Question: enter balance sheet info for both 2020 and 2019 using excel template. enter balance sheet figures from the Block annual report (input data into yellow

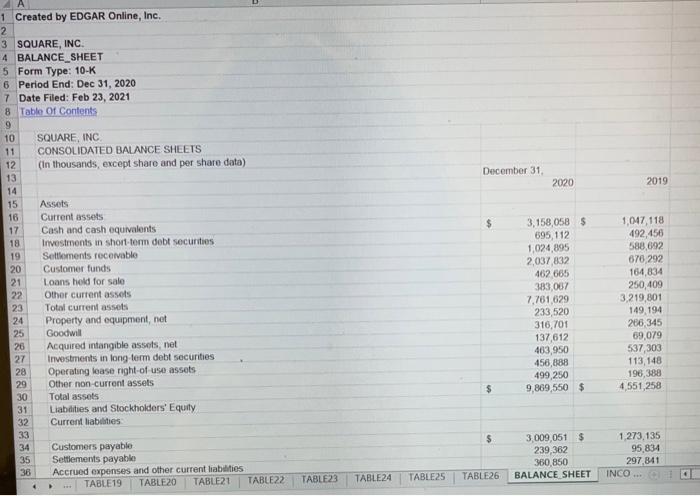

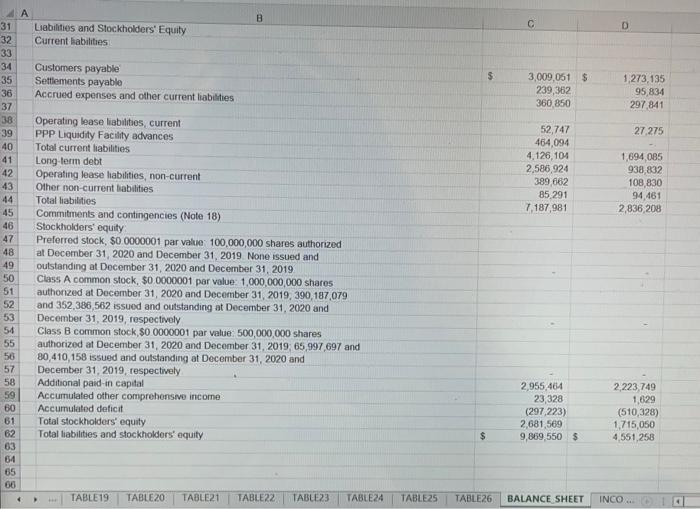

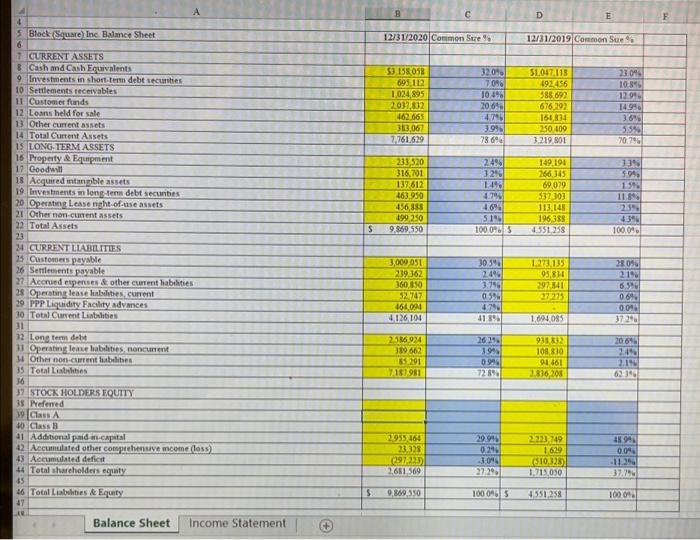

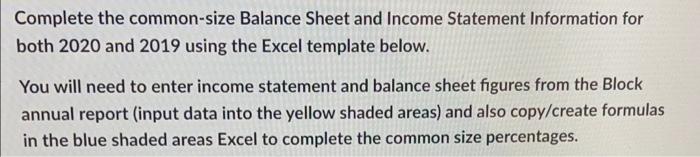

December 31 2020 2019 $ 1 Created by EDGAR Online, Inc. 2 3 SQUARE, INC 4 BALANCE SHEET 5 Form Type: 10-K 6 Period End: Dec 31, 2020 7 Date Filed: Feb 23, 2021 8 Table of Contents 9 10 SQUARE, INC 11 CONSOLIDATED BALANCE SHEETS 12 (In thousands, except share and per share data) 13 14 15 Assets 16 Current assets 17 Cash and cash equivalents 18 Investments in short-term debt securities 19 Settlements receivable 20 Customer funds 21 Loans hold for sale 22 Other current assets 23 Total current assets 24 Property and equipment, not 25 Goodwill 26 Acquired intangible assets, net 27 Investments in long-term debt securities 28 Operating lease right of use assets 29 Other non-current assets 30 Total assets 31 Liabilities and Stockholders' Equity 32 Current liabilities 33 34 Customers payable 35 Settlements payable 36 Accrued expenses and other current liabilities TABLE19 TABLE20 TABLE21 TABLE22 3,158,058 $ 695,112 1,024,895 2037832 462 665 383 067 7,781,629 233,520 316,701 137612 463,950 456,888 499 250 9,869,550 $ 1,047 118 492,456 588,692 670,292 164,834 250,409 3,219,801 149.194 206,345 59,079 537,303 113,148 196,388 4,551,258 $ $ 3,009,051 $ 239,362 360,850 BALANCE SHEET 1.273,135 95,834 297,841 INCO... TABLE23 TABLE24 TABLE 25 TABLE26 D S 3,009,051 $ 239,362 360 850 1,273,135 95,834 297 841 27 275 52,747 464,094 4,126,104 2,586,924 389 662 85,291 7,187,981 1,694,085 938,832 108,830 94.461 2,836 208 A B 31 Liabilities and Stockholders' Equity 32 Current abilities 33 34 Customers payable 35 Settlements payable 36 Accrued expenses and other current liabilities 37 38 Operating lease liabilities, current 39 PPP Liquidity Facility advances 40 Total current liabilities 41 Long-term debt 42 Operating lease habilities, non-current 43 Other non-current liabilities 44 Total liabilities 45 Commitments and contingencies (Note 18) 46 Stockholders' equity 47 Preferred stock, $0.0000001 par value 100,000,000 shares authorized 48 at December 31, 2020 and December 31, 2019 None issued and 49 outstanding at December 31, 2020 and December 31, 2019 50 Class A common stock, $0 0000001 par value: 1,000,000,000 shares 51 authorized at December 31, 2020 and December 31, 2019, 390, 187,079 52 and 352,386,562 issued and outstanding at December 31, 2020 and 53 December 31, 2019, respectively 54 Class B common stock $0 0000001 par value: 500,000,000 shares 55 authorized at December 31, 2020 and December 31, 2019, 65,997,697 and 56 80,410,158 issued and outstanding at December 31, 2020 and 57 December 31, 2019, respectively 58 Additional paid in capital 59 Accumulated other comprehensive income 60 Accumulated deficit 61 Total stockholders' equity 62 Total liabilities and stockholders' equity 63 64 65 66 TABLE 19 TABLE20 TABLE21 TABLE22 TABLE23 TABLE24 2,955,464 23,328 (297,223) 2,681,569 9,869,550 $ 2 223 749 1,629 (510,328) 1.715,050 4,551,258 $ TABLE25 TABLE26 BALANCE SHEET INCO... 3 D 12/31/2020 Common Sure 12/31/2019 Common Sue 53 158058 695112 1024,895 2037,832 462.065 363,067 7.761.629 32.0% 7096 10196 2069 4.74 3.9% 7869 51.047.118 192.456 588 692 676,292 166,831 250 409 3.219.801 23.09 10.396 12993 14.99 3.896 55% 70798 13 5996 233,520 316,701 137,612 463,950 456,385 199 250 9.869.550 2495 3.290 1.19 4.79 4.691 5.190 100.05 149.194 266.345 69.029 532303 113.145 196355 4.551258 11.89 $ 43 100.0% 5. Black Square Inc Balance Sheet 6 7. CURRENT ASSETS 3 Cash and Cash Esuivalents 9 Investments in short-term debt securities 10 Settlements receivables 11 Customer funds 12 Loans held for sale 13 Other current assets 14 Total Current Assets 15 LONG-TERM ASSETS 16 Property & Equipment 17 Goodwill 18 Acquired intanmble assets 19 Investments in long-term debt secuntes 20 Operating Leasenght of use assets 21 Other non-current assets 22 Total Assets 23 24 CURRENT LIABILITIES 33 Customers payable 26 Settlements payable 27 Accrued espeses & other current habilities 28 Operating lease linbiles, current 29 PPP Liquidity Facility advances 30 Total Current Listes 31 32 Long term debt 11 Operationen e habilities, noncurrent 30 Other non-current habilites 35 Total Litlises 36 37 STOCK HOLDERS EQUITY 38 Preferred 19 Class A 40 Class 1 41 Additional paid capital 42. Accumulated other comprehensive mcome (less) 43 Acumulated deficit 44 Total shareholders equity 45 46 Total Liabilities & Equity 47 3,009 051 219 362 360,850 52.747 161094 4.126,100 30.39 2.496 3.796 059 4.79 41 898 1.27.135 93,814 297.341 27.275 28.09 2196 6.544 0696 0.04 3729 1.694.085 2.136934 389 662 8501 7.181.981 2621 1998 0998 7289 931832 108830 91461 2836,208 2069 2440 2.11 62.39 2955460 33328 297225) 2611 569 29.99 024 30 2729 233,749 1 629 $10.325 1.715,050 489 0.04 11.29 5 9,859.350 100 ONS 4551.258 1000 Balance Sheet Income Statement Complete the common-size Balance Sheet and Income Statement Information for both 2020 and 2019 using the Excel template below. You will need to enter income statement and balance sheet figures from the Block annual report (input data into the yellow shaded areas) and also copy/create formulas in the blue shaded areas Excel to complete the common size percentages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts