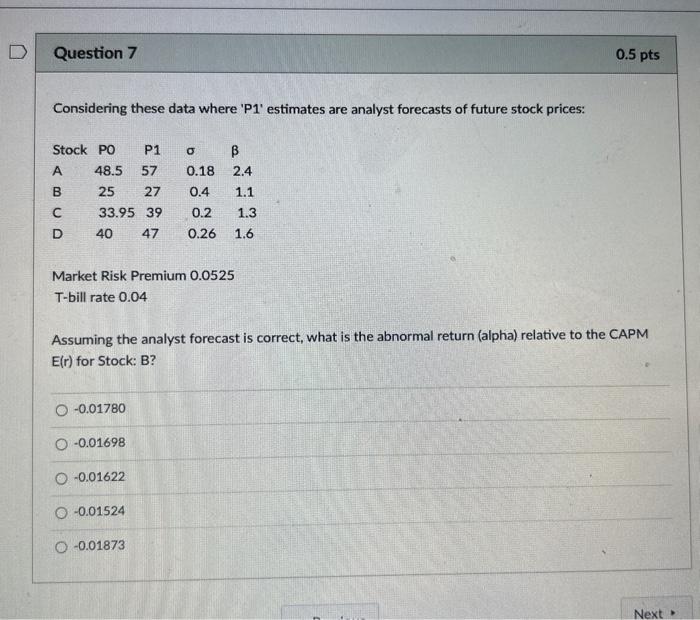

Question: EOM L7 Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0525 T-bill rate 0.04 Assuming the analyst

Considering these data where 'P1' estimates are analyst forecasts of future stock prices: Market Risk Premium 0.0525 T-bill rate 0.04 Assuming the analyst forecast is correct, what is the abnormal return (alpha) relative to the CAPM E(r) for Stock: B? 0.01780 0.01698 0.01622 0.01524 0.01873

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts