Question: For Naturalistic plc, calculate the following ratios for 2020 and 2021. Workings and formulae used must be clearly stated. (1) (ii) (iii) (iv) (v)

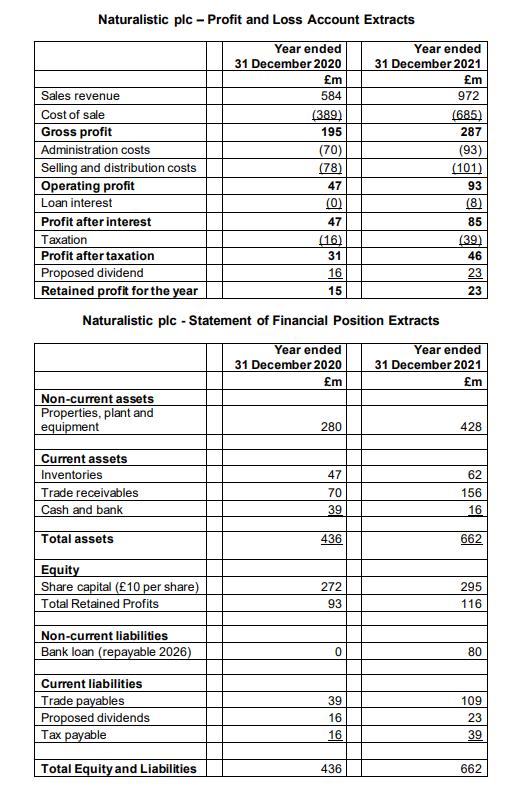

For Naturalistic plc, calculate the following ratios for 2020 and 2021. Workings and formulae used must be clearly stated. (1) (ii) (iii) (iv) (v) (vi) Current ratio Quick (also called Acid-Test) ratio Gearing ratio Interest cover Earnings per share Dividend Cover Naturalistic plc-Profit and Loss Account Extracts Year ended 31 December 2020 m 584 Sales revenue Cost of sale Gross profit Administration costs Selling and distribution costs Operating profit Loan interest Profit after interest Taxation Profit after taxation Proposed dividend Retained profit for the year Non-current assets Properties, plant and equipment Current assets Inventories Trade receivables Cash and bank Total assets Naturalistic plc - Statement of Financial Position Extracts Equity Share capital (10 per share) Total Retained Profits Non-current liabilities Bank loan (repayable 2026) (389) 195 Current liabilities Trade payables Proposed dividends Tax payable Total Equity and Liabilities (70) (78) 47 (0) 47 (16) 31 16 15 Year ended 31 December 2020 m 280 47 70 39 436 272 93 0 39 16 16 Year ended 31 December 2021 m 972 (685) 287 (93) (101) 436 93 (8) 85 (39) 46 23 23 Year ended 31 December 2021 m 428 62 156 16 662 295 116 80 109 23 39 662

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

1 2 A SNo 1 2 3 B 3 4 5 6 7 8 9 10 11 12 13 14 SNo 15 1 16 2 Quick Ratio 3 Gearing Ratio 17 18 4 19 ... View full answer

Get step-by-step solutions from verified subject matter experts