Question: Evaluate Koss's compensation structure for its executives and it board. Did that compensation structure influence corporation governance? Explain. SECTION SIX VALUATION Current Position Held Since

Evaluate Koss's compensation structure for its executives and it board. Did that compensation structure influence corporation governance? Explain.

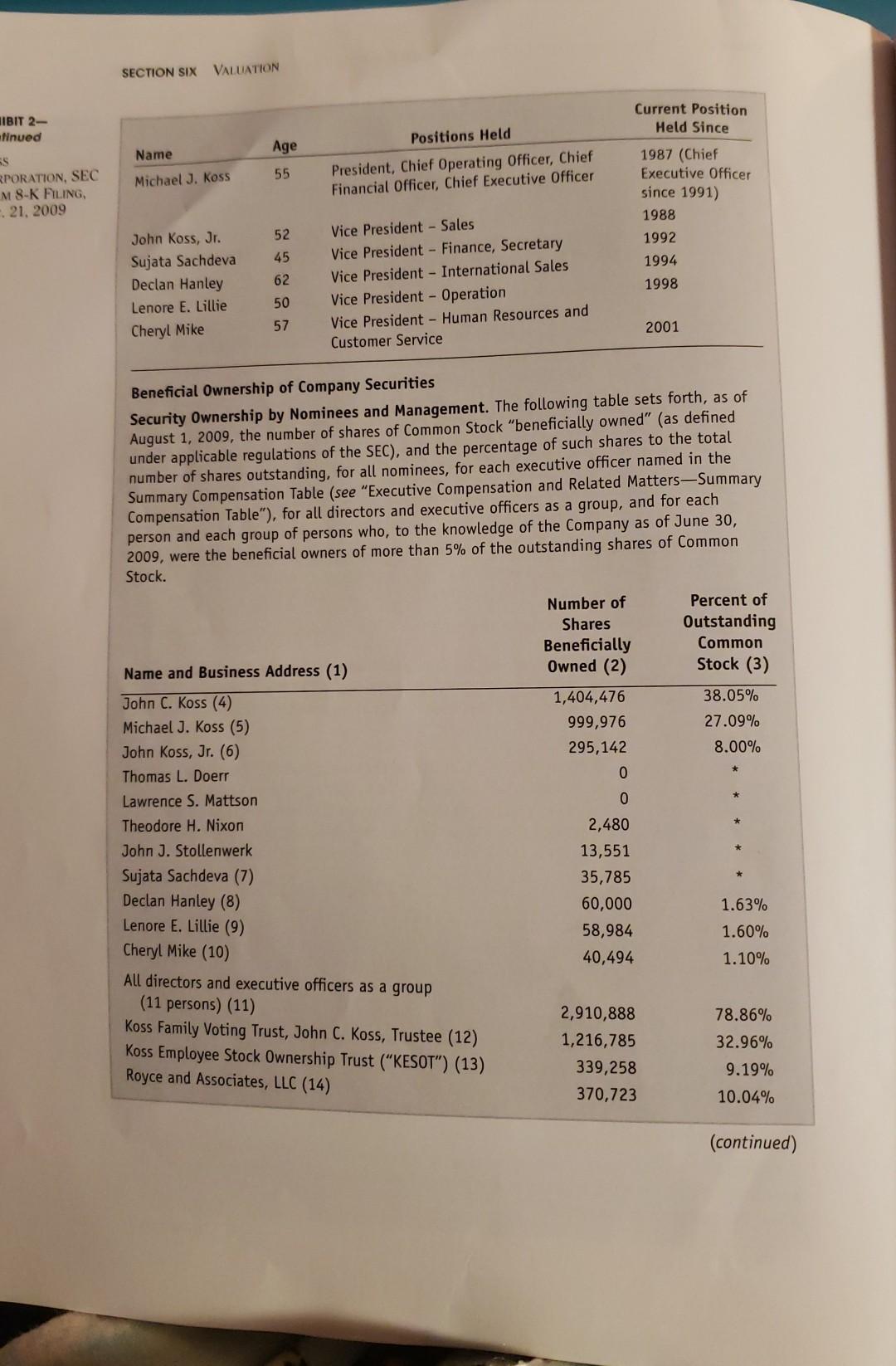

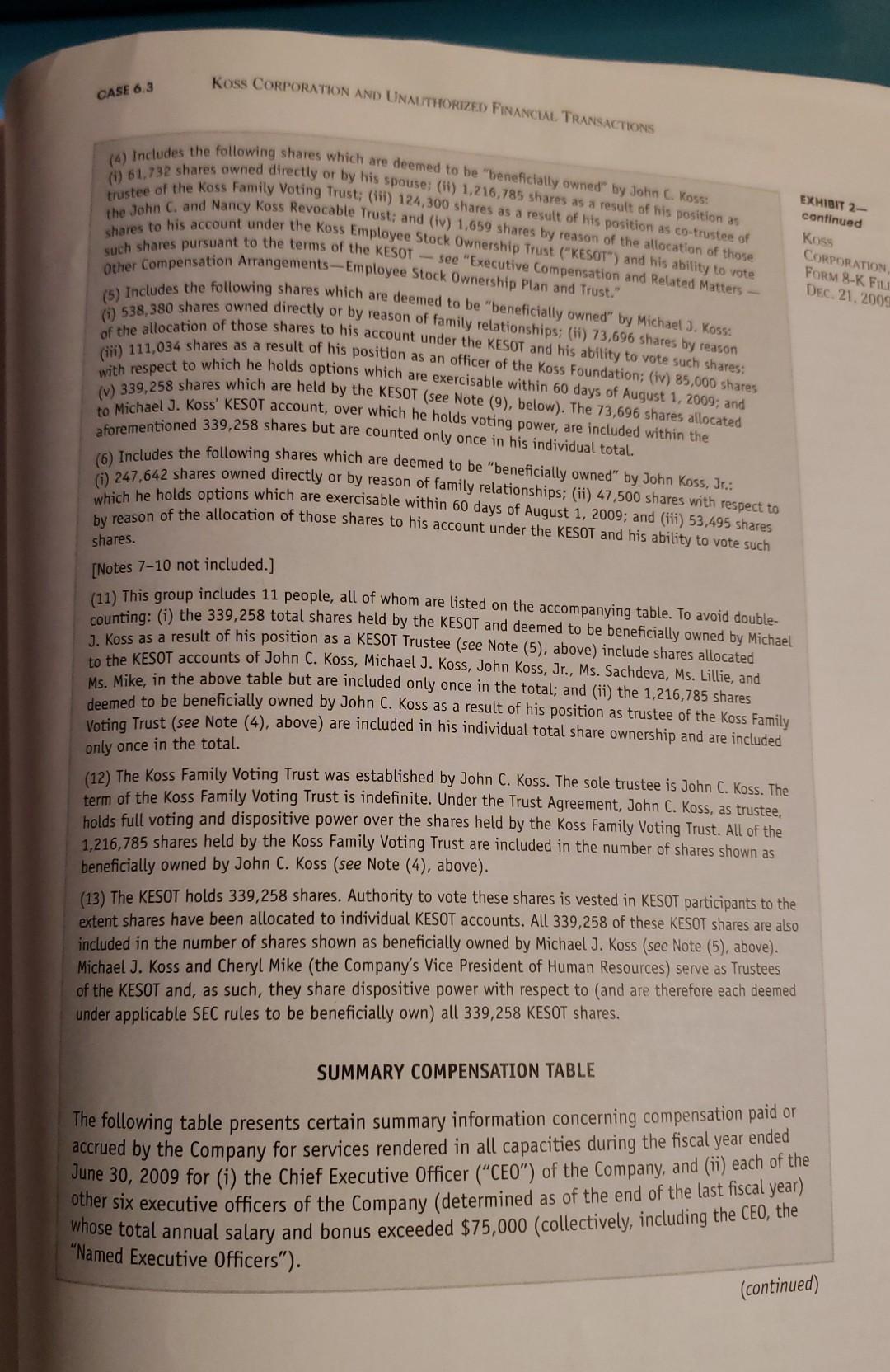

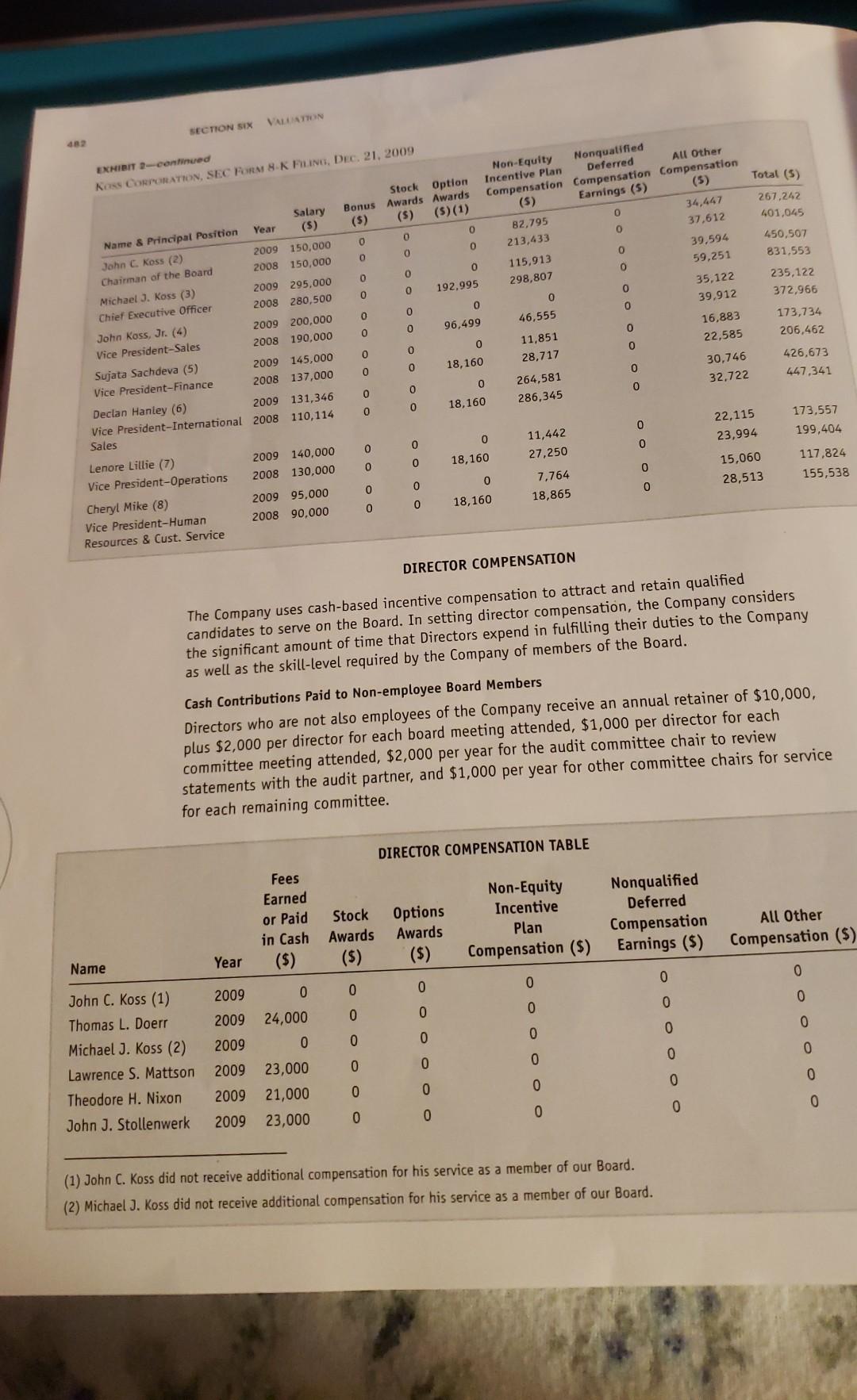

SECTION SIX VALUATION Current Position Held Since HIBIT 2- inued ES Age Name Positions Held President, Chief Operating Officer, Chief Financial Officer, Chief Executive Officer Michael J. Koss 55 RPORATION, SEC M 8-K FILING 21, 2009 1987 (Chief Executive Officer since 1991) 1988 1992 1994 1998 52 45 62 John Koss, Jr. Sujata Sachdeva Declan Hanley Lenore E. Lillie Cheryl Mike Vice President - Sales Vice President - Finance, Secretary Vice President - International Sales Vice President - Operation Vice President - Human Resources and Customer Service 50 57 2001 Beneficial Ownership of Company Securities Security Ownership by Nominees and Management. The following table sets forth, as of August 1, 2009, the number of shares of Common Stock "beneficially owned" (as defined under applicable regulations of the SEC), and the percentage of such shares to the total number of shares outstanding, for all nominees, for each executive officer named in the Summary Compensation Table (see "Executive Compensation and Related Matters-Summary Compensation Table"), for all directors and executive officers as a group, and for each person and each group of persons who, to the knowledge of the Company as of June 30, 2009, were the beneficial owners of more than 5% of the outstanding shares of Common Stock. Percent of Outstanding Common Stock (3) Name and Business Address (1) Number of Shares Beneficially Owned (2) 1,404,476 999,976 295, 142 38.05% 27.09% 8.00% 0 0 John C. Koss (4) Michael J. Koss (5) John Koss, Jr. (6) Thomas L. Doerr Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk Sujata Sachdeva (7) Declan Hanley (8) Lenore E. Lillie (9) Cheryl Mike (10) All directors and executive officers as a group (11 persons) (11) Koss Family Voting Trust, John C. Koss, Trustee (12) Koss Employee Stock Ownership Trust ("KESOT") (13) Royce and Associates, LLC (14) 2,480 13,551 35,785 60,000 58,984 40,494 1.63% 1.60% 1.10% 2,910,888 1,216,785 58 370,723 78.86% 32.96% 9.19% 10.04% (continued) Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS CASE 6.3 (4) Includes the following shares which are deemed to be "beneficially owned by John C. Koss: trustee of the koss Family Voting Trust; (ii) 124,300 shares as a result of his position as co-trustee of (i) 61,732 shares owned directly or by his spouse: (11) 1,216,785 shares as a result of his position as the John C. and Nancy Koss Revocable Trust; and (iv) 1,659 shares by reason of the allocation of those shares to his account under the Koss Employee Stock Ownership Trust ("KESOT") and his ability to vote such shares pursuant to the terms of the KESOT - see "Executive Compensation and Related Matters - Other Compensation Arrangements-Employee Stock Ownership Plan and Trust." (5) Includes the following shares which are deemed to be "beneficially owned" by Michael J. Koss: (538,380 shares owned directly or by reason of family relationships; (11) 73,696 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares: with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (in) 111,034 shares as a result of his position as an officer of the Koss Foundation; (iv) 85,000 shares (V) 339,258 shares which are held by the KESOT (see Note (9), below). The 73,696 shares allocated aforementioned 339,258 shares but are counted only once in his individual total. EXHIBIT 2 continued Koss CORPORATION FORM 8-K FI DEC 21.2009 (6) Includes the following shares which are deemed to be beneficially owned" by John Koss, Jiu * 247,642 shares owned directly or by reason of family relationships: (1) 47,500 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (ii) 53.495 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares. [Notes 7-10 not included.] (11) This group includes 11 people, all of whom are listed on the accompanying table . To avoid double- counting: (i) the 339,258 total shares held by the KESOT and deemed to be beneficially owned by Michael J. Koss as a result of his position as a KESOT Trustee (see Note (5), above) include shares allocated to the KESOT accounts of John C. Koss, Michael J. Koss, John Koss, Jr., Ms. Sachdeva, Ms. Lillie, and Ms. Mike, in the above table but are included only once in the total; and (ii) the 1,216,785 shares deemed to be beneficially owned by John C. Koss as a result of his position as trustee of the Koss Family Voting Trust (see Note (4), above) are included in his individual total share ownership and are included only once in the total. (12) The Koss Family Voting Trust was established by John C. Koss. The sole trustee is John C. Koss. The term of the Koss Family Voting Trust is indefinite. Under the Trust Agreement, John C. Koss, as trustee, holds full voting and dispositive power over the shares held by the Koss Family Voting Trust. All of the 1,216,785 shares held by the Koss Family Voting Trust are included in the number of shares shown as beneficially owned by John C. Koss (see Note (4), above). (13) The KESOT holds 339,258 shares. Authority to vote these shares is vested in KESOT participants to the extent shares have been allocated to individual KESOT accounts. All 339,258 of these KESOT shares are also included in the number of shares shown as beneficially owned by Michael J. Koss (see Note (5), above). Michael J. Koss and Cheryl Mike (the Company's Vice President of Human Resources) serve as Trustees of the KESOT and, as such, they share dispositive power with respect to (and are therefore each deemed under applicable SEC rules to be beneficially own) all 339,258 KESOT shares. SUMMARY COMPENSATION TABLE The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal year ended June 30, 2009 for (i) the Chief Executive Officer ("CEO") of the Company, and (ii) each of the other six executive officers of the Company (determined as of the end of the last fiscal year ) whose total annual salary and bonus exceeded $75,000 (collectively, including the CEO, the "Named Executive Officers"). (continued) VALLATION SECTION SEX 482 EXHIBIT 2-continued Kass CORPORATION, SEC FORM 8-K FLING, DEC, 21, 2009 Stock Option Bonus Awards Awards ($) (5) (5) (1) 0 0 0 0 0 0 0 Total (5) 267.242 401,045 450.507 831.553 235,122 372,966 173,734 206,462 0 Non-Equity Nonqualified All Other Deferred Incentive Plan Compensation Compensation Compensation (5) Earnings (5) (5) B2,795 0 34,467 213,433 37,612 115,913 o 39,594 298,807 o 59,251 0 35,122 46,555 0 39,912 11,851 0 16,883 28,717 0 22,585 264,581 0 30,746 286,345 0 32,722 0 192,995 Salary Name & Principal Position Year ($) John C. Koss (2) 2009 150,000 Chairman of the Board 2008 150,000 Michael J. Koss (3) 2009 295,000 Chief Executive Officer 2008 280,500 John Koss, Jr. (4) 2009 200,000 Vice President-Sales 2008 190,000 Sujata Sachdeva (5) 2009 145,000 Vice President-Finance 2008 137,000 0 0 0 0 0 96,499 0 0 0 0 0 0 18,160 426,673 447,341 0 0 0 0 18,160 0 0 22,115 23,994 173,557 199,404 0 0 11,442 27,250 18,160 0 Declan Hanley (6) 2009 131,346 Vice President-International 2008 110,114 Sales Lenore Lillie (7) 2009 140,000 Vice President-Operations 2008 130,000 Cheryl Mike (8) 2009 95,000 Vice President-Human 2008 90,000 Resources & Cust. Service oo oo oo oo 15,060 28,513 117.824 155,538 0 0 7,764 18,865 0 18,160 DIRECTOR COMPENSATION The Company uses cash-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Company considers the significant amount of time that Directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board. Cash Contributions Paid to Non-employee Board Members Directors who are not also employees of the Company receive an annual retainer of $10,000, plus $2,000 per director for each board meeting attended, $1,000 per director for each committee meeting attended, $2,000 per year for the audit committee chair to review statements with the audit partner, and $1,000 per year for other committee chairs for service for each remaining committee. DIRECTOR COMPENSATION TABLE Fees Earned or Paid in Cash ($) Stock Awards ($) Options Awards ($) Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Name Year 0 0 0 0 2009 0 0 0 0 0 0 0 0 0 John C. Koss (1) Thomas L. Doerr Michael J. Koss (2) Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk o o o o o o 0 0 2009 24,000 2009 0 2009 23,000 2009 21,000 2009 23,000 0 0 0 0 0 0 0 0 0 0 (1) John C. Koss did not receive additional compensation for his service as a member of our Board. (2) Michael J. Koss did not receive additional compensation for his service as a member of our Board. SECTION SIX VALUATION Current Position Held Since HIBIT 2- inued ES Age Name Positions Held President, Chief Operating Officer, Chief Financial Officer, Chief Executive Officer Michael J. Koss 55 RPORATION, SEC M 8-K FILING 21, 2009 1987 (Chief Executive Officer since 1991) 1988 1992 1994 1998 52 45 62 John Koss, Jr. Sujata Sachdeva Declan Hanley Lenore E. Lillie Cheryl Mike Vice President - Sales Vice President - Finance, Secretary Vice President - International Sales Vice President - Operation Vice President - Human Resources and Customer Service 50 57 2001 Beneficial Ownership of Company Securities Security Ownership by Nominees and Management. The following table sets forth, as of August 1, 2009, the number of shares of Common Stock "beneficially owned" (as defined under applicable regulations of the SEC), and the percentage of such shares to the total number of shares outstanding, for all nominees, for each executive officer named in the Summary Compensation Table (see "Executive Compensation and Related Matters-Summary Compensation Table"), for all directors and executive officers as a group, and for each person and each group of persons who, to the knowledge of the Company as of June 30, 2009, were the beneficial owners of more than 5% of the outstanding shares of Common Stock. Percent of Outstanding Common Stock (3) Name and Business Address (1) Number of Shares Beneficially Owned (2) 1,404,476 999,976 295, 142 38.05% 27.09% 8.00% 0 0 John C. Koss (4) Michael J. Koss (5) John Koss, Jr. (6) Thomas L. Doerr Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk Sujata Sachdeva (7) Declan Hanley (8) Lenore E. Lillie (9) Cheryl Mike (10) All directors and executive officers as a group (11 persons) (11) Koss Family Voting Trust, John C. Koss, Trustee (12) Koss Employee Stock Ownership Trust ("KESOT") (13) Royce and Associates, LLC (14) 2,480 13,551 35,785 60,000 58,984 40,494 1.63% 1.60% 1.10% 2,910,888 1,216,785 58 370,723 78.86% 32.96% 9.19% 10.04% (continued) Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS CASE 6.3 (4) Includes the following shares which are deemed to be "beneficially owned by John C. Koss: trustee of the koss Family Voting Trust; (ii) 124,300 shares as a result of his position as co-trustee of (i) 61,732 shares owned directly or by his spouse: (11) 1,216,785 shares as a result of his position as the John C. and Nancy Koss Revocable Trust; and (iv) 1,659 shares by reason of the allocation of those shares to his account under the Koss Employee Stock Ownership Trust ("KESOT") and his ability to vote such shares pursuant to the terms of the KESOT - see "Executive Compensation and Related Matters - Other Compensation Arrangements-Employee Stock Ownership Plan and Trust." (5) Includes the following shares which are deemed to be "beneficially owned" by Michael J. Koss: (538,380 shares owned directly or by reason of family relationships; (11) 73,696 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares: with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (in) 111,034 shares as a result of his position as an officer of the Koss Foundation; (iv) 85,000 shares (V) 339,258 shares which are held by the KESOT (see Note (9), below). The 73,696 shares allocated aforementioned 339,258 shares but are counted only once in his individual total. EXHIBIT 2 continued Koss CORPORATION FORM 8-K FI DEC 21.2009 (6) Includes the following shares which are deemed to be beneficially owned" by John Koss, Jiu * 247,642 shares owned directly or by reason of family relationships: (1) 47,500 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (ii) 53.495 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares. [Notes 7-10 not included.] (11) This group includes 11 people, all of whom are listed on the accompanying table . To avoid double- counting: (i) the 339,258 total shares held by the KESOT and deemed to be beneficially owned by Michael J. Koss as a result of his position as a KESOT Trustee (see Note (5), above) include shares allocated to the KESOT accounts of John C. Koss, Michael J. Koss, John Koss, Jr., Ms. Sachdeva, Ms. Lillie, and Ms. Mike, in the above table but are included only once in the total; and (ii) the 1,216,785 shares deemed to be beneficially owned by John C. Koss as a result of his position as trustee of the Koss Family Voting Trust (see Note (4), above) are included in his individual total share ownership and are included only once in the total. (12) The Koss Family Voting Trust was established by John C. Koss. The sole trustee is John C. Koss. The term of the Koss Family Voting Trust is indefinite. Under the Trust Agreement, John C. Koss, as trustee, holds full voting and dispositive power over the shares held by the Koss Family Voting Trust. All of the 1,216,785 shares held by the Koss Family Voting Trust are included in the number of shares shown as beneficially owned by John C. Koss (see Note (4), above). (13) The KESOT holds 339,258 shares. Authority to vote these shares is vested in KESOT participants to the extent shares have been allocated to individual KESOT accounts. All 339,258 of these KESOT shares are also included in the number of shares shown as beneficially owned by Michael J. Koss (see Note (5), above). Michael J. Koss and Cheryl Mike (the Company's Vice President of Human Resources) serve as Trustees of the KESOT and, as such, they share dispositive power with respect to (and are therefore each deemed under applicable SEC rules to be beneficially own) all 339,258 KESOT shares. SUMMARY COMPENSATION TABLE The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal year ended June 30, 2009 for (i) the Chief Executive Officer ("CEO") of the Company, and (ii) each of the other six executive officers of the Company (determined as of the end of the last fiscal year ) whose total annual salary and bonus exceeded $75,000 (collectively, including the CEO, the "Named Executive Officers"). (continued) VALLATION SECTION SEX 482 EXHIBIT 2-continued Kass CORPORATION, SEC FORM 8-K FLING, DEC, 21, 2009 Stock Option Bonus Awards Awards ($) (5) (5) (1) 0 0 0 0 0 0 0 Total (5) 267.242 401,045 450.507 831.553 235,122 372,966 173,734 206,462 0 Non-Equity Nonqualified All Other Deferred Incentive Plan Compensation Compensation Compensation (5) Earnings (5) (5) B2,795 0 34,467 213,433 37,612 115,913 o 39,594 298,807 o 59,251 0 35,122 46,555 0 39,912 11,851 0 16,883 28,717 0 22,585 264,581 0 30,746 286,345 0 32,722 0 192,995 Salary Name & Principal Position Year ($) John C. Koss (2) 2009 150,000 Chairman of the Board 2008 150,000 Michael J. Koss (3) 2009 295,000 Chief Executive Officer 2008 280,500 John Koss, Jr. (4) 2009 200,000 Vice President-Sales 2008 190,000 Sujata Sachdeva (5) 2009 145,000 Vice President-Finance 2008 137,000 0 0 0 0 0 96,499 0 0 0 0 0 0 18,160 426,673 447,341 0 0 0 0 18,160 0 0 22,115 23,994 173,557 199,404 0 0 11,442 27,250 18,160 0 Declan Hanley (6) 2009 131,346 Vice President-International 2008 110,114 Sales Lenore Lillie (7) 2009 140,000 Vice President-Operations 2008 130,000 Cheryl Mike (8) 2009 95,000 Vice President-Human 2008 90,000 Resources & Cust. Service oo oo oo oo 15,060 28,513 117.824 155,538 0 0 7,764 18,865 0 18,160 DIRECTOR COMPENSATION The Company uses cash-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Company considers the significant amount of time that Directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board. Cash Contributions Paid to Non-employee Board Members Directors who are not also employees of the Company receive an annual retainer of $10,000, plus $2,000 per director for each board meeting attended, $1,000 per director for each committee meeting attended, $2,000 per year for the audit committee chair to review statements with the audit partner, and $1,000 per year for other committee chairs for service for each remaining committee. DIRECTOR COMPENSATION TABLE Fees Earned or Paid in Cash ($) Stock Awards ($) Options Awards ($) Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Name Year 0 0 0 0 2009 0 0 0 0 0 0 0 0 0 John C. Koss (1) Thomas L. Doerr Michael J. Koss (2) Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk o o o o o o 0 0 2009 24,000 2009 0 2009 23,000 2009 21,000 2009 23,000 0 0 0 0 0 0 0 0 0 0 (1) John C. Koss did not receive additional compensation for his service as a member of our Board. (2) Michael J. Koss did not receive additional compensation for his service as a member of our Board

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts