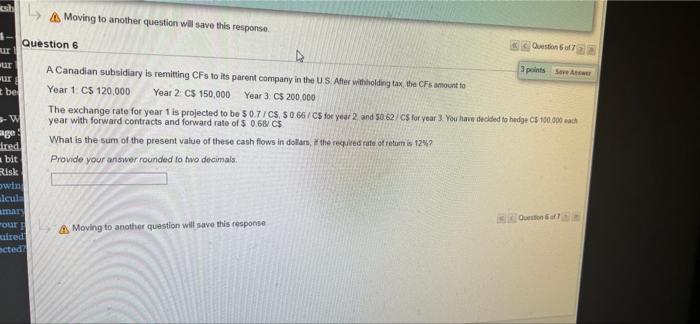

Question: esh A Moving to another question will save this response 3 points SA 1 Question 6 Question 67 UT ur A Canadian subsidiary is remitting

esh A Moving to another question will save this response 3 points SA 1 Question 6 Question 67 UT ur A Canadian subsidiary is remitting CFs to its parent company in the US. Aher withholding tax the CFs amount to Ur be Year 1 C$ 120,000 Year 2 C$ 150,000 Year 3 C$ 200.000 The exchange rate for year 1 is projected to be 50.77C$ 5066/CS for year 2 and 50:62/C$for year 3 You have decided to hedge CS 100.000 each -W year with forward contracts and forward rate of $ 0.68 C5 ge What is the sum of the present value of these cash flows in dollars, the required rate ofretum is 1257 ired. bit Provide your answer rounded to two decimals. Risk win alcul amar Outono Our A Moving to another question will save this response alred acted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts