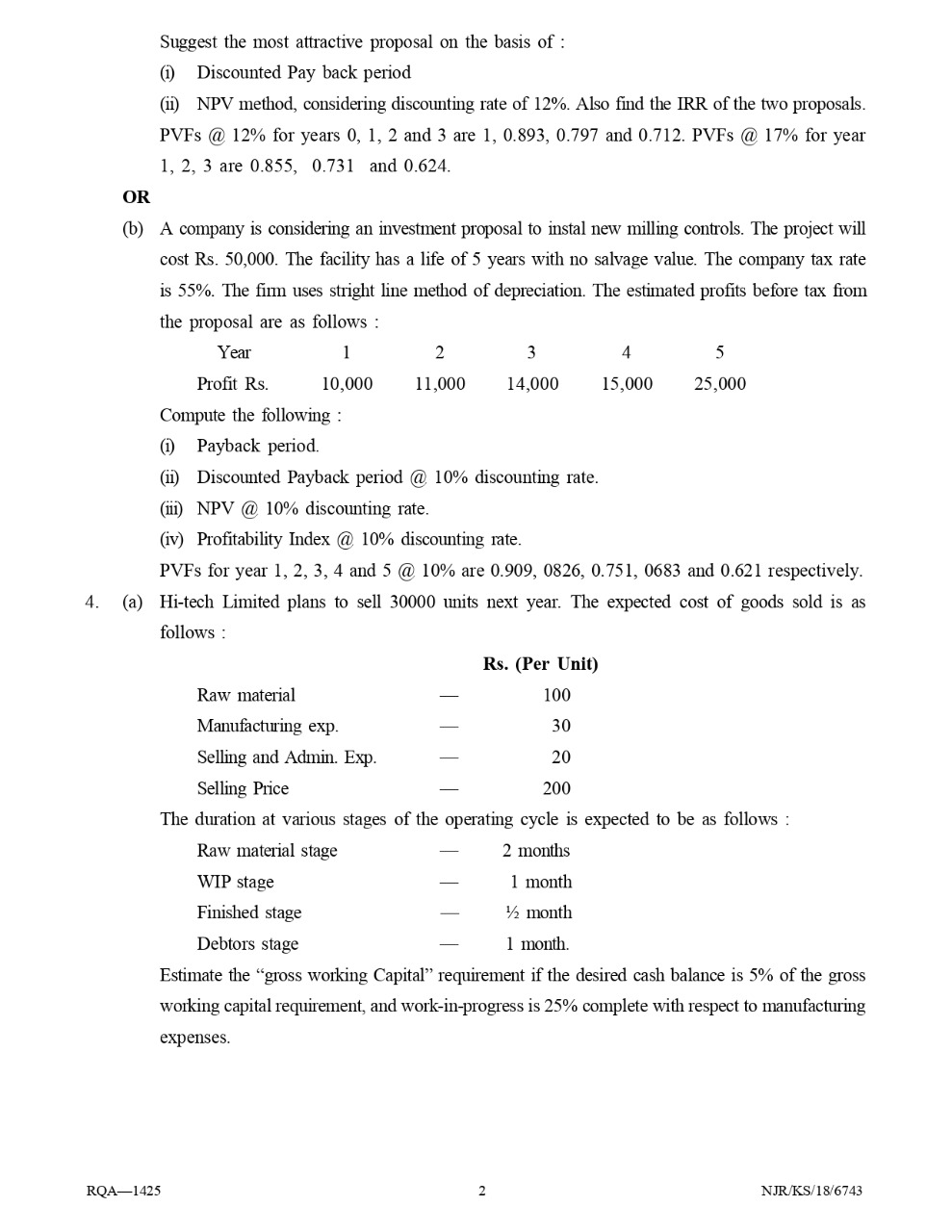

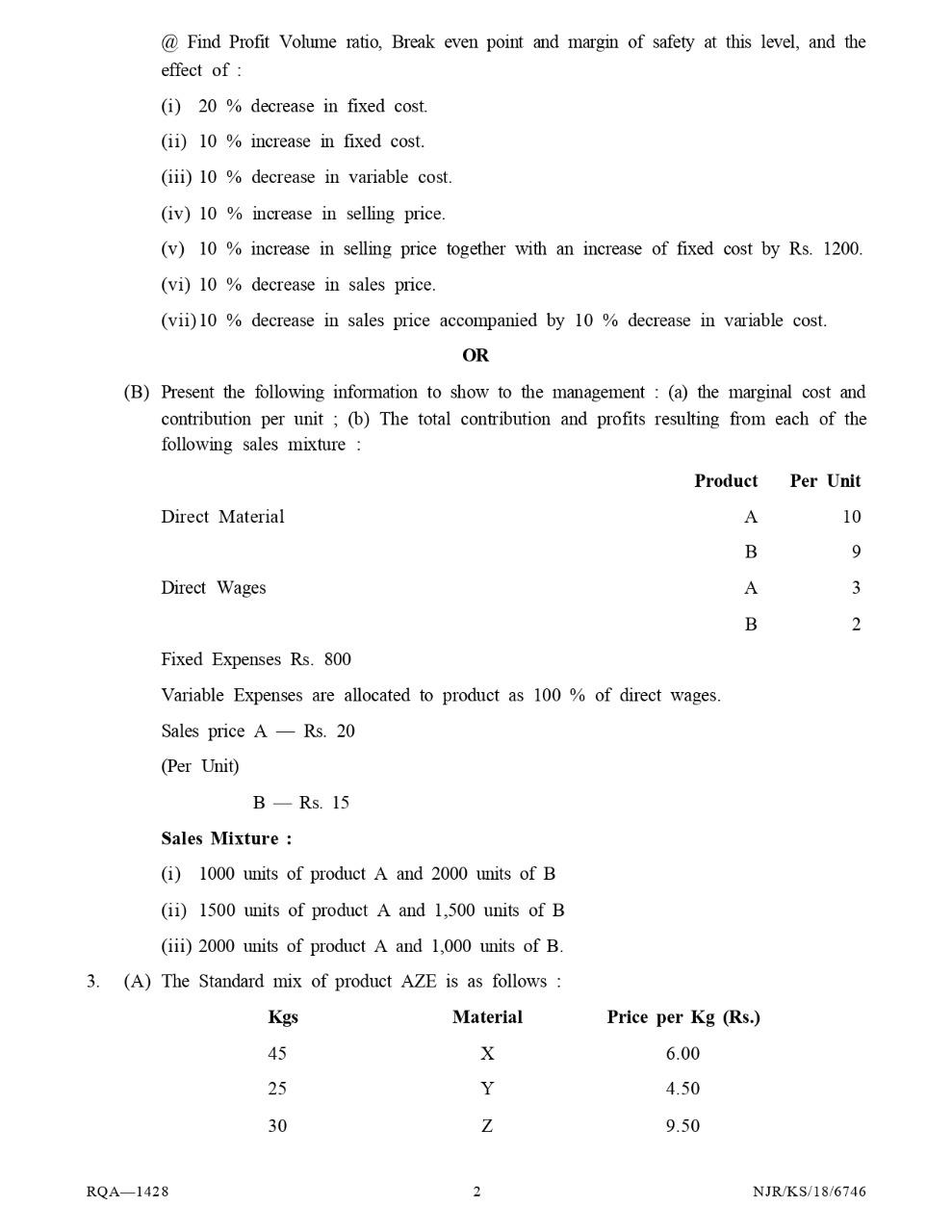

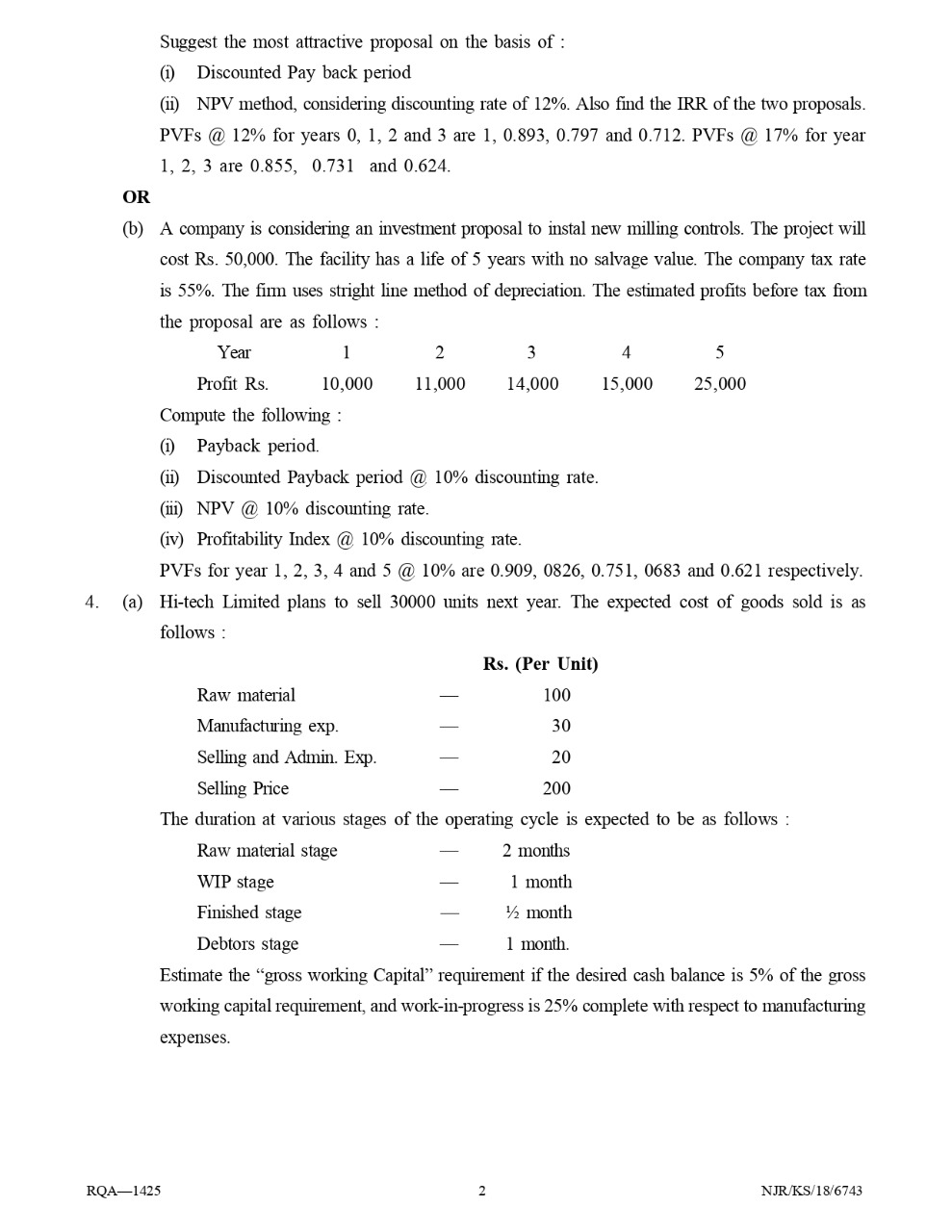

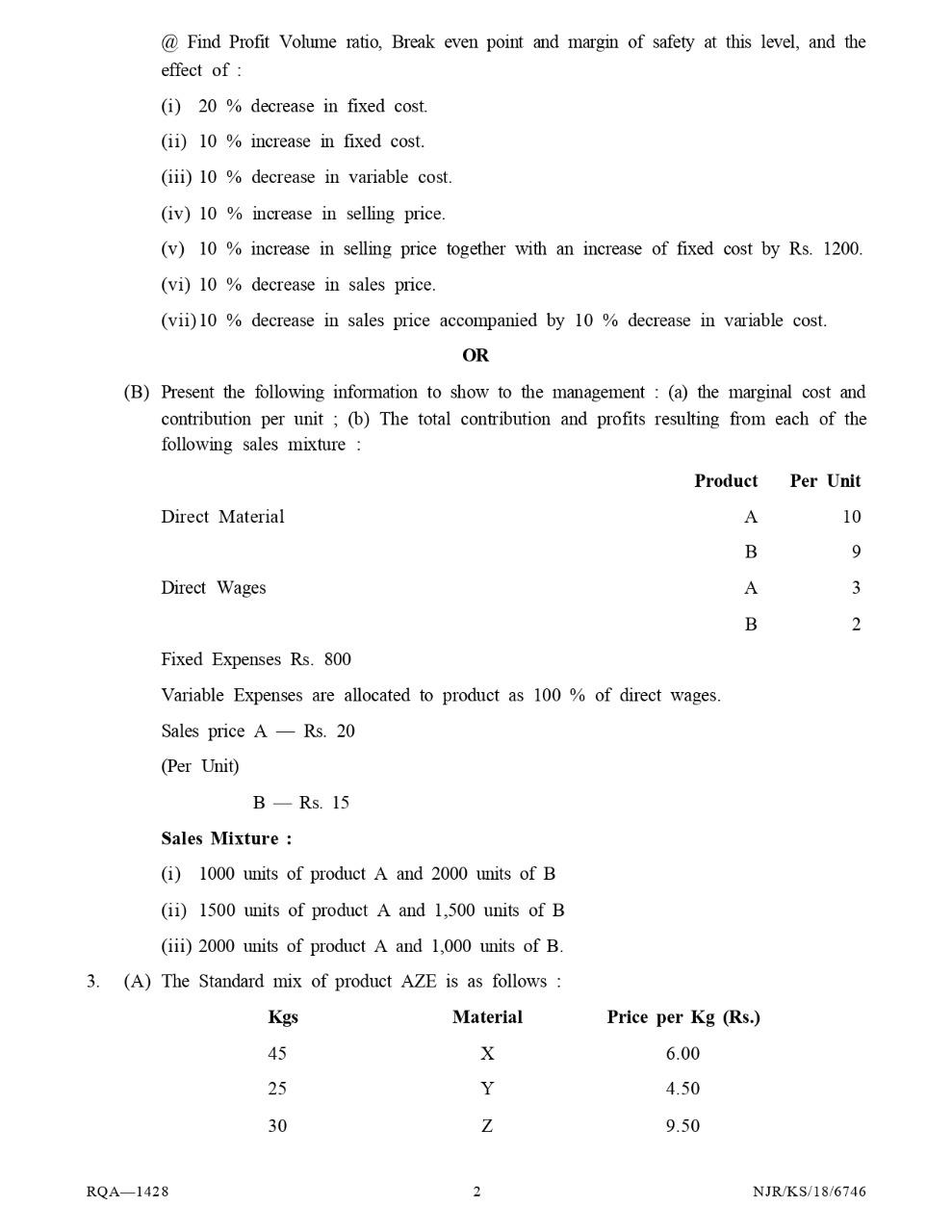

Suggest the most attractive proposal on the basis of : (1) Discounted Pay back period (ii) NPV method, considering discounting rate of 12%. Also find the IRR of the two proposals. PVFs @ 12% for years 0, 1, 2 and 3 are 1, 0.893, 0.797 and 0.712. PVFs @ 17% for year 1, 2, 3 are 0.855, 0.731 and 0.624. OR (b) A company is considering an investment proposal to instal new milling controls. The project will cost Rs. 50,000. The facility has a life of 5 years with no salvage value. The company tax rate is 55%. The firm uses stright line method of depreciation. The estimated profits before tax from the proposal are as follows: Year 1 2 5 3 4 Profit Rs. 10,000 11,000 14,000 15,000 25,000 Compute the following: (1) Payback period. (11) Discounted Payback period @ 10% discounting rate. () NPV @ 10% discounting rate. (iv) Profitability Index @ 10% discounting rate. PVFs for year 1, 2, 3, 4 and 5 @ 10% are 0.909, 0826, 0.751, 0683 and 0.621 respectively. 4. (a) Hi-tech Limited plans to sell 30000 units next year. The expected cost of goods sold is as follows: Rs. (Per Unit) Raw material 100 Manufacturing exp. 30 Selling and Admin. Exp. 20 Selling Price 200 The duration at various stages of the operating cycle is expected to be as follows: Raw material stage 2 months WIP stage 1 month Finished stage 12 month Debtors stage 1 month. Estimate the "gross working Capital requirement if the desired cash balance is 5% of the gross working capital requirement, and work-in-progress is 25% complete with respect to manufacturing expenses. RQA-1425 2 NJR/KS/18/6743 @ Find Profit Volume ratio, Break even point and margin of safety at this level, and the effect of: (i) 20 % decrease in fixed cost. (ii) 10 % increase in fixed cost. (iii) 10 % decrease in variable cost. (iv) 10 % increase in selling price. (v) 10 % increase in selling price together with an increase of fixed cost by Rs. 1200. (vi) 10 % decrease in sales price. (vii) 10 % decrease in sales price accompanied by 10 % decrease in variable cost. OR (B) Present the following information to show to the management : (a) the marginal cost and contribution per unit ; (b) The total contribution and profits resulting from each of the following sales mixture : Product Per Unit Direct Material A 10 B 9 Direct Wages A 3 . 2 Fixed Expenses Rs. 800 Variable Expenses are allocated to product as 100 % of direct wages. Sales price A Rs. 20 (Per Unit) B Rs. 15 Sales Mixture : (i) 1000 units of product A and 2000 units of B (ii) 1500 units of product A and 1,500 units of B (iii) 2000 units of product A and 1,000 units of B. 3. (A) The Standard mix of product AZE is as follows: Kgs Material Price per Kg (Rs.) 45 X 6.00 25 Y 4.50 30 Z 9.50 RQA-1428 2 NJR/KS/18/6746