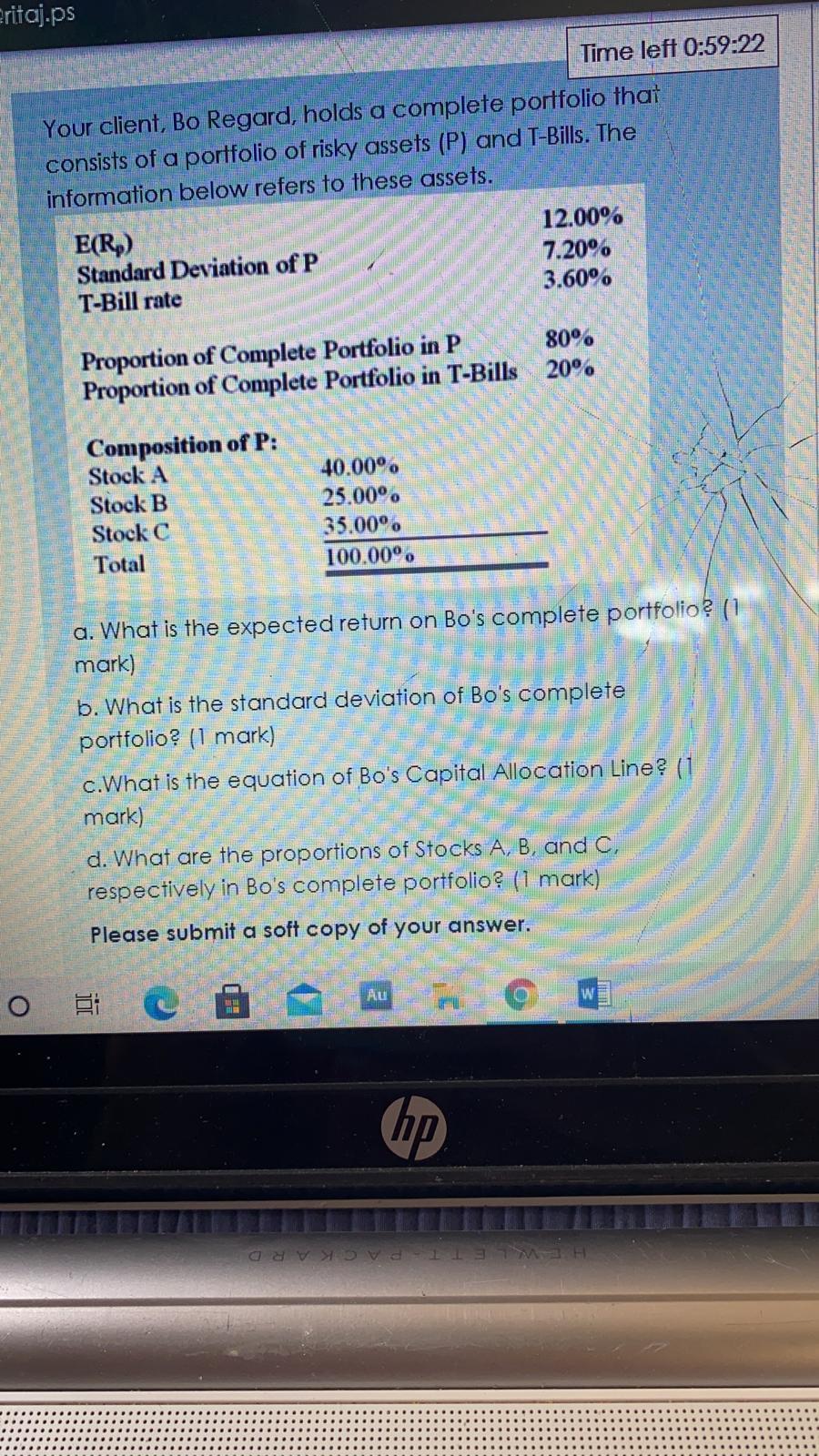

Question: Eritaj.ps Time left 0:59:22 Your client, Bo Regard, holds a complete portfolio thai consists of a portfolio of risky assets (P) and T-Bills. The information

Eritaj.ps Time left 0:59:22 Your client, Bo Regard, holds a complete portfolio thai consists of a portfolio of risky assets (P) and T-Bills. The information below refers to these assets. E(R) Standard Deviation of P T-Bill rate 12.00% 7.20% 3.60 Proportion of Complete Portfolio in P 80 Proportion of Complete Portfolio in T-Bills 20% Composition of P: Stock A Stock B Stock C Total 40.00 25.00. 35.000 6 100.00. a. What is the expected return on Bo's complete portfolio? (1 mark) b. What is the standard deviation of Bo's complete portfolio? (1 mark) c.What is the equation of Bo's Capital Allocation Line? (1 mark) d. What are the proportions of Stocks A, B, and C, respectively in Bo's complete portfolio? (1 mark) Please submit a soft copy of your answer. Au W o GP a avval MH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts