Question: Entity A , a publicly listed company, has been operating in the cargo truck business in Hong Kong for many years. One of its cargo

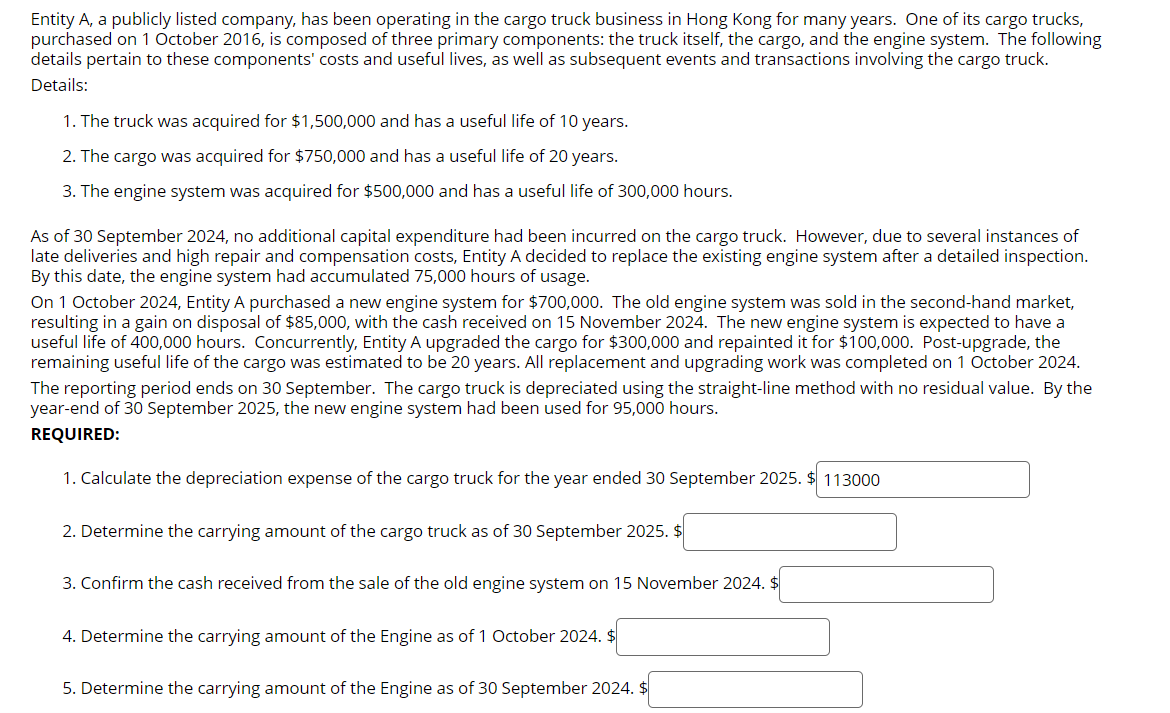

Entity A a publicly listed company, has been operating in the cargo truck business in Hong Kong for many years. One of its cargo trucks, purchased on October is composed of three primary components: the truck itself, the cargo, and the engine system. The following details pertain to these components' costs and useful lives, as well as subsequent events and transactions involving the cargo truck.

Details:

The truck was acquired for $ and has a useful life of years.

The cargo was acquired for $ and has a useful life of years.

The engine system was acquired for $ and has a useful life of hours.

As of September no additional capital expenditure had been incurred on the cargo truck. However, due to several instances of late deliveries and high repair and compensation costs, Entity A decided to replace the existing engine system after a detailed inspection. By this date, the engine system had accumulated hours of usage.

On October Entity A purchased a new engine system for $ The old engine system was sold in the secondhand market, resulting in a gain on disposal of $ with the cash received on November The new engine system is expected to have a useful life of hours. Concurrently, Entity A upgraded the cargo for $ and repainted it for $ Postupgrade, the remaining useful life of the cargo was estimated to be years. All replacement and upgrading work was completed on October The reporting period ends on September. The cargo truck is depreciated using the straightline method with no residual value. By the yearend of September the new engine system had been used for hours.

REQUIRED:

Calculate the depreciation expense of the cargo truck for the year ended September $

Determine the carrying amount of the cargo truck as of September $

Confirm the cash received from the sale of the old engine system on November $

Determine the carrying amount of the Engine as of October $

Determine the carrying amount of the Engine as of September :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock