Question: Entire question please 4% Problem 2 (Required, 35 marks) The following table show the information of three bonds available in the market: Bond term Annual

Entire question please

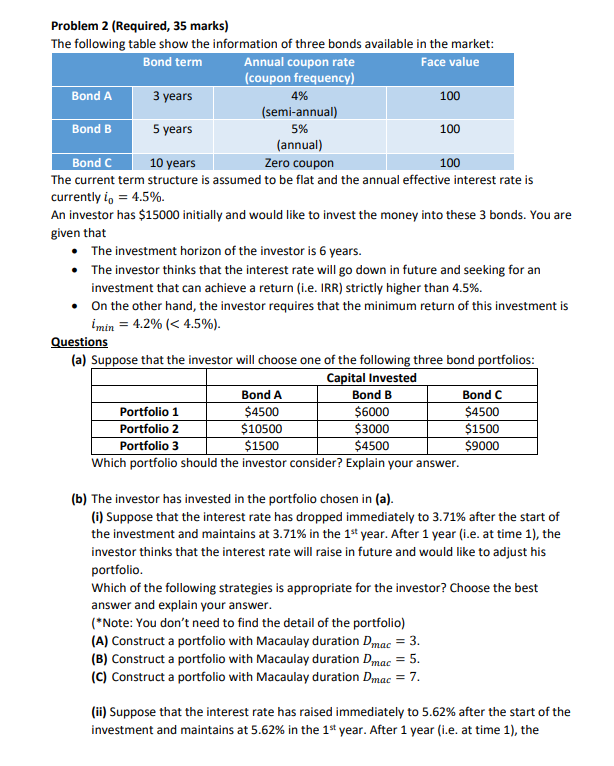

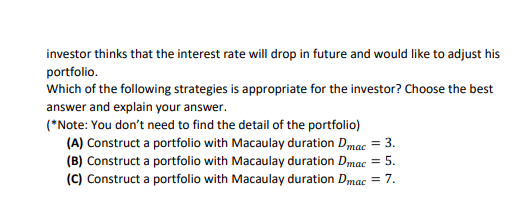

4% Problem 2 (Required, 35 marks) The following table show the information of three bonds available in the market: Bond term Annual coupon rate Face value (coupon frequency) Bond A 3 years 100 (semi-annual) Bond B 5 years 5% 100 (annual) Bond C 10 years Zero coupon 100 The current term structure is assumed to be flat and the annual effective interest rate is currently i, = 4.5%. An investor has $15000 initially and would like to invest the money into these 3 bonds. You are given that The investment horizon of the investor is 6 years. The investor thinks that the interest rate will go down in future and seeking for an investment that can achieve a return (i.e. IRR) strictly higher than 4.5%. On the other hand, the investor requires that the minimum return of this investment is imin = 4.2% (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts