Question: 1.Evaluate Koss's compensation structure for its executives and board. 2. Did that compensation structure influence corporation governance? Explain. CASE 6.3 Koss CORPORATION AND UNAUTHOR FINANCIAL

1.Evaluate Koss's compensation structure for its executives and board.

2. Did that compensation structure influence corporation governance? Explain.

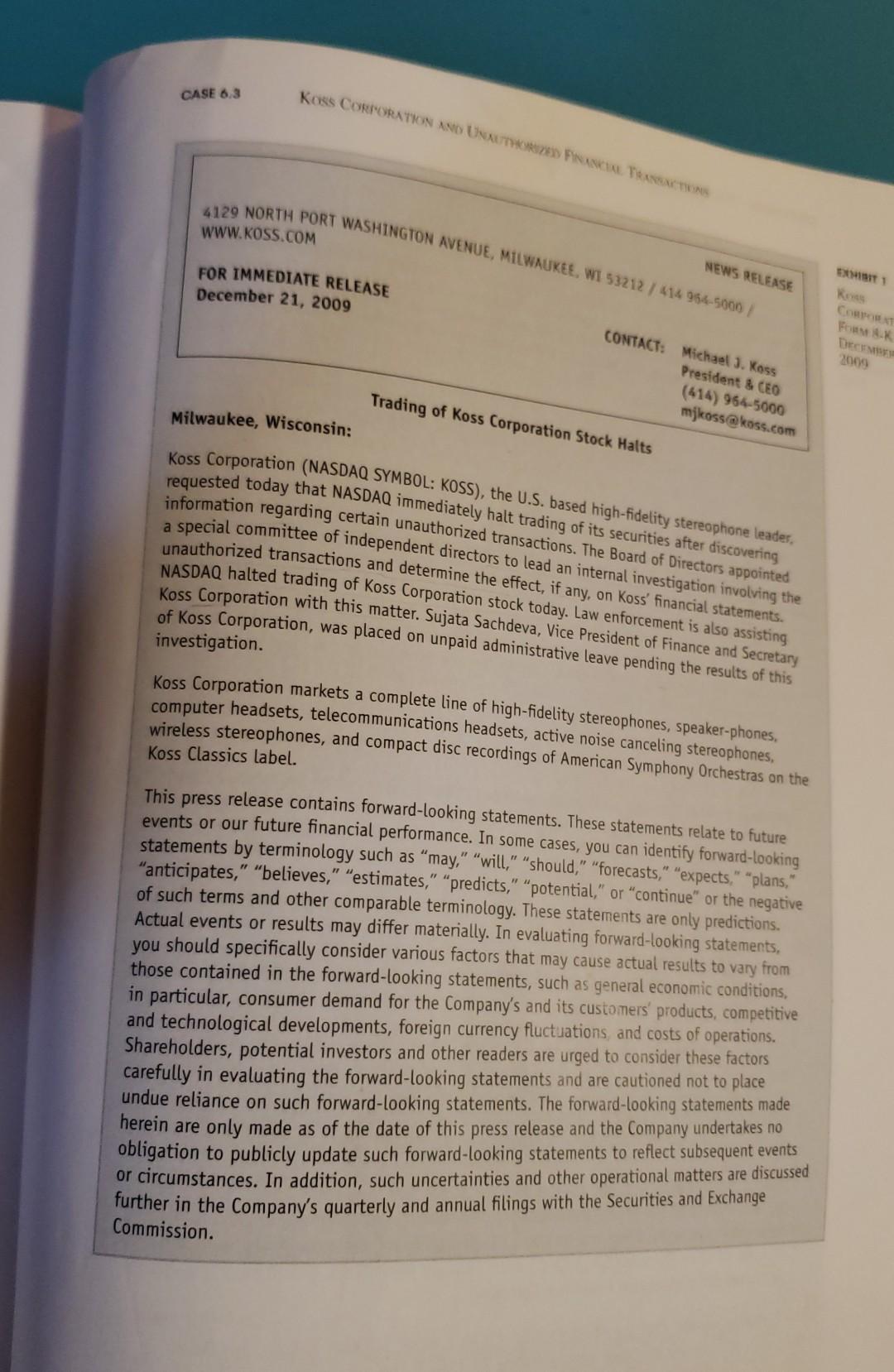

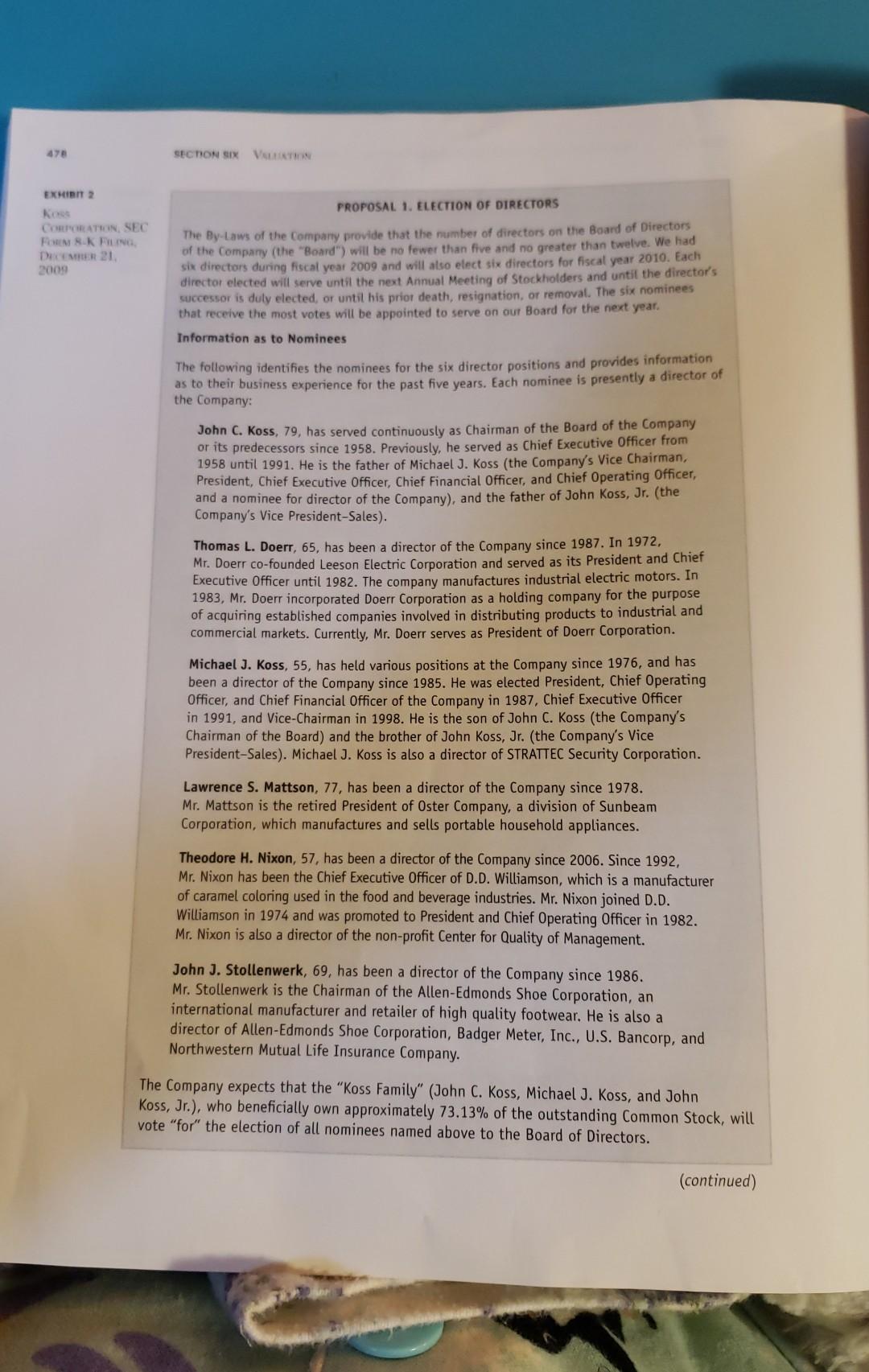

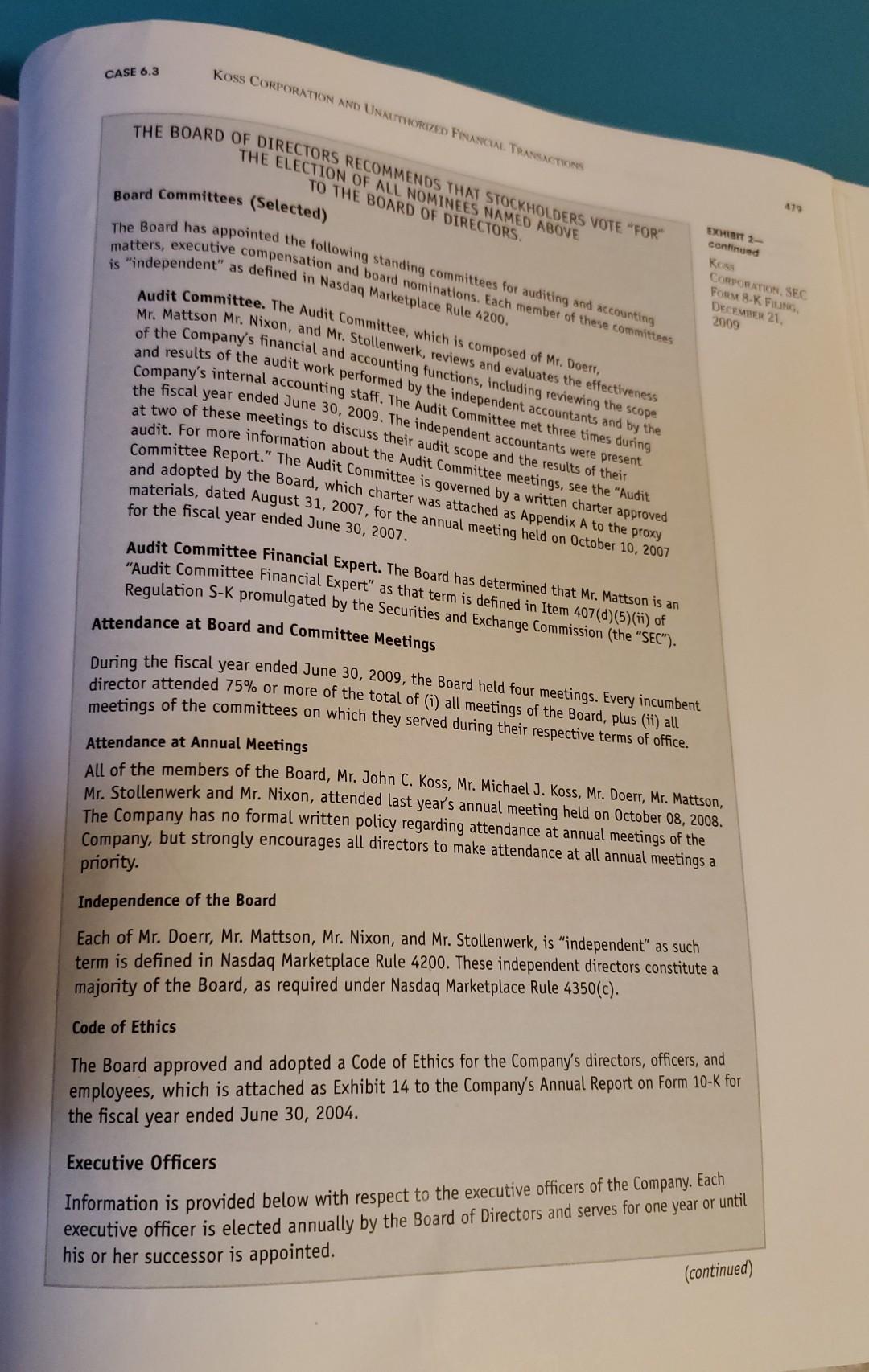

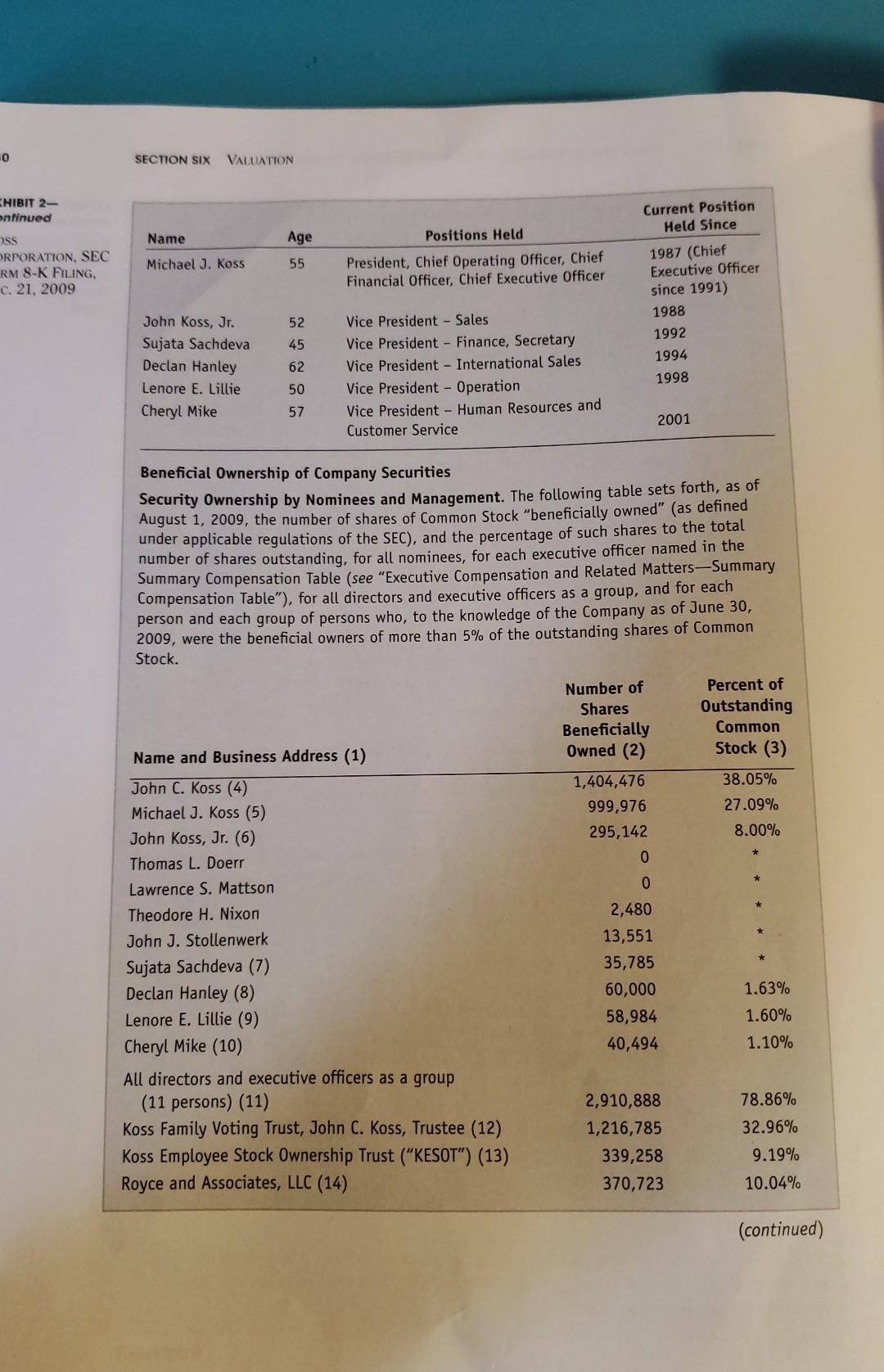

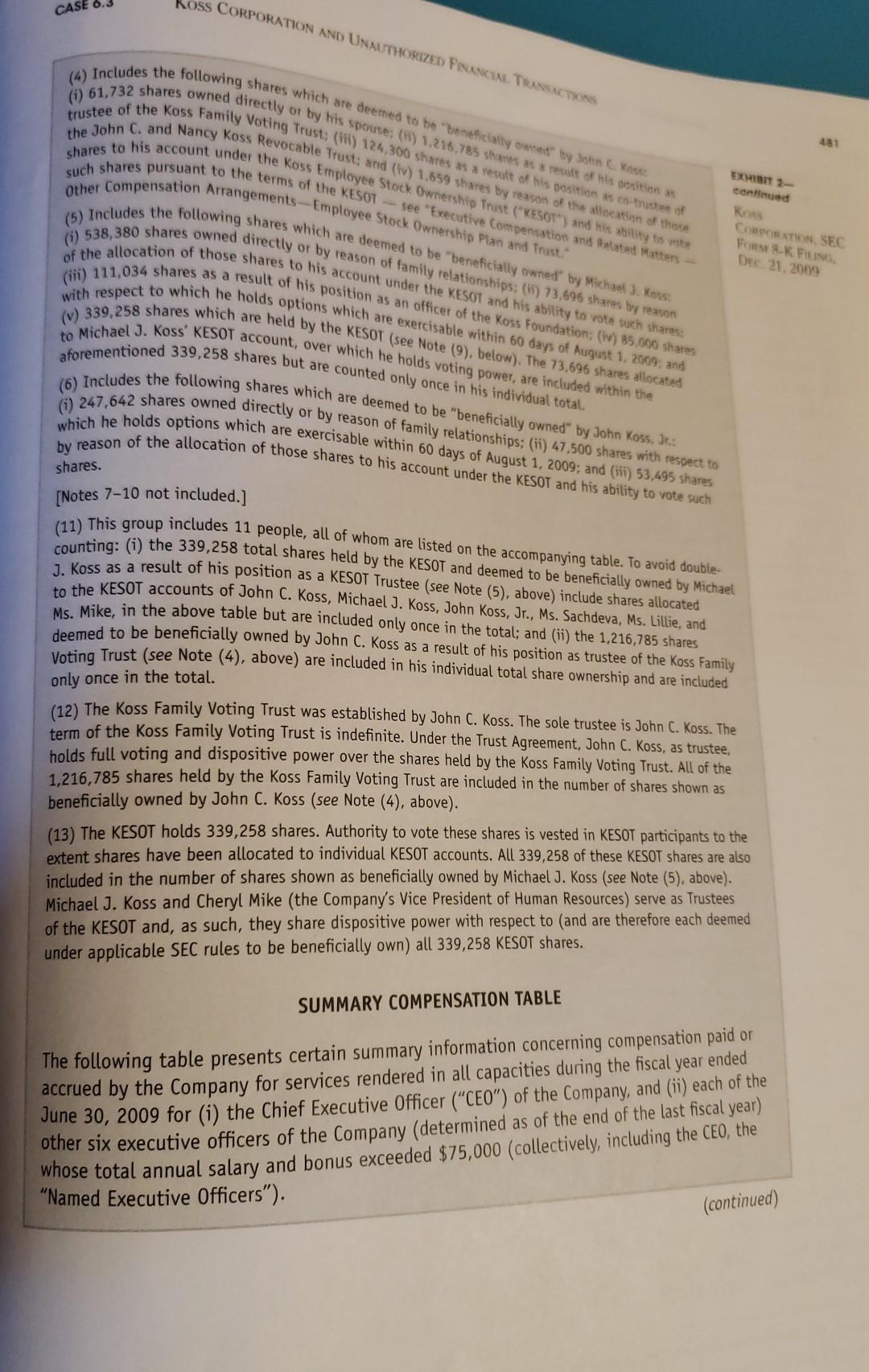

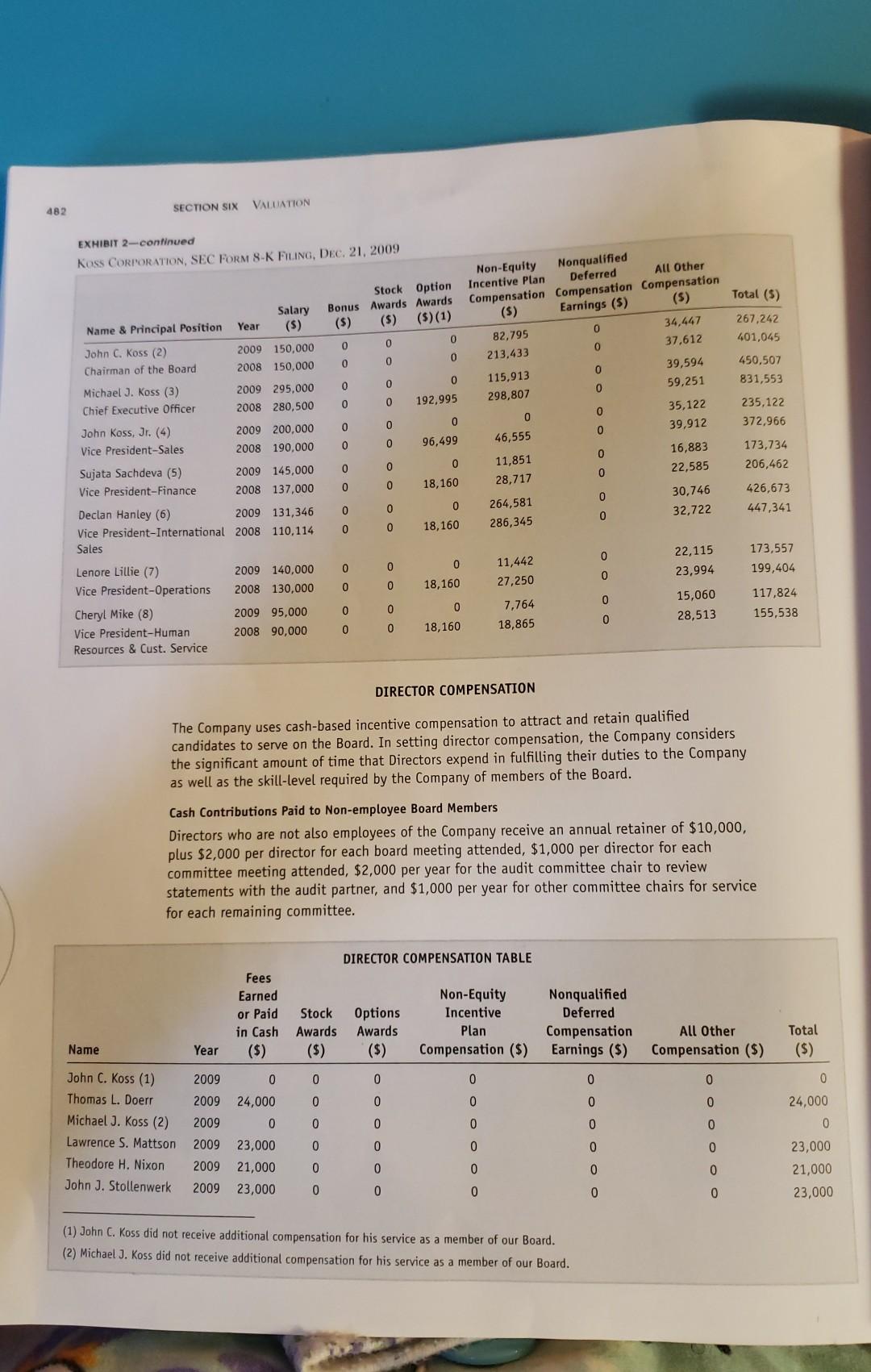

CASE 6.3 Koss CORPORATION AND UNAUTHOR FINANCIAL TRANS NEWS RELEASE 4129 NORTH PORT WASHINGTON AVENUE, MILWAUKEE, WI 53212 414 954-5000 WWW.KOSS.COM ET1 FOR IMMEDIATE RELEASE December 21, 2009 Roran Copprinn FK D 2009 CONTACT: Michael J. Koss President & CEO (414) 964-5000 mjkoss@koss.com Trading of Koss Corporation Stock Halts Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high-fidelity stereophone leader, requested today that NASDAQ immediately halt trading of its securities after discovering information regarding certain unauthorized transactions. The Board of Directors appointed a special committee of independent directors to lead an internal investigation involving the unauthorized transactions and determine the effect, if any, on Koss' financial statements. NASDAQ halted trading of Koss Corporation stock today. Law enforcement is also assisting Koss Corporation with this matter. Sujata Sachdeva, Vice President of Finance and Secretary of Koss Corporation, was placed on unpaid administrative leave pending the results of this investigation. Koss Corporation markets a complete line of high-fidelity stereophones, speaker-phones, computer headsets, telecommunications headsets, active noise canceling stereophones, wireless stereophones, and compact disc recordings of American Symphony Orchestras on the Koss Classics label. This press release contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "forecasts," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of such terms and other comparable terminology. These statements are only predictions. Actual events or results may differ materially. In evaluating forward-looking statements, you should specifically consider various factors that may cause actual results to vary from those contained in the forward-looking statements, such as general economic conditions, in particular, consumer demand for the Company's and its customers' products, competitive and technological developments, foreign currency fluctuations and costs of operations. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. In addition, such uncertainties and other operational matters are discussed further in the Company's quarterly and annual filings with the Securities and Exchange Commission. 47 SECTION SIX VATION EXHIRIT 2 kes CORPORATION SEC FRK FLING DESEMBER 21 2009 PROPOSAL 1. ELECTION OF DIRECTORS The By-Laws of the Company provide that the number of directors on the Board of Directors of the Company (the Board") will be no fewer than five and no greater than twelve. We had six directors during fiscal year 2009 and will also elect six directors for fiscal year 2010. Each director elected will serve until the next Annual Meeting of Stockholders and until the director's successor is duly elected, or until his prior death, resignation, or removal. The six nominees that receive the most votes will be appointed to serve on our Board for the next year. Information as to Nominees The following identifies the nominees for the six director positions and provides information as to their business experience for the past five years. Each nominee is presently a director of the Company: John C. Koss, 79, has served continuously as Chairman of the Board of the Company or its predecessors since 1958. Previously, he served as Chief Executive Officer from 1958 until 1991. He is the father of Michael J. Koss (the Company's Vice Chairman, President, Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer, and a nominee for director of the Company), and the father of John Koss, Jr. (the Company's Vice President-Sales). Thomas L. Doerr, 65, has been a director of the Company since 1987. In 1972, Mr. Doerr co-founded Leeson Electric Corporation and served as its President and Chief Executive Officer until 1982. The company manufactures industrial electric motors. In 1983, Mr. Doerr incorporated Doerr Corporation as a holding company for the purpose of acquiring established companies involved in distributing products to industrial and commercial markets. Currently, Mr. Doerr serves as President of Doerr Corporation. Michael J. Koss, 55, has held various positions at the Company since 1976, and has been a director of the Company since 1985. He was elected President, Chief Operating Officer, and Chief Financial Officer of the Company in 1987, Chief Executive Officer in 1991, and Vice-Chairman in 1998. He is the son of John C. Koss (the Company's Chairman of the Board) and the brother of John Koss, Jr. (the Company's Vice President-Sales). Michael J. Koss is also a director of STRATTEC Security Corporation. Lawrence S. Mattson, 77, has been a director of the Company since 1978. Mr. Mattson is the retired President of Oster Company, a division of Sunbeam Corporation, which manufactures and sells portable household appliances. Theodore H. Nixon, 57, has been a director of the Company since 2006. Since 1992, Mr. Nixon has been the Chief Executive Officer of D.D. Williamson, which is a manufacturer of caramel coloring used in the food and beverage industries. Mr. Nixon joined D.D. Williamson in 1974 and was promoted to President and Chief Operating Officer in 1982. Mr. Nixon is also a director of the non-profit Center for Quality of Management. John J. Stollenwerk, 69, has been a director of the Company since 1986. Mr. Stollenwerk is the Chairman of the Allen-Edmonds Shoe Corporation, an international manufacturer and retailer of high quality footwear. He is also a director of Allen-Edmonds Shoe Corporation, Badger Meter, Inc., U.S. Bancorp, and Northwestern Mutual Life Insurance Company. The Company expects that the "Koss Family" (John C. Koss, Michael J. Koss, and John Koss, Jr.), who beneficially own approximately 73.13% of the outstanding Common Stock, will vote "for the election of all nominees named above to the Board of Directors. (continued) CASE 6.3 Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR THE ELECTION OF ALL NOMINEES NAMED ABOVE TO THE BOARD OF DIRECTORS. Board Committees (Selected) 415 EXHIBIT 2- continued matters, executive compensation and board nominations. Each member of these committees The Board has appointed the following standing committees for auditing and accounting is "independent" as defined in Nasdaq Marketplace Rule 4200. Audit Committee. The Audit Committee, which is composed of Mt. Doerr, Mr. Mattson Mr. Nixon, and Mr. Stollenwerk, reviews and evaluates the effectiveness of the Company's financial and accounting functions, including reviewing the scope and results of the audit work performed by the independent accountants and by the Company's internal accounting staff. The Audit Committee met three times during the fiscal year ended June 30, 2009. The independent accountants were present CORPORATION SEC For 8-K FUN DECEMBER 21, 2009 audit. For more information about the Audit Committee meetings, see the "Audit Committee Report." The Audit Committee is governed by a written charter approved and adopted by the Board, which charter was attached as Appendix A to the proxy materials, dated August 31, 2007, for the annual meeting held on October 10, 2007 for the fiscal year ended June 30, 2007. Audit Committee Financial Expert. The Board has determined that Mr. Mattson is an "Audit Committee Financial Expert" as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (the "SEC"). Attendance at Board and Committee Meetings During the fiscal year ended June 30, 2009, the Board held four meetings. Every incumbent director attended 75% or more of the total of (i) all meetings of the Board, plus (ii) all meetings of the committees on which they served during their respective terms of office. Attendance at Annual Meetings All of the members of the Board, Mr. John C. Koss, Mr. Michael J. Koss, Mr. Doerr, Mr. Mattson, Mr. Stollenwerk and Mr. Nixon, attended last year's annual meeting held on October 08, 2008. The Company has no formal written policy regarding attendance at annual meetings of the Company, but strongly encourages all directors to make attendance at all annual meetings a priority. Independence of the Board Each of Mr. Doerr, Mr. Mattson, Mr. Nixon, and Mr. Stollenwerk, is "independent" as such term is defined in Nasdaq Marketplace Rule 4200. These independent directors constitute a majority of the Board, as required under Nasdaq Marketplace Rule 4350(c). Code of Ethics The Board approved and adopted a Code of Ethics for the Company's directors, officers, and employees, which is attached as Exhibit 14 to the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2004. Executive Officers Information is provided below with respect to the executive officers of the Company. Each executive officer is elected annually by the Board of Directors and serves for one year or until his or her successor is appointed. (continued) -0 SECTION SIX VALUATION HIBIT 2- ontinued Current Position Held Since Name Age Positions Held OSS ORPORATION, SEC RM 8-K FILING, C. 21, 2009 Michael J. Koss 55 President, Chief Operating Officer, Chief Financial Officer, Chief Executive Officer 52 1987 (Chief Executive Officer since 1991) 1988 1992 1994 1998 John Koss, Jr. Sujata Sachdeva Declan Hanley Lenore E. Lillie Cheryl Mike 45 Vice President - Sales Vice President - Finance, Secretary Vice President - International Sales Vice President - Operation Vice President - Human Resources and Customer Service 62 50 57 2001 Beneficial Ownership of Company Securities Security Ownership by Nominees and Management. The following table sets forth, as of August 1, 2009, the number of shares of Common Stock "beneficially owned" (as defined under applicable regulations of the SEC), and the percentage of such shares to the total number of shares outstanding, for all nominees, for each executive officer named in the Summary Compensation Table (see "Executive Compensation and Related Matters-Summary Compensation Table"), for all directors and executive officers as a group, and for each person and each group of persons who, to the knowledge of the Company as of June 30, 2009, were the beneficial owners of more than 5% of the outstanding shares of Common Stock. Percent of Outstanding Common Stock (3) 38.05% 27.09% 8.00% Name and Business Address (1) John C. Koss (4) Michael J. Koss (5) John Koss, Jr. (6) Thomas L. Doerr Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk Sujata Sachdeva (7) Declan Hanley (8) Lenore E. Lillie (9) Cheryl Mike (10) All directors and executive officers as a group (11 persons) (11) Koss Family Voting Trust, John C. Koss, Trustee (12) Koss Employee Stock Ownership Trust (KESOT") (13) Royce and Associates, LLC (14) Number of Shares Beneficially Owned (2) 1,404,476 999,976 295,142 0 0 2,480 13,551 35,785 60,000 58,984 40,494 1.63% 1.60% 1.10% 78.86% 32.96% 2,910,888 1,216,785 339,258 370,723 9.19% 10.04% (continued) Koss CORPORATION AND UNAUTHORIZED FISU TRANSACTIONS CASE 431 Knies (4) Includes the following shares which are deemed to be "beneficially wed by John (1) 61,732 shares owned directly or by his spouse: (1) 1.216.785 shares as rexit of his goitia EXHIBIT 2 trustee of the Koss Family Voting Trust: (1) 124,300 shares as result of this positions trists of continued the John C. and Nancy Koss Revocable Trust: and (iv) 1,659 shares by reason of the allocation of those shares to his account under the Koss Employee Stock Ownership Trust (ESO) and his ability to vote CORTION, SEC such shares pursuant to the terms of the KESOT - see "Executive Compensation and Related Matters FUM- FI Other Compensation Arrangements - Employee Stock Ownership Plan and Trust." De 21.2009 (5) Includes the following shares which are deemed to be "beneficially owned by Michael J. Koss: (i) 538,380 shares owned directly or by reason of family relationships: (i) 73,696 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares: (ii) 111,034 shares as a result of his position as an officer of the Koss Foundation: () 85.000 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009, and (V) 339,258 shares which are held by the KESOT (see Note (9), below). The 73,696 shares allocated to Michael J. Koss' KESOT account, over which he holds voting power, are included within the aforementioned 339,258 shares but are counted only once in his individual total. (6) Includes the following shares which are deemed to be "beneficially owned" by John Koss, J.: (1) 247,642 shares owned directly or by reason of family relationships; (ii) 47,500 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (iii) 53,495 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares. [Notes 7-10 not included.] (11) This group includes 11 people , all of whom are listed on the accompanying table . To avoid double- counting: (i) the 339,258 total shares held by the KESOT and deemed to be beneficially owned by Michael J. Koss as a result of his position as a KESOT Trustee (see Note (5), above) include shares allocated to the KESOT accounts of John C. Koss, Michael J. Koss, John Koss , Jr., Ms. Sachdeva, Ms. Lillie, and Ms. Mike, in the above table but are included only once in the total ; and (ii) the 1,216,785 shares deemed to be beneficially owned by John C. Koss as a result of his position as trustee of the Koss Family Voting Trust (see Note (4), above) are included in his individual total share ownership and are included only once in the total. (12) The Koss Family Voting Trust was established by John C. Koss. The sole trustee is John C. Koss. The term of the Koss Family Voting Trust is indefinite. Under the Trust Agreement, John C. Koss, as trustee, holds full voting and dispositive power over the shares held by the Koss Family Voting Trust. All of the 1,216,785 shares held by the Koss Family Voting Trust are included in the number of shares shown as beneficially owned by John C. Koss (see Note (4), above). (13) The KESOT holds 339,258 shares. Authority to vote these shares is vested in KESOT participants to the extent shares have been allocated to individual KESOT accounts. All 339,258 of these KESOT shares are also included in the number of shares shown as beneficially owned by Michael J. Koss (see Note (5), above). Michael J. Koss and Cheryl Mike (the Company's Vice President of Human Resources) serve as Trustees of the KESOT and, as such, they share dispositive power with respect to (and are therefore each deemed under applicable SEC rules to be beneficially own) all 339,258 KESOT shares. SUMMARY COMPENSATION TABLE The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal year ended June 30, 2009 for (i) the Chief Executive Officer ("CEO") of the Company, and (ii) each of the other six executive officers of the Company (determined as of the end of the last fiscal year) whose total annual salary and bonus exceeded $75,000 (collectively, including the CEO, the "Named Executive Officers"). (continued) 482 SECTION SIX VALUATION EXHIBIT 2-continued Koss CORPORATION, SEC FORM 8-K FLING, DEC, 21, 2009 Total (5) Salary Stock Option Bonus Awards Awards (5) (5) (5) (1) Non-Equity Nonqualified Incentive Plan Deferred All Other Compensation Compensation Compensation (5) Earnings (5) (5) 82,795 0 34,447 213,433 0 37.612 267,242 401,045 0 0 0 0 0 0 0 39,594 59,251 450,507 831,553 0 0 115,913 298,807 0 0 0 0 192,995 0 235,122 372,966 0 0 0 Name & Principal Position Year ($) John C. Koss (2) 2009 150,000 Chairman of the Board 2008 150,000 Michael J. Koss (3) 2009 295,000 Chief Executive Officer 2008 280,500 John Koss, Jr. (4) 2009 200,000 Vice President-Sales 2008 190,000 Sujata Sachdeva (5) 2009 145,000 Vice President-Finance 2008 137,000 Declan Hanley (6) 2009 131,346 Vice President-International 2008 110,114 Sales 0 0 46,555 35,122 39,912 16,883 22,585 0 0 96,499 0 11,851 173,734 206,462 0 0 0 0 0 18,160 28,717 0 0 30,746 32,722 426,673 447,341 0 0 264,581 286,345 0 18,160 0 0 0 0 22,115 23,994 173,557 199,404 0 0 11,442 27,250 2009 140,000 2008 130,000 0 0 0 18,160 Lenore Lillie (7) Vice President-Operations Cheryl Mike (8) Vice President-Human Resources & Cust. Service 0 0 15,060 28,513 117,824 155,538 0 0 7,764 18,865 2009 95,000 2008 90,000 0 18,160 DIRECTOR COMPENSATION The Company uses cash-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Company considers the significant amount of time that Directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board. Cash Contributions Paid to Non-employee Board Members Directors who are not also employees of the Company receive an annual retainer of $10,000, plus $2,000 per director for each board meeting attended, $1,000 per director for each committee meeting attended, $2,000 per year for the audit committee chair to review statements with the audit partner, and $1,000 per year for other committee chairs for service for each remaining committee. DIRECTOR COMPENSATION TABLE Fees Earned or Paid in Cash ($) Stock Awards (5) Options Awards Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Total ($) Name Year 0 0 0 0 0 0 0 0 0 0 24,000 0 0 0 0 0 John C. Koss (1) Thomas L. Doerr Michael J. Koss (2) Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk 2009 0 2009 24,000 2009 0 2009 23,000 2009 21,000 2009 23,000 0 0 0 0 0 0 0 0 23,000 21,000 23,000 0 0 0 0 (1) John C. Koss did not receive additional compensation for his service as a member of our Board. (2) Michael J. Koss did not receive additional compensation for his service as a member of our Board. anisms redz to se izkazit. tancazzetszisztett ou longe de teste comes to tra mis pontse Company and casos matematica series and strate mecanisms to the urant and the Gr December 31, 2009, upon a commentation from the contents auditus. More of Grant Thomant's attento e Corporationis fracast cluding site des for ste sa te fiscal yes contained an attesa apiman, dan inter, for mere Steynuzlified or modified as uncertainty urting lietampanysraelauagerticesareacarenaara 488 SECTION SIX VALUATION EXHIBIT 7- continued Koss CORPORATION PRESS RELEASES Dec 24, 2009, AND JAN. 4. FER 16 AND FEB. 24, 2010 The Company's internal investigation, supervised by an independent committee of the Board of Directors, including the committee's independent counsel and forensic accountants, is continuing, as are efforts to recover merchandise related to the unauthorized transactions. The Company continues to work with law enforcement and regulatory authorities. C. February 16, 2010 Restatement Delays Koss 02 Financial Results Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, announced that its quarterly report on Form 10-Q for the period ended December 31, 2009 filed with the sec today did not include unaudited consolidated financial statements due to delays relating to the previously disclosed unauthorized transactions by its former Vice President of Finance and Secretary, Sujata Sachdeva. The Company intends to amend its SEC filing to include the quarterly unaudited financial statements promptly after the restatements of the Company's previously issued consolidated financial statements are completed. The Company anticipates restating its financial statements for at least fiscal years 2008 and 2009, and the quarter ending September 30, 2009. The Company has discussed with its independent auditor, Baker Tilly, a preliminary schedule to file restated consolidated financial statements possibly as early as April 2010. In any event, although the Company cannot predict with certainty when these financial statements will be available, it expects that these financial statements will be available no later than June 2010. The Company did report that the total amount of unauthorized transactions that occurred from October 2009 through December 2009 remains at approximately $5 million, which is consistent with amounts previously reported by the Company. The Company further reported that this $5 million amount is included in the total estimated amount of $31.5 million of unauthorized transactions that occurred since fiscal year 2005. "The Company has continued to operate in the normal course of business despite the disruption resulting from the discovery of the unauthorized transactions," Michael J. Koss, President and CEO said today. "We believe that the elimination of these unauthorized transactions will enhance our future operating results." "Over 25,000 items have now been seized by law enforcement authorities," Michael Koss continued. "The Company intends to vigorously pursue proceeds from the sale of these items as well as from insurance coverage, potential claims against third parties, and tax refunds." The Company anticipates that its current liquidity and cash flow from operations will meet its cash requirements for operations, including the additional investigation costs related to the unauthorized transactions, and new product development. After discovering the unauthorized transactions, the Company's cash and cash equivalents have increased since December 31, 2009. The unauthorized transactions adversely affected the Company's cash flow from operations. But the Company noted that the absence of such unauthorized transactions can be expected to result in improved cash flow from operations in the future. The Company reported that as of December 31, 2009 and leading up through today, the outstanding balance on the Company's credit facility with Harris, N.A. was approximately $5.9 million. The Company does not anticipate drawing additional amounts on the credit facility to support the Company's short term cash requirements. In terms of legal proceedings relating to the unauthorized transactions, the Company reported the following: On January 11, 2010, the Company received a letter from a law firm stating that it represented a shareholder and demanding that the Company's Board of Directors o (continued) CASE 6.3 Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS completed investigate and take legal action against all responsible parties to ensure compensation for EXHIBIT 1- the Company's losses stemming from the unauthorized transactions. The Company's legal continued counsel has responded preliminarily to the letter indicating that the Board of Directors Koss CORPORAT will determine the appropriate course of action after an independent investigation is PRESS RELEASES DEC. 24.2009 JAN. 4. FEB. 16. On January 15, 2010, a class action complaint was filed in federal court in Wisconsin AND FEB. 24.20 against the Company, the Company's President and CEO Michael Koss, and Ms. Sachdeva. The suit alleges violations of Section 10(b), Rule 10b-5 and Section 20(a) of the Exchange Act relating to the unauthorized transactions and requests an award of compensatory damages in an amount to be proven at trial. On January 26, 2010, the SEC's Division of Enforcement advised the Company that it obtained a formal order of investigation in connection with the unauthorized transactions. The Company immediately brought the unauthorized transactions to the SEC staff's attention when they were discovered in December 2009, and is cooperating fully with the ongoing SEC investigation. D. February 24, 2010 Koss Receives Notice of Non-Compliance with NASDAQ Continued Listing Requirements Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, received notice from The NASDAQ Stock Market that because Koss's Form 10-Q for the period ended December 31, 2009 contained no financial statements, it is incomplete and does not comply with Listing Rule 5250(c)(1), which requires the timely filing of periodic financial statements. Koss has 60 calendar days, or until April 20, 2010, to submit a plan to regain compliance. If the compliance plan is accepted, NASDAQ can grant an exception of up to 180 calendar days from the filing's due date, or until August 16, 2010, to regain compliance. If the compliance plan is not accepted, Koss will have the opportunity to appeal that decision to a NASDAQ hearings panel. As previously disclosed, because of certain previously reported unauthorized financial transactions, Koss is restating its previously issued financial statements for the fiscal years ended 2008 and 2009, for all quarterly periods during those fiscal years, and for the period ended September 30, 2009. Koss's unaudited consolidated quarterly financial statements for the period ended December 31, 2009 were not available to be included in Koss's quarterly report on Form 10-Q filed on February 16, 2010. Although Koss cannot predict with certainty when the restated consolidated financial statements will be available, Koss anticipates that the restated consolidated financial statements will be available as early as April 2010 but no later than June 2010. The quarterly report on Form 10-Q for the period ended December 31, 2009 will be amended to include the unaudited consolidated quarterly financial statements promptly after the restated consolidated financial statements are available. On February 16 and 18, 2010, separate shareholder derivative suits were filed in Milwaukee County Circuit Court in connection with the previously disclosed unauthorized transactions. The first suit names as defendants Michael Koss, John Koss Sr., the other Koss directors, Sujata Sachdeva, Grant Thornton LLP, and Koss Corporation (as a nominal defendant); the second suit names the same parties except Grant Thornton LLP . Among other things, both suits allege various breaches of fiduciary and other duties, and seek recovery of unspecified damages and other relief. See Ruiz v. Koss , et al., Circuit Court, Milwaukee County, Wisconsin , 00100V002422 (February 16, 2010 ) and Mentkowski v. Koss , et al., Circuit Court, Milwaukee County, Wisconsin, No. 10CV002290 (February 18, 2010). CASE 6.3 Koss CORPORATION AND UNAUTHOR FINANCIAL TRANS NEWS RELEASE 4129 NORTH PORT WASHINGTON AVENUE, MILWAUKEE, WI 53212 414 954-5000 WWW.KOSS.COM ET1 FOR IMMEDIATE RELEASE December 21, 2009 Roran Copprinn FK D 2009 CONTACT: Michael J. Koss President & CEO (414) 964-5000 mjkoss@koss.com Trading of Koss Corporation Stock Halts Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high-fidelity stereophone leader, requested today that NASDAQ immediately halt trading of its securities after discovering information regarding certain unauthorized transactions. The Board of Directors appointed a special committee of independent directors to lead an internal investigation involving the unauthorized transactions and determine the effect, if any, on Koss' financial statements. NASDAQ halted trading of Koss Corporation stock today. Law enforcement is also assisting Koss Corporation with this matter. Sujata Sachdeva, Vice President of Finance and Secretary of Koss Corporation, was placed on unpaid administrative leave pending the results of this investigation. Koss Corporation markets a complete line of high-fidelity stereophones, speaker-phones, computer headsets, telecommunications headsets, active noise canceling stereophones, wireless stereophones, and compact disc recordings of American Symphony Orchestras on the Koss Classics label. This press release contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "forecasts," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of such terms and other comparable terminology. These statements are only predictions. Actual events or results may differ materially. In evaluating forward-looking statements, you should specifically consider various factors that may cause actual results to vary from those contained in the forward-looking statements, such as general economic conditions, in particular, consumer demand for the Company's and its customers' products, competitive and technological developments, foreign currency fluctuations and costs of operations. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. In addition, such uncertainties and other operational matters are discussed further in the Company's quarterly and annual filings with the Securities and Exchange Commission. 47 SECTION SIX VATION EXHIRIT 2 kes CORPORATION SEC FRK FLING DESEMBER 21 2009 PROPOSAL 1. ELECTION OF DIRECTORS The By-Laws of the Company provide that the number of directors on the Board of Directors of the Company (the Board") will be no fewer than five and no greater than twelve. We had six directors during fiscal year 2009 and will also elect six directors for fiscal year 2010. Each director elected will serve until the next Annual Meeting of Stockholders and until the director's successor is duly elected, or until his prior death, resignation, or removal. The six nominees that receive the most votes will be appointed to serve on our Board for the next year. Information as to Nominees The following identifies the nominees for the six director positions and provides information as to their business experience for the past five years. Each nominee is presently a director of the Company: John C. Koss, 79, has served continuously as Chairman of the Board of the Company or its predecessors since 1958. Previously, he served as Chief Executive Officer from 1958 until 1991. He is the father of Michael J. Koss (the Company's Vice Chairman, President, Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer, and a nominee for director of the Company), and the father of John Koss, Jr. (the Company's Vice President-Sales). Thomas L. Doerr, 65, has been a director of the Company since 1987. In 1972, Mr. Doerr co-founded Leeson Electric Corporation and served as its President and Chief Executive Officer until 1982. The company manufactures industrial electric motors. In 1983, Mr. Doerr incorporated Doerr Corporation as a holding company for the purpose of acquiring established companies involved in distributing products to industrial and commercial markets. Currently, Mr. Doerr serves as President of Doerr Corporation. Michael J. Koss, 55, has held various positions at the Company since 1976, and has been a director of the Company since 1985. He was elected President, Chief Operating Officer, and Chief Financial Officer of the Company in 1987, Chief Executive Officer in 1991, and Vice-Chairman in 1998. He is the son of John C. Koss (the Company's Chairman of the Board) and the brother of John Koss, Jr. (the Company's Vice President-Sales). Michael J. Koss is also a director of STRATTEC Security Corporation. Lawrence S. Mattson, 77, has been a director of the Company since 1978. Mr. Mattson is the retired President of Oster Company, a division of Sunbeam Corporation, which manufactures and sells portable household appliances. Theodore H. Nixon, 57, has been a director of the Company since 2006. Since 1992, Mr. Nixon has been the Chief Executive Officer of D.D. Williamson, which is a manufacturer of caramel coloring used in the food and beverage industries. Mr. Nixon joined D.D. Williamson in 1974 and was promoted to President and Chief Operating Officer in 1982. Mr. Nixon is also a director of the non-profit Center for Quality of Management. John J. Stollenwerk, 69, has been a director of the Company since 1986. Mr. Stollenwerk is the Chairman of the Allen-Edmonds Shoe Corporation, an international manufacturer and retailer of high quality footwear. He is also a director of Allen-Edmonds Shoe Corporation, Badger Meter, Inc., U.S. Bancorp, and Northwestern Mutual Life Insurance Company. The Company expects that the "Koss Family" (John C. Koss, Michael J. Koss, and John Koss, Jr.), who beneficially own approximately 73.13% of the outstanding Common Stock, will vote "for the election of all nominees named above to the Board of Directors. (continued) CASE 6.3 Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR THE ELECTION OF ALL NOMINEES NAMED ABOVE TO THE BOARD OF DIRECTORS. Board Committees (Selected) 415 EXHIBIT 2- continued matters, executive compensation and board nominations. Each member of these committees The Board has appointed the following standing committees for auditing and accounting is "independent" as defined in Nasdaq Marketplace Rule 4200. Audit Committee. The Audit Committee, which is composed of Mt. Doerr, Mr. Mattson Mr. Nixon, and Mr. Stollenwerk, reviews and evaluates the effectiveness of the Company's financial and accounting functions, including reviewing the scope and results of the audit work performed by the independent accountants and by the Company's internal accounting staff. The Audit Committee met three times during the fiscal year ended June 30, 2009. The independent accountants were present CORPORATION SEC For 8-K FUN DECEMBER 21, 2009 audit. For more information about the Audit Committee meetings, see the "Audit Committee Report." The Audit Committee is governed by a written charter approved and adopted by the Board, which charter was attached as Appendix A to the proxy materials, dated August 31, 2007, for the annual meeting held on October 10, 2007 for the fiscal year ended June 30, 2007. Audit Committee Financial Expert. The Board has determined that Mr. Mattson is an "Audit Committee Financial Expert" as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (the "SEC"). Attendance at Board and Committee Meetings During the fiscal year ended June 30, 2009, the Board held four meetings. Every incumbent director attended 75% or more of the total of (i) all meetings of the Board, plus (ii) all meetings of the committees on which they served during their respective terms of office. Attendance at Annual Meetings All of the members of the Board, Mr. John C. Koss, Mr. Michael J. Koss, Mr. Doerr, Mr. Mattson, Mr. Stollenwerk and Mr. Nixon, attended last year's annual meeting held on October 08, 2008. The Company has no formal written policy regarding attendance at annual meetings of the Company, but strongly encourages all directors to make attendance at all annual meetings a priority. Independence of the Board Each of Mr. Doerr, Mr. Mattson, Mr. Nixon, and Mr. Stollenwerk, is "independent" as such term is defined in Nasdaq Marketplace Rule 4200. These independent directors constitute a majority of the Board, as required under Nasdaq Marketplace Rule 4350(c). Code of Ethics The Board approved and adopted a Code of Ethics for the Company's directors, officers, and employees, which is attached as Exhibit 14 to the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2004. Executive Officers Information is provided below with respect to the executive officers of the Company. Each executive officer is elected annually by the Board of Directors and serves for one year or until his or her successor is appointed. (continued) -0 SECTION SIX VALUATION HIBIT 2- ontinued Current Position Held Since Name Age Positions Held OSS ORPORATION, SEC RM 8-K FILING, C. 21, 2009 Michael J. Koss 55 President, Chief Operating Officer, Chief Financial Officer, Chief Executive Officer 52 1987 (Chief Executive Officer since 1991) 1988 1992 1994 1998 John Koss, Jr. Sujata Sachdeva Declan Hanley Lenore E. Lillie Cheryl Mike 45 Vice President - Sales Vice President - Finance, Secretary Vice President - International Sales Vice President - Operation Vice President - Human Resources and Customer Service 62 50 57 2001 Beneficial Ownership of Company Securities Security Ownership by Nominees and Management. The following table sets forth, as of August 1, 2009, the number of shares of Common Stock "beneficially owned" (as defined under applicable regulations of the SEC), and the percentage of such shares to the total number of shares outstanding, for all nominees, for each executive officer named in the Summary Compensation Table (see "Executive Compensation and Related Matters-Summary Compensation Table"), for all directors and executive officers as a group, and for each person and each group of persons who, to the knowledge of the Company as of June 30, 2009, were the beneficial owners of more than 5% of the outstanding shares of Common Stock. Percent of Outstanding Common Stock (3) 38.05% 27.09% 8.00% Name and Business Address (1) John C. Koss (4) Michael J. Koss (5) John Koss, Jr. (6) Thomas L. Doerr Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk Sujata Sachdeva (7) Declan Hanley (8) Lenore E. Lillie (9) Cheryl Mike (10) All directors and executive officers as a group (11 persons) (11) Koss Family Voting Trust, John C. Koss, Trustee (12) Koss Employee Stock Ownership Trust (KESOT") (13) Royce and Associates, LLC (14) Number of Shares Beneficially Owned (2) 1,404,476 999,976 295,142 0 0 2,480 13,551 35,785 60,000 58,984 40,494 1.63% 1.60% 1.10% 78.86% 32.96% 2,910,888 1,216,785 339,258 370,723 9.19% 10.04% (continued) Koss CORPORATION AND UNAUTHORIZED FISU TRANSACTIONS CASE 431 Knies (4) Includes the following shares which are deemed to be "beneficially wed by John (1) 61,732 shares owned directly or by his spouse: (1) 1.216.785 shares as rexit of his goitia EXHIBIT 2 trustee of the Koss Family Voting Trust: (1) 124,300 shares as result of this positions trists of continued the John C. and Nancy Koss Revocable Trust: and (iv) 1,659 shares by reason of the allocation of those shares to his account under the Koss Employee Stock Ownership Trust (ESO) and his ability to vote CORTION, SEC such shares pursuant to the terms of the KESOT - see "Executive Compensation and Related Matters FUM- FI Other Compensation Arrangements - Employee Stock Ownership Plan and Trust." De 21.2009 (5) Includes the following shares which are deemed to be "beneficially owned by Michael J. Koss: (i) 538,380 shares owned directly or by reason of family relationships: (i) 73,696 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares: (ii) 111,034 shares as a result of his position as an officer of the Koss Foundation: () 85.000 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009, and (V) 339,258 shares which are held by the KESOT (see Note (9), below). The 73,696 shares allocated to Michael J. Koss' KESOT account, over which he holds voting power, are included within the aforementioned 339,258 shares but are counted only once in his individual total. (6) Includes the following shares which are deemed to be "beneficially owned" by John Koss, J.: (1) 247,642 shares owned directly or by reason of family relationships; (ii) 47,500 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (iii) 53,495 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares. [Notes 7-10 not included.] (11) This group includes 11 people , all of whom are listed on the accompanying table . To avoid double- counting: (i) the 339,258 total shares held by the KESOT and deemed to be beneficially owned by Michael J. Koss as a result of his position as a KESOT Trustee (see Note (5), above) include shares allocated to the KESOT accounts of John C. Koss, Michael J. Koss, John Koss , Jr., Ms. Sachdeva, Ms. Lillie, and Ms. Mike, in the above table but are included only once in the total ; and (ii) the 1,216,785 shares deemed to be beneficially owned by John C. Koss as a result of his position as trustee of the Koss Family Voting Trust (see Note (4), above) are included in his individual total share ownership and are included only once in the total. (12) The Koss Family Voting Trust was established by John C. Koss. The sole trustee is John C. Koss. The term of the Koss Family Voting Trust is indefinite. Under the Trust Agreement, John C. Koss, as trustee, holds full voting and dispositive power over the shares held by the Koss Family Voting Trust. All of the 1,216,785 shares held by the Koss Family Voting Trust are included in the number of shares shown as beneficially owned by John C. Koss (see Note (4), above). (13) The KESOT holds 339,258 shares. Authority to vote these shares is vested in KESOT participants to the extent shares have been allocated to individual KESOT accounts. All 339,258 of these KESOT shares are also included in the number of shares shown as beneficially owned by Michael J. Koss (see Note (5), above). Michael J. Koss and Cheryl Mike (the Company's Vice President of Human Resources) serve as Trustees of the KESOT and, as such, they share dispositive power with respect to (and are therefore each deemed under applicable SEC rules to be beneficially own) all 339,258 KESOT shares. SUMMARY COMPENSATION TABLE The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal year ended June 30, 2009 for (i) the Chief Executive Officer ("CEO") of the Company, and (ii) each of the other six executive officers of the Company (determined as of the end of the last fiscal year) whose total annual salary and bonus exceeded $75,000 (collectively, including the CEO, the "Named Executive Officers"). (continued) 482 SECTION SIX VALUATION EXHIBIT 2-continued Koss CORPORATION, SEC FORM 8-K FLING, DEC, 21, 2009 Total (5) Salary Stock Option Bonus Awards Awards (5) (5) (5) (1) Non-Equity Nonqualified Incentive Plan Deferred All Other Compensation Compensation Compensation (5) Earnings (5) (5) 82,795 0 34,447 213,433 0 37.612 267,242 401,045 0 0 0 0 0 0 0 39,594 59,251 450,507 831,553 0 0 115,913 298,807 0 0 0 0 192,995 0 235,122 372,966 0 0 0 Name & Principal Position Year ($) John C. Koss (2) 2009 150,000 Chairman of the Board 2008 150,000 Michael J. Koss (3) 2009 295,000 Chief Executive Officer 2008 280,500 John Koss, Jr. (4) 2009 200,000 Vice President-Sales 2008 190,000 Sujata Sachdeva (5) 2009 145,000 Vice President-Finance 2008 137,000 Declan Hanley (6) 2009 131,346 Vice President-International 2008 110,114 Sales 0 0 46,555 35,122 39,912 16,883 22,585 0 0 96,499 0 11,851 173,734 206,462 0 0 0 0 0 18,160 28,717 0 0 30,746 32,722 426,673 447,341 0 0 264,581 286,345 0 18,160 0 0 0 0 22,115 23,994 173,557 199,404 0 0 11,442 27,250 2009 140,000 2008 130,000 0 0 0 18,160 Lenore Lillie (7) Vice President-Operations Cheryl Mike (8) Vice President-Human Resources & Cust. Service 0 0 15,060 28,513 117,824 155,538 0 0 7,764 18,865 2009 95,000 2008 90,000 0 18,160 DIRECTOR COMPENSATION The Company uses cash-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Company considers the significant amount of time that Directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board. Cash Contributions Paid to Non-employee Board Members Directors who are not also employees of the Company receive an annual retainer of $10,000, plus $2,000 per director for each board meeting attended, $1,000 per director for each committee meeting attended, $2,000 per year for the audit committee chair to review statements with the audit partner, and $1,000 per year for other committee chairs for service for each remaining committee. DIRECTOR COMPENSATION TABLE Fees Earned or Paid in Cash ($) Stock Awards (5) Options Awards Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Total ($) Name Year 0 0 0 0 0 0 0 0 0 0 24,000 0 0 0 0 0 John C. Koss (1) Thomas L. Doerr Michael J. Koss (2) Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk 2009 0 2009 24,000 2009 0 2009 23,000 2009 21,000 2009 23,000 0 0 0 0 0 0 0 0 23,000 21,000 23,000 0 0 0 0 (1) John C. Koss did not receive additional compensation for his service as a member of our Board. (2) Michael J. Koss did not receive additional compensation for his service as a member of our Board. anisms redz to se izkazit. tancazzetszisztett ou longe de teste comes to tra mis pontse Company and casos matematica series and strate mecanisms to the urant and the Gr December 31, 2009, upon a commentation from the contents auditus. More of Grant Thomant's attento e Corporationis fracast cluding site des for ste sa te fiscal yes contained an attesa apiman, dan inter, for mere Steynuzlified or modified as uncertainty urting lietampanysraelauagerticesareacarenaara 488 SECTION SIX VALUATION EXHIBIT 7- continued Koss CORPORATION PRESS RELEASES Dec 24, 2009, AND JAN. 4. FER 16 AND FEB. 24, 2010 The Company's internal investigation, supervised by an independent committee of the Board of Directors, including the committee's independent counsel and forensic accountants, is continuing, as are efforts to recover merchandise related to the unauthorized transactions. The Company continues to work with law enforcement and regulatory authorities. C. February 16, 2010 Restatement Delays Koss 02 Financial Results Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, announced that its quarterly report on Form 10-Q for the period ended December 31, 2009 filed with the sec today did not include unaudited consolidated financial statements due to delays relating to the previously disclosed unauthorized transactions by its former Vice President of Finance and Secretary, Sujata Sachdeva. The Company intends to amend its SEC filing to include the quarterly unaudited financial statements promptly after the restatements of the Company's previously issued consolidated financial statements are completed. The Company anticipates restating its financial statements for at least fiscal years 2008 and 2009, and the quarter ending September 30, 2009. The Company has discussed with its independent auditor, Baker Tilly, a preliminary schedule to file restated consolidated financial statements possibly as early as April 2010. In any event, although the Company cannot predict with certainty when these financial statements will be available, it expects that these financial statements will be available no later than June 2010. The Company did report that the total amount of unauthorized transactions that occurred from October 2009 through December 2009 remains at approximately $5 million, which is consistent with amounts previously reported by the Company. The Company further reported that this $5 million amount is included in the total estimated amount of $31.5 million of unauthorized transactions that occurred since fiscal year 2005. "The Company has continued to operate in the normal course of business despite the disruption resulting from the discovery of the unauthorized transactions," Michael J. Koss, President and CEO said today. "We believe that the elimination of these unauthorized transactions will enhance our future operating results." "Over 25,000 items have now been seized by law enforcement authorities," Michael Koss continued. "The Company intends to vigorously pursue proceeds from the sale of these items as well as from insurance coverage, potential claims against third parties, and tax refunds." The Company anticipates that its current liquidity and cash flow from operations will meet its cash requirements for operations, including the additional investigation costs related to the unauthorized transactions, and new product development. After discovering the unauthorized transactions, the Company's cash and cash equivalents have increased since December 31, 2009. The unauthorized transactions adversely affected the Company's cash flow from operations. But the Company noted that the absence of such unauthorized transactions can be expected to result in improved cash flow from operations in the future. The Company reported that as of December 31, 2009 and leading up through today, the outstanding balance on the Company's credit facility with Harris, N.A. was approximately $5.9 million. The Company does not anticipate drawing additional amounts on the credit facility to support the Company's short term cash requirements. In terms of legal proceedings relating to the unauthorized transactions, the Company reported the following: On January 11, 2010, the Company received a letter from a law firm stating that it represented a shareholder and demanding that the Company's Board of Directors o (continued) CASE 6.3 Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS completed investigate and take legal action against all responsible parties to ensure compensation for EXHIBIT 1- the Company's losses stemming from the unauthorized transactions. The Company's legal continued counsel has responded preliminarily to the letter indicating that the Board of Directors Koss CORPORAT will determine the appropriate course of action after an independent investigation is PRESS RELEASES DEC. 24.2009 JAN. 4. FEB. 16. On January 15, 2010, a class action complaint was filed in federal court in Wisconsin AND FEB. 24.20 against the Company, the Company's President and CEO Michael Koss, and Ms. Sachdeva. The suit alleges violations of Section 10(b), Rule 10b-5 and Section 20(a) of the Exchange Act relating to the unauthorized transactions and requests an award of compensatory damages in an amount to be proven at trial. On January 26, 2010, the SEC's Division of Enforcement advised the Company that it obtained a formal order of investigation in connection with the unauthorized transactions. The Company immediately brought the unauthorized transactions to the SEC staff's attention when they were discovered in December 2009, and is cooperating fully with the ongoing SEC investigation. D. February 24, 2010 Koss Receives Notice of Non-Compliance with NASDAQ Continued Listing Requirements Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, received notice from The NASDAQ Stock Market that because Koss's Form 10-Q for the period ended December 31, 2009 contained no financial statements, it is incomplete and does not comply with Listing Rule 5250(c)(1), which requires the timely filing of periodic financial statements. Koss has 60 calendar days, or until April 20, 2010, to submit a plan to regain compliance. If the compliance plan is accepted, NASDAQ can grant an exception of up to 180 calendar days from the filing's due date, or until August 16, 2010, to regain compliance. If the compliance plan is not accepted, Koss will have the opportunity to appeal that decision to a NASDAQ hearings panel. As previously disclosed, because of certain previously reported unauthorized financial transactions, Koss is restating its previously issued financial statements for the fiscal years ended 2008 and 2009, for all quarterly periods during those fiscal years, and for the period ended September 30, 2009. Koss's unaudited consolidated quarterly financial statements for the period ended December 31, 2009 were not available to be included in Koss's quarterly report on Form 10-Q filed on February 16, 2010. Although Koss cannot predict with certainty when the restated consolidated financial statements will be available, Koss anticipates that the restated consolidated financial statements will be available as early as April 2010 but no later than June 2010. The quarterly report on Form 10-Q for the period ended December 31, 2009 will be amended to include the unaudited consolidated quarterly financial statements promptly after the restated consolidated financial statements are available. On February 16 and 18, 2010, separate shareholder derivative suits were filed in Milwaukee County Circuit Court in connection with the previously disclosed unauthorized transactions. The first suit names as defendants Michael Koss, John Koss Sr., the other Koss directors, Sujata Sachdeva, Grant Thornton LLP, and Koss Corporation (as a nominal defendant); the second suit names the same parties except Grant Thornton LLP . Among other things, both suits allege various breaches of fiduciary and other duties, and seek recovery of unspecified damages and other relief. See Ruiz v. Koss , et al., Circuit Court, Milwaukee County, Wisconsin , 00100V002422 (February 16, 2010 ) and Mentkowski v. Koss , et al., Circuit Court, Milwaukee County, Wisconsin, No. 10CV002290 (February 18, 2010)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts